Hiring an independent contractor: Free checklist

Independent contractor checklist

Hiring an independent contractor can offer flexibility and specialized skills, but it’s crucial to ensure they are correctly classified to avoid legal risks. This independent contractor checklist guides you through the necessary steps to properly engage independent contractors while maintaining compliance with tax and labor laws.

By following this independent contractor checklist, you’ll cover all bases, from confirming the contractor’s business setup to ensuring that their work remains truly independent from your company’s operations. This helps prevent misclassification issues that could lead to significant financial penalties.

How to use this independent contractor checklist

Here’s how to effectively use this independent contractor checklist:

- Follow the steps thoroughly: This checklist guides you through every stage of the process, from verifying the contractor’s business entity to managing the relationship. Use it as a blueprint to ensure compliance and avoid misclassification risks.

- Tailor the checklist to your needs: While the checklist is comprehensive, adjust it to fit your specific project requirements, industry, and the contractor's unique circumstances. Make sure to address both legal obligations and operational needs.

- Engage the right departments: Involve key departments like HR, finance, and legal to ensure that contracts, payment terms, and legal documentation are aligned with company policy and current regulations.

- Track progress: As you move through the checklist, mark off completed items to ensure you don’t miss any critical steps. This helps keep the process organized and prevents oversight.

- Review and update regularly: Independent contractor laws and regulations can change, so be sure to review and update your checklist regularly. Keep your contractor relationships compliant with any new legal requirements to avoid potential misclassification issues.

