Vendor due diligence: Free checklist

Vendor due diligence checklist

This vendor checklist template is designed to guide your organization through a a comprehensive vendor due diligence process, assuming there is an request for proposal in connection with the vendor selection. Whether you’re conducting a vendor audit, assessing vendor risk, or qualifying a new vendor, this checklist ensures you cover all essential steps.

By using this template, you’ll be able to effectively manage vendor risk and compliance, ensuring the selected vendor aligns with your business requirements.

How to use this vendor checklist

To get the most value from this vendor risk management checklist, follow these steps:

- Familiarize yourself with the checklist: Start by reading through the entire vendor checklist to understand the vendor due diligence and risk assessment process.

- Tailor it to your needs: Modify the checklist as needed to fit your specific vendor qualification or compliance requirements, such as additional background checks or data security measures.

- Follow the steps carefully: Work through each section methodically, whether you're conducting a vendor risk assessment or a vendor audit. Each step is crucial to ensure you assess all potential risks.

- Collaborate with your team: Involve relevant departments, such as legal, IT, or procurement, to ensure all aspects of vendor compliance and qualification are covered.

- Document everything: Keep a detailed record of your findings during the vendor risk management process, including the vendor’s compliance status and background checks.

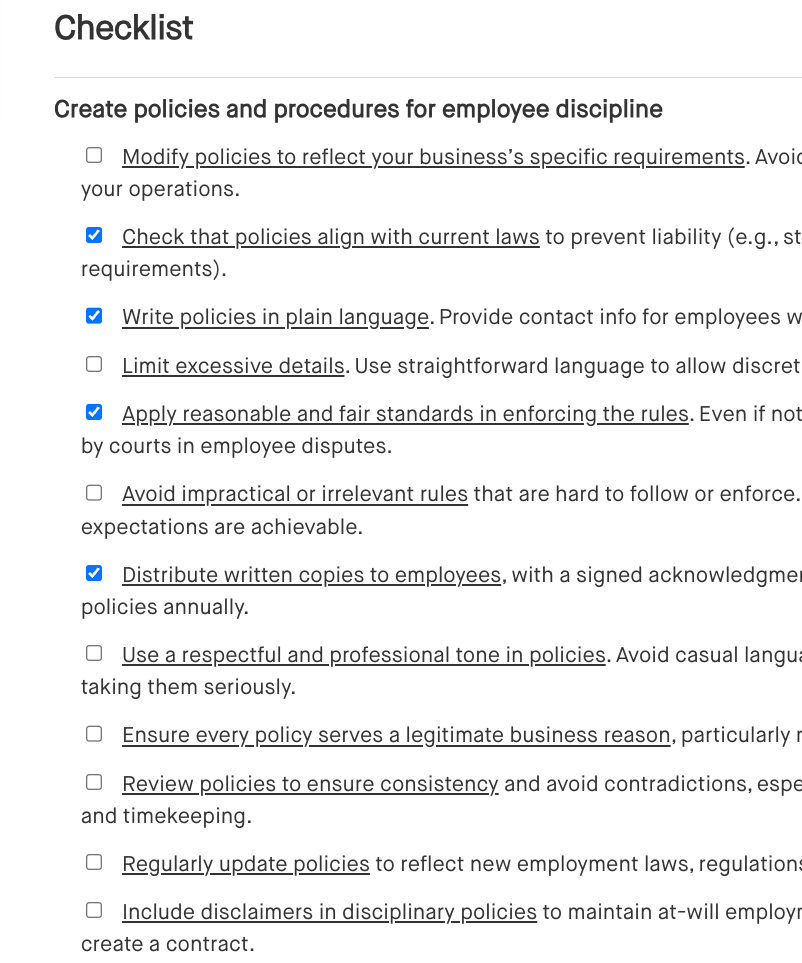

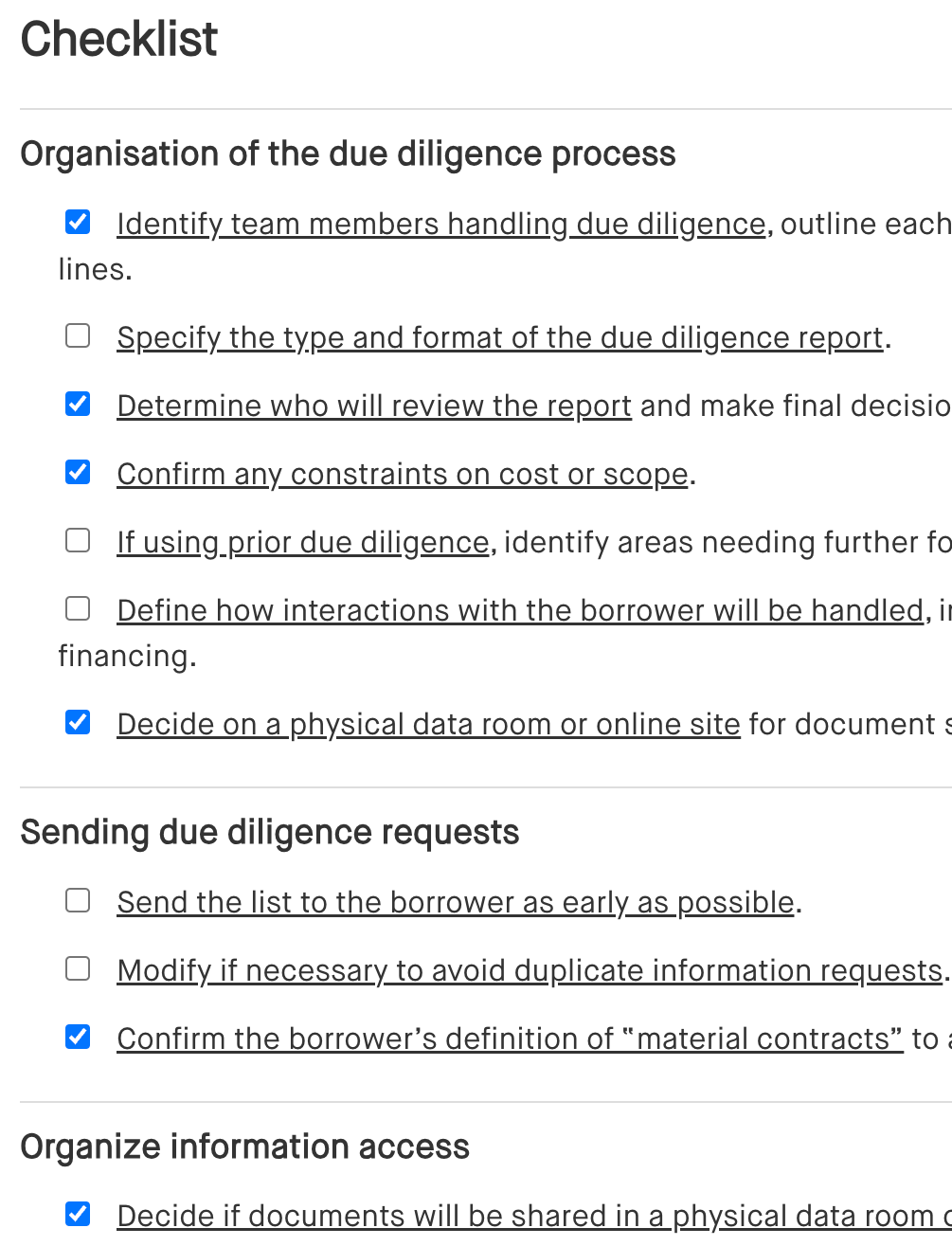

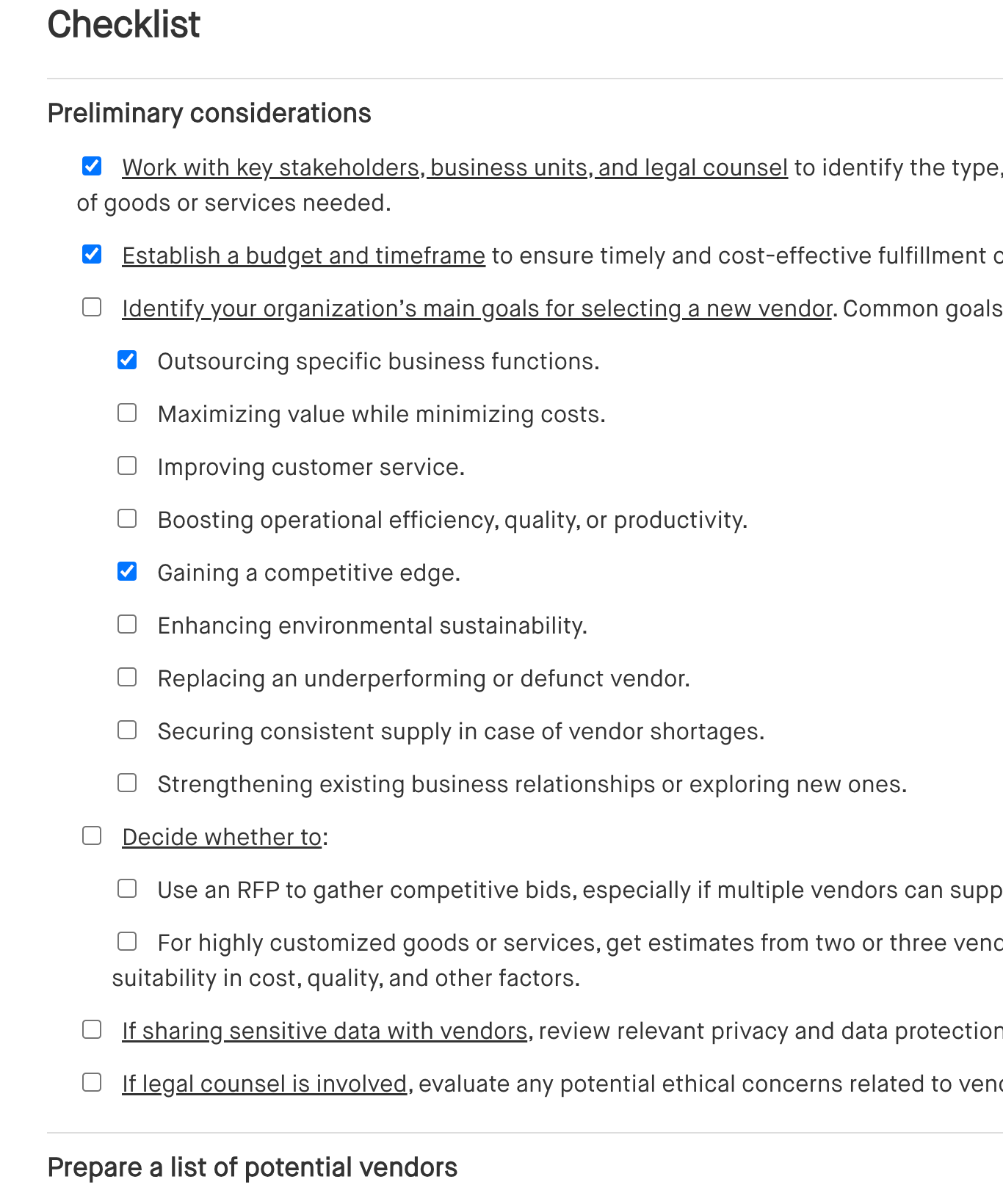

Checklist

Benefits of using a vendor due diligence checklist

This vendor checklist is a simple but powerful tool for small and medium-sized businesses (SMBs) to make smarter decisions when selecting vendors. Here’s how it helps.

- Save time: This checklist cuts through the clutter, giving you a clear, step-by-step process to follow. It helps you get through the vendor due diligence stage faster without missing any key details.

- Reduce risk: By using this vendor risk management checklist, you can identify and avoid common risks like data breaches or compliance issues. It helps you check a vendor’s background, ensure they meet legal standards, and make sure they’re financially stable.

- Make better decisions: The checklist standardizes your process, so every vendor is evaluated on the same criteria. Whether you’re using an RFP or direct quotes, it helps keep decision-making clear and organized.

- Stay compliant: This vendor compliance checklist walks you through all the steps to ensure your vendors follow privacy laws and data security regulations, reducing the chance of any legal headaches later.

- Build stronger vendor relationships: By setting clear expectations from the start, this checklist can help you form solid, long-lasting vendor relationships. It minimizes misunderstandings and makes sure your chosen vendor can meet your needs long-term.

Frequently asked questions (FAQs)

Q: Why is a vendor due diligence checklist important?

A: It helps you thoroughly assess a vendor’s financial health, security practices, and legal compliance before signing any contracts. It’s all about reducing the risk of future problems like data breaches or service disruptions.

Q: How can I customize this checklist?

A: You can adjust the checklist to fit your specific industry or compliance needs. For example, if you need extra security checks or specific legal compliance, just add those steps.

Q: What’s included in a vendor audit checklist?

A: A vendor audit checklist should include items like financial reviews, compliance checks, security assessments, and references. It’s all about making sure the vendor is reliable and able to meet your business needs.

Q: How often should I do a vendor risk assessment?

A: Ideally, before signing a contract and then at least once a year after that. This helps keep tabs on any changes in the vendor’s operations or risks.

Q: Can this checklist help with vendor qualification?

A: Absolutely. This vendor qualification checklist helps you assess if a vendor is capable of meeting your needs, from their capacity to their security measures and compliance.

Q: What should I do if I don’t get enough vendor proposals after sending an RFP?

A: If responses are low, review your RFP and make adjustments to the scope or requirements. You can also reach out directly to potential vendors to increase the number of submissions.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.