Vendor management compliance: Free checklist

Vendor management compliance checklist

This checklist helps financial institutions create a vendor management program for consumer-facing vendors and their compliance with federal consumer financial laws. It outlines the main responsibilities involved in selecting, onboarding, and overseeing vendors to ensure they follow federal consumer financial laws. Covering everything from assessing regulatory risks to ongoing monitoring, this checklist offers a clear process for managing vendor relationships and protecting consumer interests.

By following this checklist, institutions can set up effective vendor management practices that promote accountability, reduce regulatory risks, and keep consumer protections in place.

How to use this vendor management compliance checklist

To build and maintain an effective vendor management program, follow these steps to get the most out of the checklist:

- Work through each step in order: Begin by assessing risks associated with each vendor, then proceed through due diligence, contracting, and monitoring for ongoing compliance. This step-by-step process ensures thorough vetting and oversight.

- Involve the right teams: A successful vendor management program requires collaboration across departments. Engage legal, compliance, risk management, and relevant business units to ensure vendors align with your institution’s regulatory and consumer protection standards.

- Document all actions and decisions: Keep a comprehensive record of risk assessments, contracts, monitoring outcomes, and corrective actions. Documentation serves as an audit trail, demonstrating compliance with regulatory requirements.

- Customize for your institution’s needs: Adapt this checklist to suit your institution’s specific vendor relationships and risk profile. Different types of vendors and services may need unique compliance checks or monitoring protocols.

- Regularly review and update policies: Laws, regulations, and best practices for vendor management evolve over time. Periodically review and update your vendor management processes to ensure they remain compliant and effective in mitigating risks.

