Business acquisition: Free checklist

Business acquisition checklist

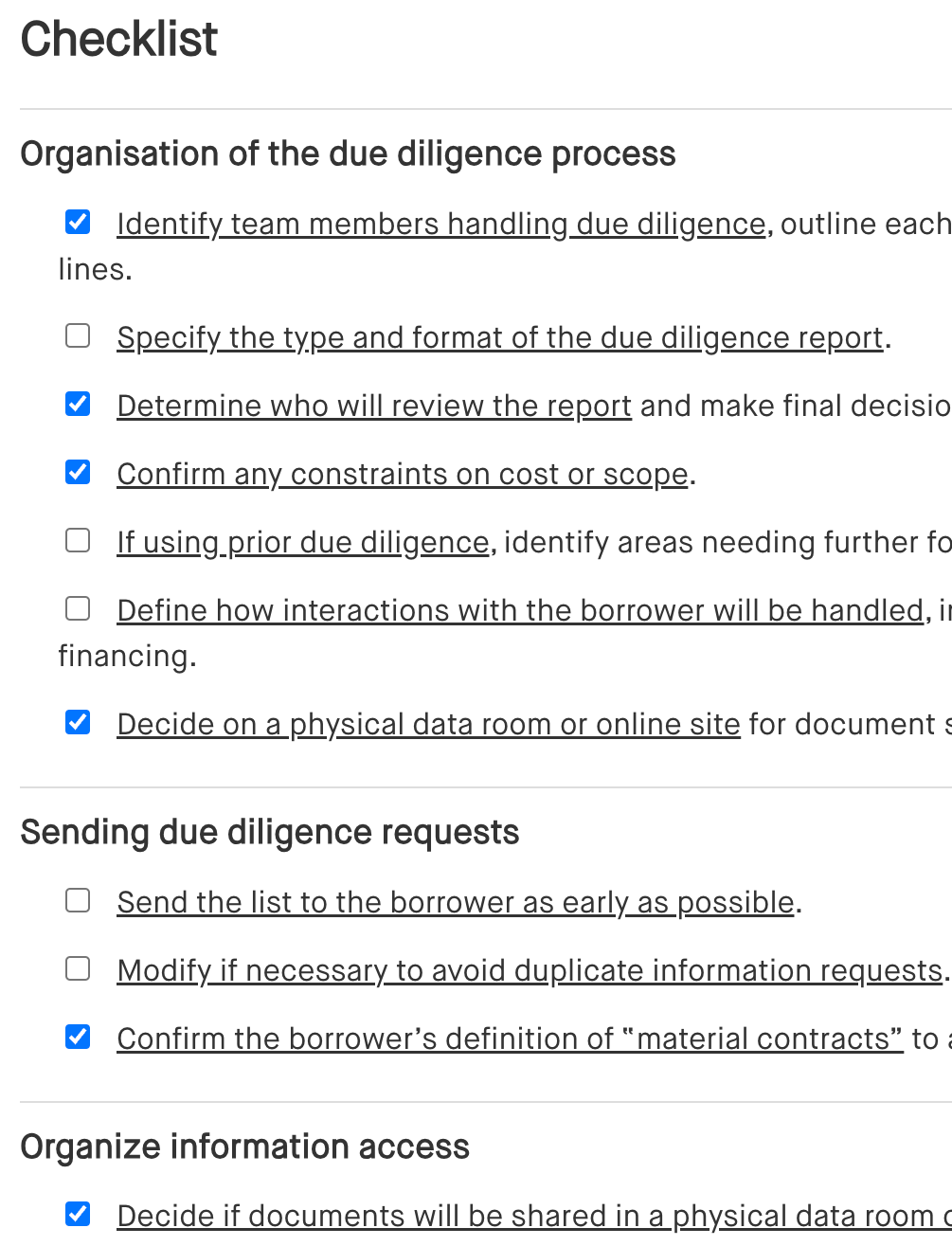

Acquiring a business can be a transformative move for growth, but it’s critical to make sure every part of the process is carefully managed. This business acquisition checklist helps you navigate the process, from assessing the structure of the deal to ensuring compliance with legal, tax, and financial requirements.

Using this due diligence checklist for business acquisitions helps you avoid common mistakes and ensures a smooth transition for both buyer and seller.

How to use this business acquisition checklist

Here’s how to use this business acquisition checklist effectively:

- Follow the steps: This checklist walks you through each key stage of a business acquisition, from preliminary considerations to post-closing. Use it to make sure you cover all necessary tasks and documentation.

