Sale of Goods Agreement (Pro-Seller) (Alabama): Free template

Sale of Goods Agreement (Pro-Seller) (Alabama)

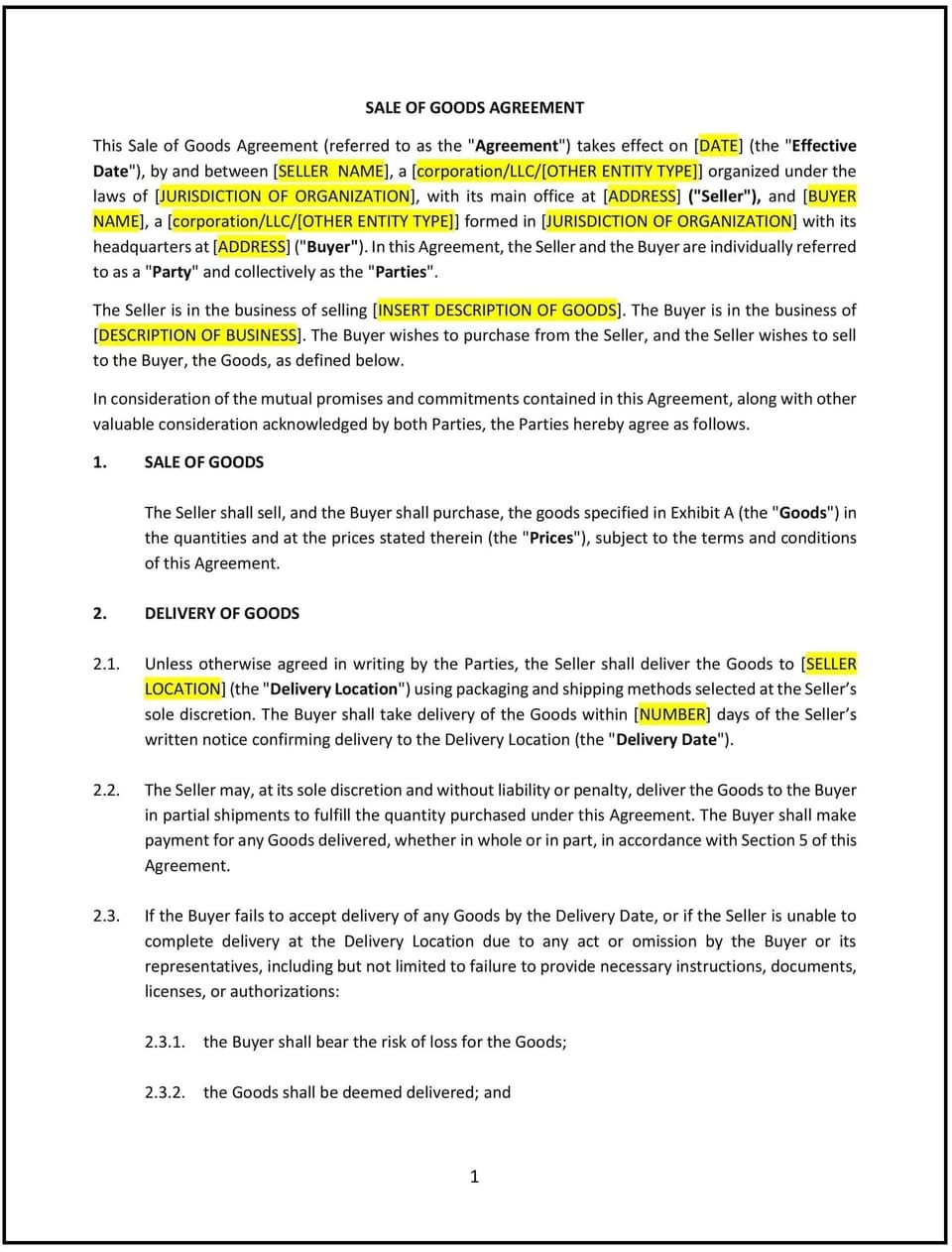

A Sale of Goods Agreement (Pro-Seller) in Alabama is a legally binding contract that establishes the terms under which a seller provides goods to a buyer. This agreement protects the seller’s interests by defining payment terms, delivery obligations, risk allocation, and liability limitations. It is commonly used in industries such as manufacturing, wholesale distribution, retail, and e-commerce, where businesses regularly engage in sales transactions.

Alabama businesses use this agreement to secure payments, prevent disputes over product quality, and establish enforceable sales terms. Alabama follows Uniform Commercial Code (UCC) Article 2, which governs the sale of goods and allows sellers to disclaim certain warranties, enforce payment terms, and set delivery obligations. A well-drafted agreement helps sellers prevent issues related to late payments, product returns, and liability for lost or damaged goods.

For sellers operating in Alabama, this agreement provides a structured framework that ensures smooth transactions, reduces financial risks, and protects revenue. While Alabama contract law generally upholds clearly drafted agreements, businesses should ensure that their terms comply with UCC provisions and any state-specific commercial regulations.

Tips for drafting and maintaining a Sale of Goods Agreement (Pro-Seller) in Alabama

- Clearly define the goods being sold, including specifications, quantity, pricing, and acceptable quality standards to prevent disputes.

- Establish payment terms, including required deposits, invoicing timelines, penalties for late payments, and acceptable payment methods. Alabama law enforces properly documented payment obligations.

- Specify delivery terms, including shipping responsibilities, risk transfer, and liability for lost or damaged goods. Under Alabama UCC Article 2, risk of loss generally passes to the buyer upon delivery unless otherwise stated.

- Limit seller liability by disclaiming implied warranties unless the seller explicitly offers guarantees. Alabama law allows sellers to exclude warranties of merchantability and fitness for a particular purpose, provided the disclaimer is clearly stated in writing.

- Include a return and refund policy that specifies whether returns are allowed and under what conditions. Alabama law permits sellers to establish "no return" policies, provided they are clearly disclosed to the buyer.

- Incorporate a force majeure clause to protect the seller from liability if unforeseen events, such as natural disasters or supply chain disruptions, delay or prevent fulfillment of the agreement.

Frequently asked questions (FAQs)

Q: What should Alabama businesses include in a Sale of Goods Agreement (Pro-Seller)?

A: Businesses should outline product descriptions, payment terms, delivery obligations, warranty disclaimers, risk of loss terms, and liability limitations to protect the seller.

Q: How does a Sale of Goods Agreement (Pro-Seller) benefit Alabama sellers?

A: It protects sellers from disputes over product quality, late payments, and liability while ensuring that payment and delivery terms are legally enforceable.

Q: Are disclaimers of warranties enforceable in Alabama?

A: Yes, under Alabama UCC Article 2, sellers can disclaim implied warranties, such as the warranty of merchantability and fitness for a particular purpose, as long as the disclaimer is clearly stated in writing.

Q: What happens if a buyer refuses to pay under a Sale of Goods Agreement in Alabama?

A: The seller can enforce payment terms through legal action, including contract damages, repossession of goods, or interest penalties on late payments.

Q: How should Alabama sellers handle disputes under a Sale of Goods Agreement?

A: Sellers should include a dispute resolution clause specifying whether disputes will be handled through arbitration, mediation, or Alabama courts.

Q: Does Alabama require sales tax on goods sold under this agreement?

A: Yes, most sales of tangible goods in Alabama are subject to Alabama sales and use tax laws, and sellers must collect and remit applicable taxes unless an exemption applies.

Q: Can a seller refuse returns under a Sale of Goods Agreement in Alabama?

A: Yes, the agreement can specify no returns or limited returns, as long as this policy is clearly disclosed to the buyer in the contract.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.