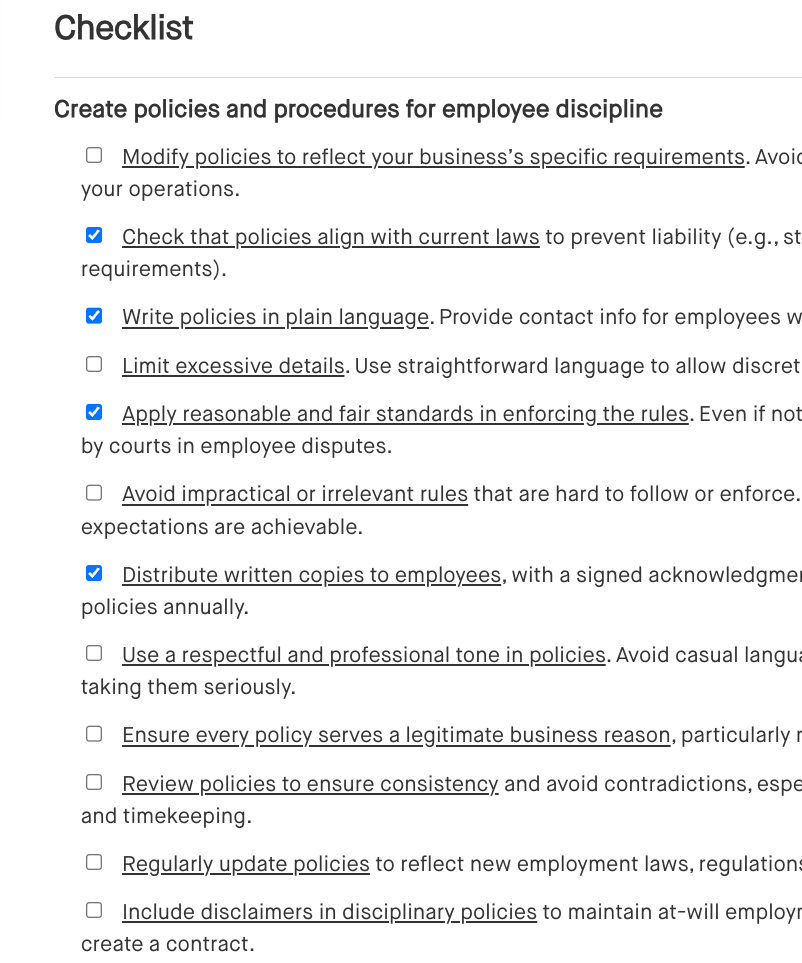

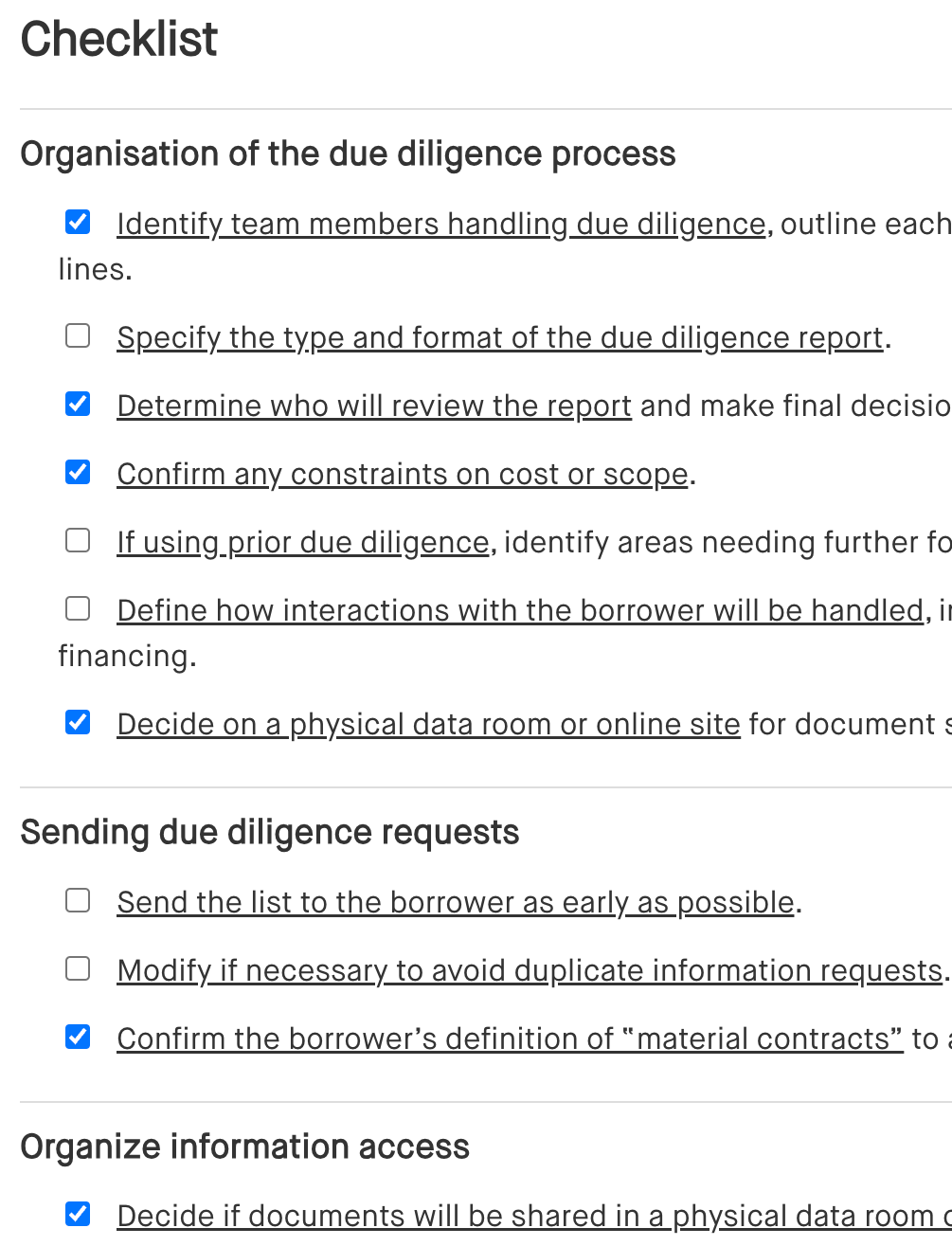

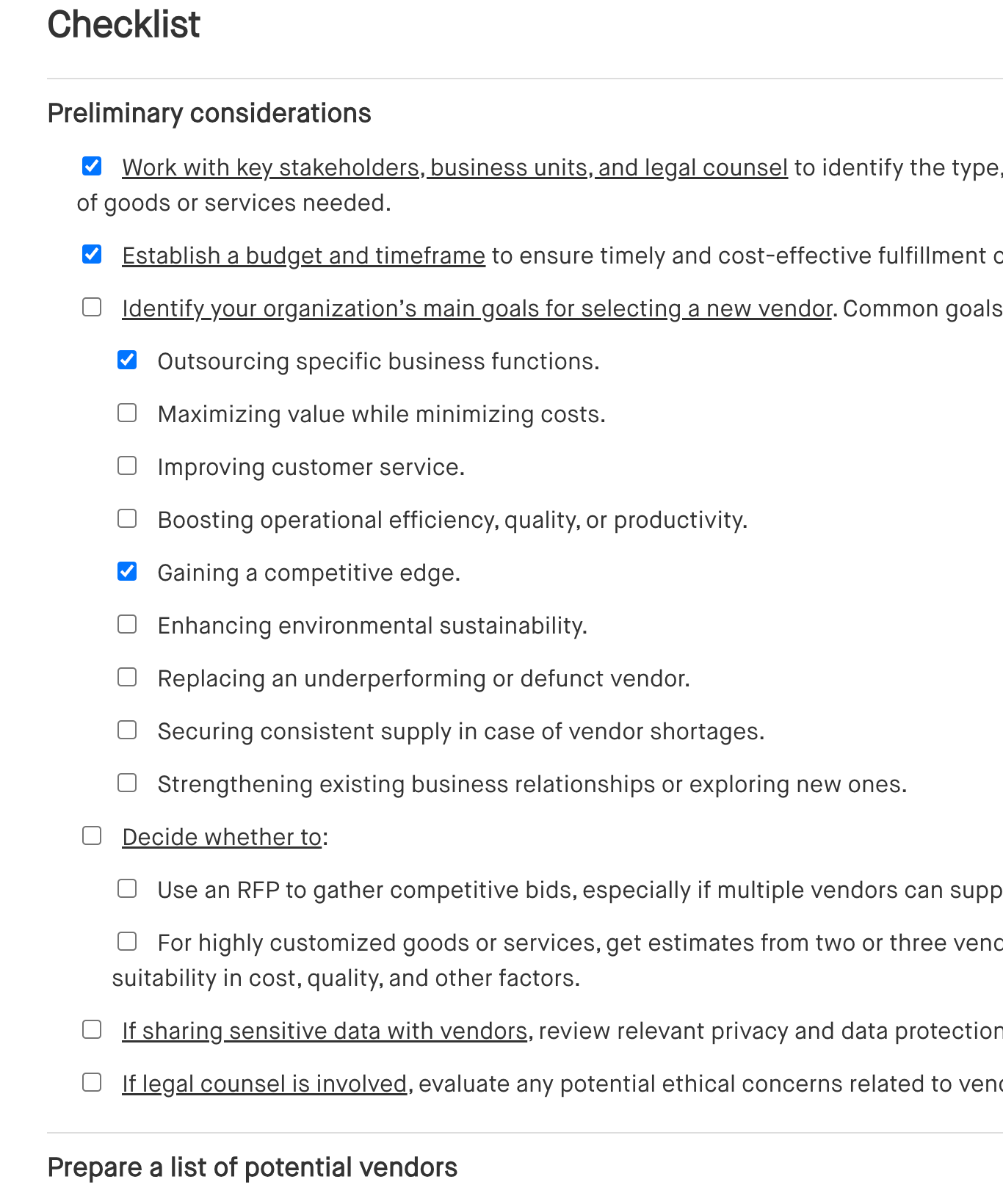

Checklist

Benefits of using a vendor management compliance checklist

Using this checklist brings several benefits for managing your consumer-facing vendors effectively:

- Ensure regulatory compliance: This checklist helps you stay aligned with federal consumer financial laws, reducing the risk of penalties or compliance issues.

- Protect consumers: By setting standards for data security, privacy, and fair treatment, you’re better positioned to protect consumer rights and build trust.

- Reduce risk: Clear guidelines and regular oversight lower the chances of legal or reputational issues due to vendor actions.

- Set clear expectations: With defined roles and responsibilities in your contracts and policies, you can make sure vendors understand and meet compliance requirements.

- Simplify oversight: This checklist provides a structured approach to consistently monitor vendors, making it easier to spot and address any issues early.

Frequently asked questions (FAQs)

Q: Why do I need a vendor management compliance checklist?

A: A checklist like this helps you ensure that vendors meet regulatory standards and protects both your institution and consumers from risks tied to non-compliant vendor practices.

Q: How often should I update my vendor management checklist?

A: Review it at least once a year, or whenever there are significant regulatory changes, to keep your compliance standards up to date.

Q: What areas of vendor compliance does this checklist cover?

A: This checklist guides you through everything from initial risk assessment and onboarding to contract requirements, policy reviews, and ongoing monitoring.

Q: Who should be using this checklist?

A: Compliance officers, risk managers, and any team members involved in vendor selection and oversight within your institution will find this checklist valuable.

Q: How does this checklist support consumer protection?

A: By helping you enforce privacy, security, and fair treatment practices, the checklist can prevent consumer harm and strengthen trust with your customers.

Q: What should I do if a vendor isn’t meeting compliance standards?

A: This checklist includes steps for taking corrective action, which may mean working with the vendor to resolve issues—or, if needed, ending the relationship to protect your institution.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.