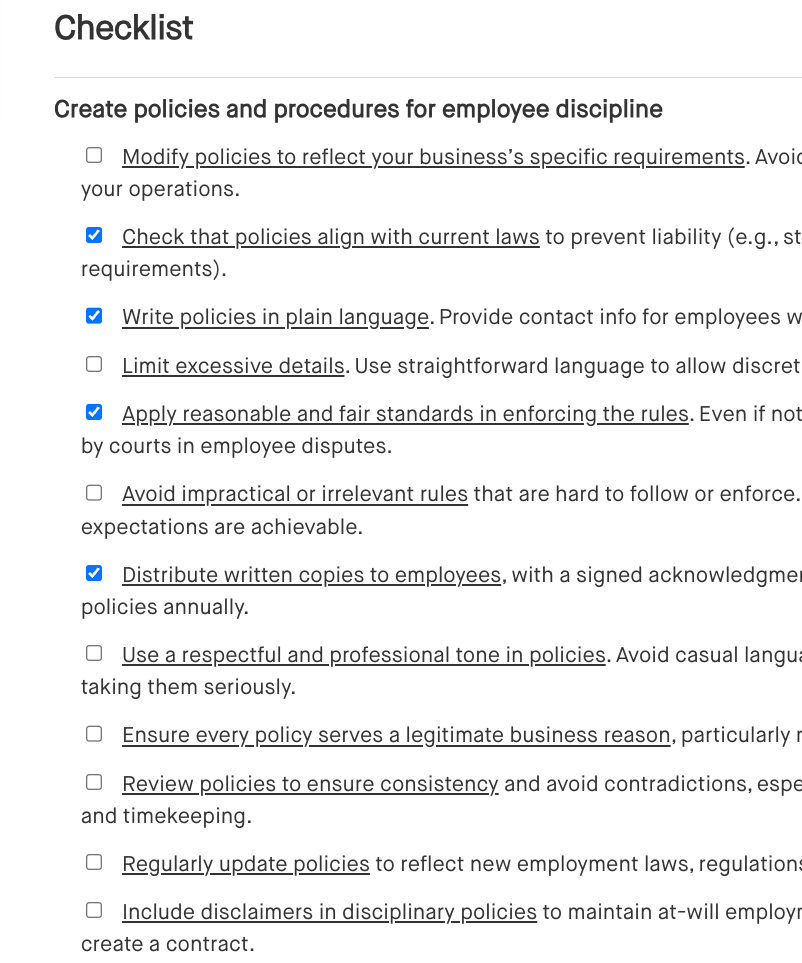

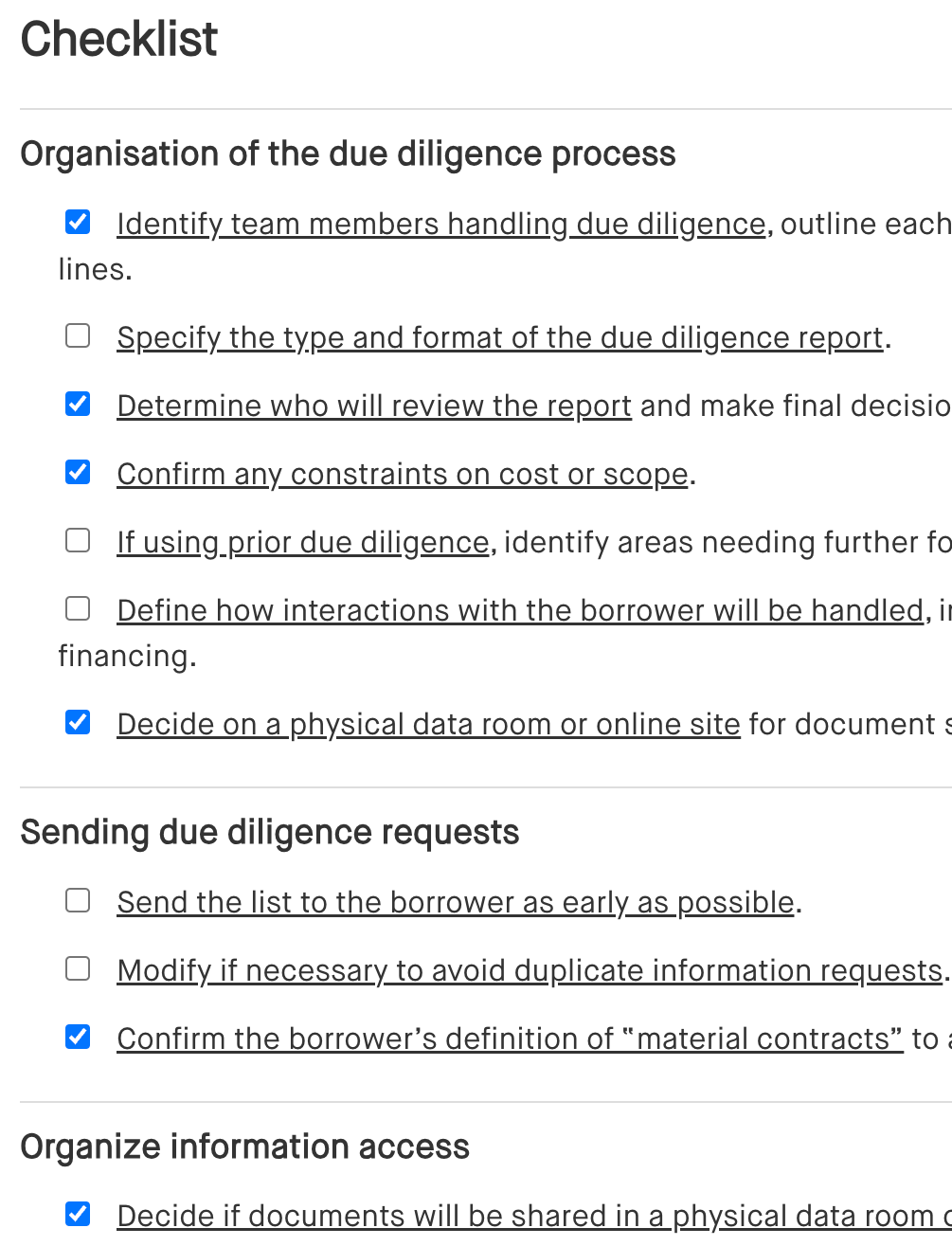

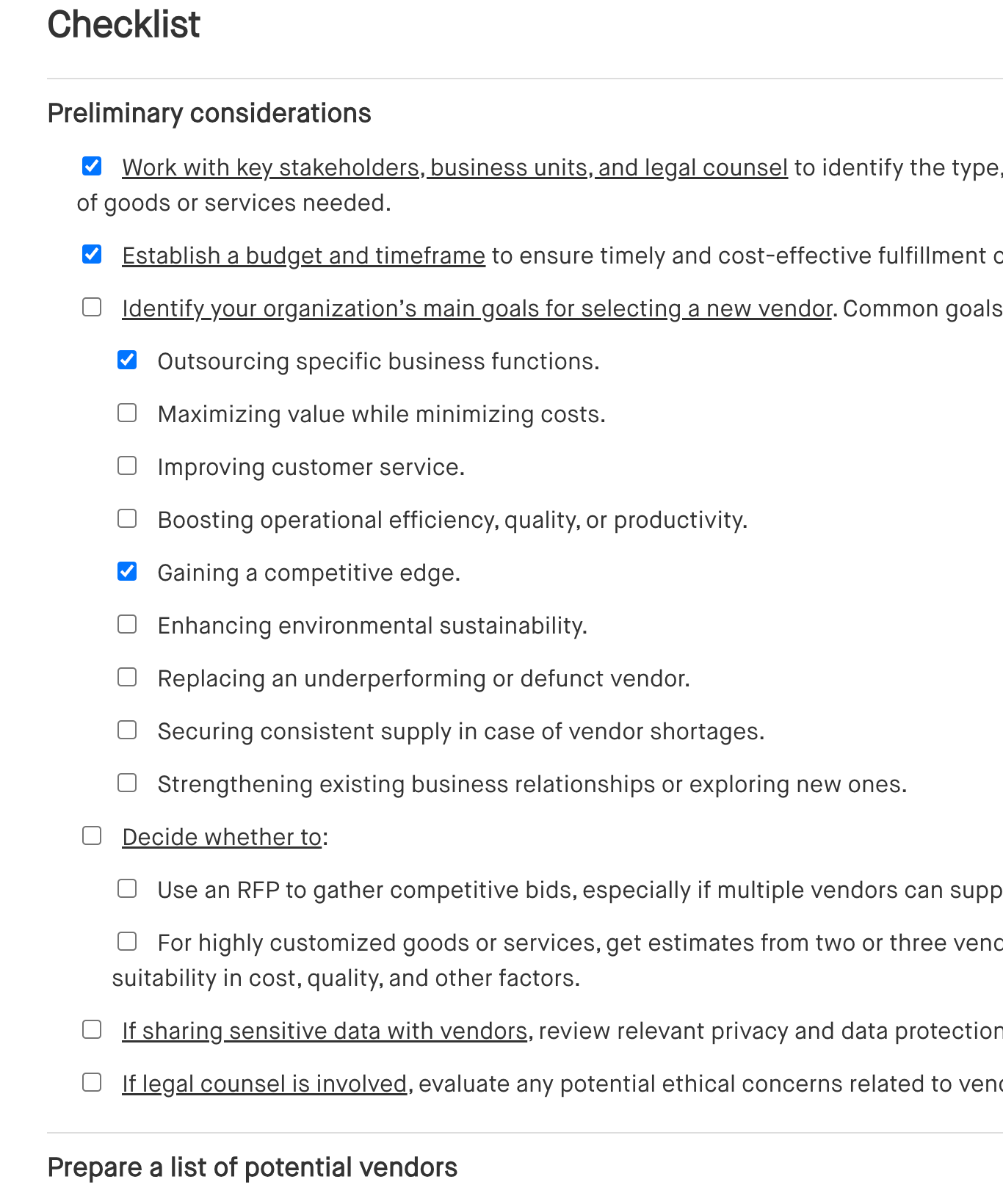

Checklist

Benefits of using an independent contractor checklist

Using an independent contractor checklist ensures your business remains compliant with legal requirements and avoids costly misclassification issues. Here’s how it benefits your organization:

- Legal compliance: The checklist helps ensure you meet all federal, state, and local regulations when hiring independent contractors, reducing the risk of fines or penalties for misclassification.

- Clear documentation: It provides a structured approach to collecting and verifying important documents, ensuring you have the necessary proof to support the independent contractor classification if ever challenged.

- Operational consistency: Following a standardized checklist ensures that your company handles contractor engagements the same way each time, preventing errors or oversights that could lead to legal or financial issues.

- Risk management: By clearly defining the contractor’s role and responsibilities, the checklist minimizes the risk of inadvertently creating an employment relationship, which could expose your business to liability.

- Efficiency: A well-organized process saves time and effort by streamlining the onboarding and management of contractors, ensuring nothing is missed and helping to maintain productive working relationships.

Frequently asked questions (FAQs)

Q: Why is an independent contractor checklist necessary?

A: The checklist ensures that your business complies with legal standards when engaging independent contractors, preventing costly misclassification mistakes and providing clear documentation of the contractor's independence.

Q: What happens if a contractor is misclassified?

A: Misclassifying an independent contractor can lead to serious financial penalties, including back pay, benefits, taxes, and civil penalties. This checklist helps mitigate that risk by ensuring proper classification from the start.

Q: Can I hire a former employee as an independent contractor?

A: It's generally not advisable to rehire former employees as independent contractors to perform the same work. This could increase the risk of misclassification, as the role may still be seen as employee-like.

Q: How often should we review independent contractor agreements?

A: Independent contractor agreements should be reviewed regularly, especially if a contractor is engaged for a new project or term. It’s important to ensure the agreement remains up-to-date and compliant with any legal changes.

Q: What documents do we need to collect from independent contractors?

A: Essential documents include proof of business entity registration, tax documents like a W-9, insurance certificates, and proof of work for other clients. These help demonstrate the contractor’s independence from your company.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.