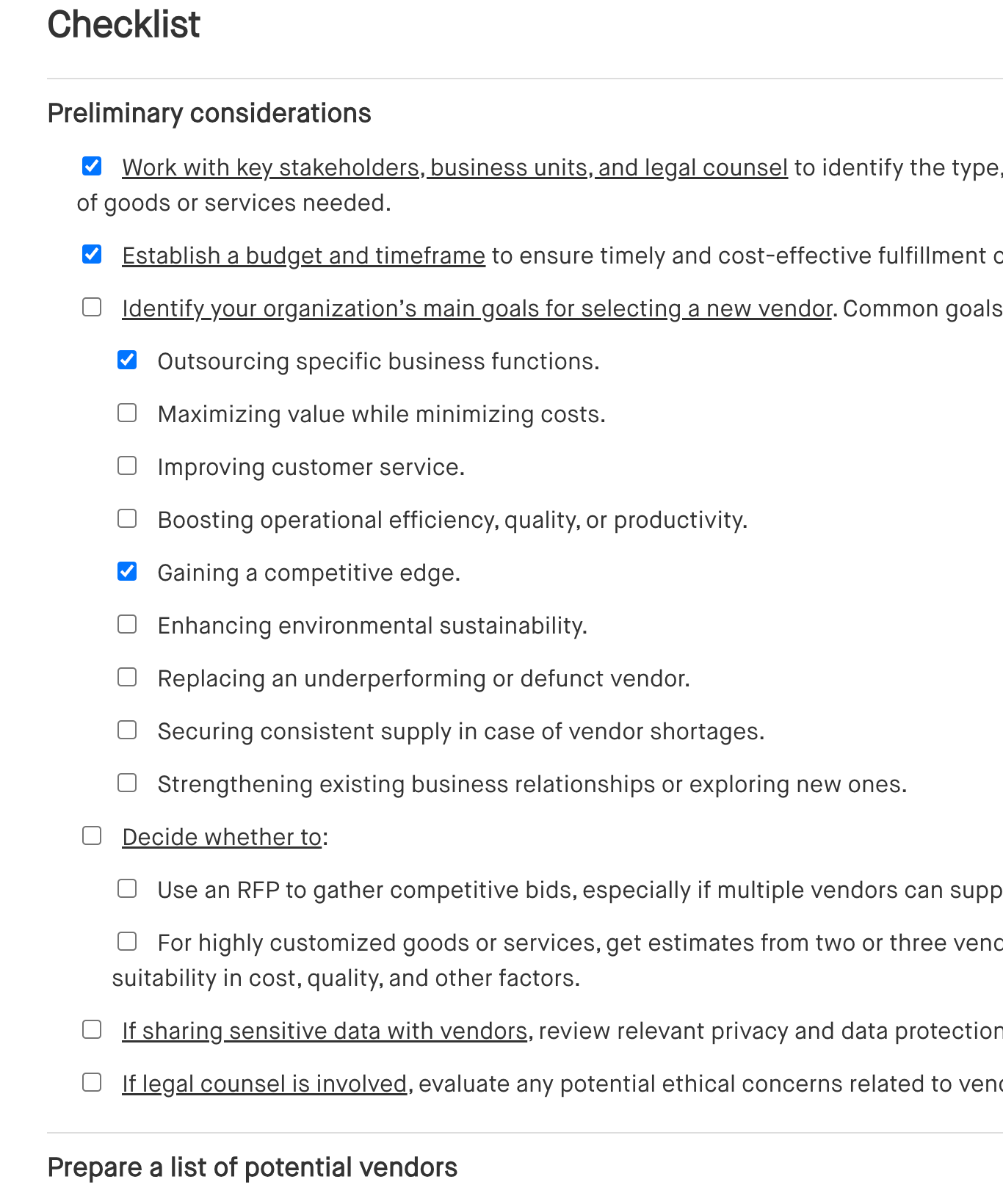

- Tailor to your deal: Every acquisition is different. Adjust the checklist based on the specifics of your transaction—whether you’re acquiring through an asset sale, share purchase, or merger.

- Stay on top of tasks: As you move through the acquisition, mark off completed steps to stay organized and ensure nothing is missed, from due diligence to finalizing agreements.

- Consult advisors: Make sure to involve legal, financial, and tax advisors throughout the process to help identify any potential risks or compliance issues.

Checklist

Benefits of using a business acquisition checklist

When acquiring a business, the process can be complex with numerous tasks to manage. A checklist provides structure, ensuring nothing gets overlooked. Here’s how it helps:

- Avoid missing steps: Acquisitions involve many details and deadlines. A checklist ensures all tasks are covered, preventing important steps from being forgotten.

- Save time: With a clear roadmap, a checklist helps you focus on tasks and avoid delays, keeping the acquisition process on track.

- Minimize risk: Following a structured list reduces the chance of errors or missteps that could lead to costly consequences down the line.

- Stay organized: A checklist organizes each stage of the acquisition, helping manage tasks efficiently, especially when multiple teams are involved.

- Improve efficiency: With everyone clear on what needs to be done and by when, a checklist ensures the team works together seamlessly.

Frequently asked questions (FAQs)

Q: What is a business acquisition checklist?

A: A business acquisition checklist is a step-by-step guide that helps buyers go through the acquisition process systematically, covering everything from due diligence to finalizing legal documents.

Q: Why is a business acquisition checklist important?

A: It ensures that no essential tasks are missed, helps streamline the process, and reduces potential risks or oversights during the acquisition.

Q: What should be included in a business acquisition checklist?

A: It should include sections like structuring the deal, tax considerations, financing, due diligence, legal documents, and post-closing tasks.

Q: When should I use a business acquisition checklist?

A: You should use a checklist throughout the acquisition process, starting from the initial stages of due diligence all the way through to post-closing activities to ensure all steps are completed properly.

Q: How does a checklist help with due diligence?

A: A checklist ensures that all necessary areas of due diligence, such as legal, financial, and operational aspects, are thoroughly reviewed, reducing the risk of missing critical issues.

Q: Who should use a business acquisition checklist?

A: Anyone involved in the acquisition process—whether you’re a buyer, seller, legal team, or financial advisor—can benefit from using a checklist to stay organized and avoid mistakes.

Q: Can a checklist be customized for different types of acquisitions?

A: Yes, you can tailor the checklist to suit the specific nature of your transaction, whether it's a cross-border acquisition, private company purchase, or industry-specific deal.

Q: Do I need a checklist for small acquisitions?

A: Even for smaller deals, a checklist helps streamline the process, ensuring that all necessary steps are taken, minimizing risks, and improving efficiency.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.