Letter confirming angel investor funding round closure: Free template

Letter confirming angel investor funding round closure

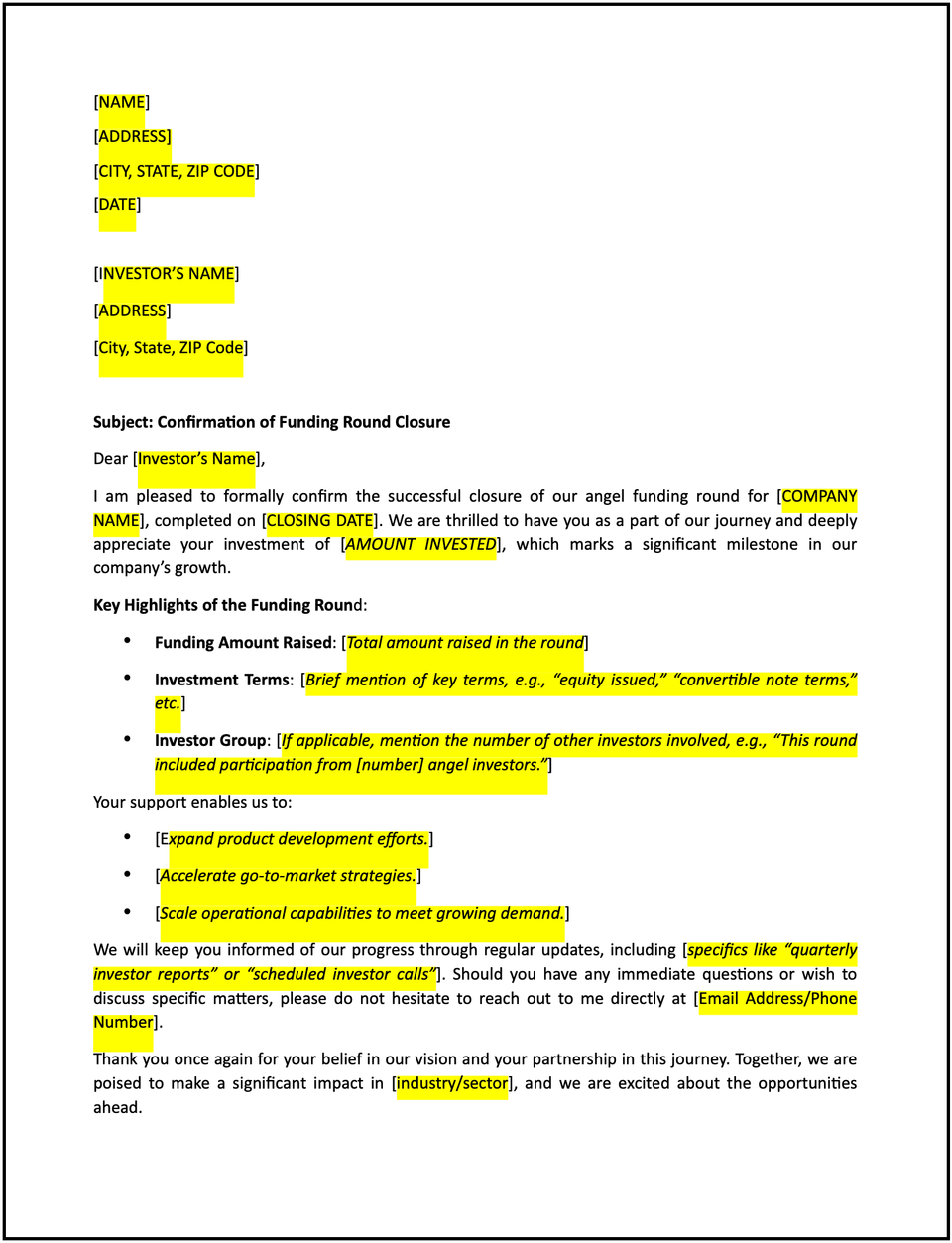

A letter confirming the closure of an angel investor funding round is a formal communication used to announce the successful completion of a fundraising round. It serves to acknowledge and thank participating investors, provide high-level details about the round, and outline the next steps for collaboration.

How to use this letter confirming angel investor funding round closure

- Open with an introduction: Address the recipient respectfully and express gratitude for their participation and support in the funding round.

- Announce the closure: Clearly state that the funding round has successfully closed, including the total amount raised if appropriate.

- Provide key details: Share high-level information about the round, such as the number of participants, target achievements, and its alignment with the company’s goals.

- Reaffirm the relationship: Highlight the importance of the investor’s role in supporting the company’s vision and growth.

- Outline next steps: Briefly mention plans for how the funds will be utilized and the timeline for updates or reports to investors.

- Encourage ongoing collaboration: Reassure investors of their integral role and invite them to stay actively engaged with the company’s progress.

- Maintain a professional tone: Ensure the letter is clear, respectful, and focused on fostering a strong relationship.

- Provide contact information: Include details for the recipient to reach out with questions or discuss future opportunities.

Benefits of using a letter confirming angel investor funding round closure

This letter ensures a structured and professional way to communicate funding success while fostering investor confidence and collaboration. Here’s how it helps:

- Strengthens relationships: Acknowledging investor support builds trust and goodwill.

- Promotes transparency: Sharing key details about the funding round demonstrates accountability.

- Reflects professionalism: A well-crafted letter reinforces the company’s credibility and commitment.

- Encourages ongoing engagement: Highlighting future collaboration opportunities keeps investors involved.

- Supports alignment: Providing next steps ensures investors are informed about how their funds will be used.

Tips for writing an effective letter confirming angel investor funding round closure

- Be specific: Clearly outline the funding round details, including the total raised and its significance.

- Use professional language: Maintain a respectful and appreciative tone to foster trust.

- Provide context: Briefly explain how the funds align with the company’s mission and growth plans.

- Highlight mutual benefits: Emphasize how the funding supports both the company’s vision and investor goals.

- Include actionable steps: Share information about upcoming updates, events, or reports to keep investors informed.

- Keep it concise: Focus on the essential points while ensuring the tone is professional and engaging.

Frequently asked questions (FAQs)

Q: What details should I include in this letter?

A: Include the total amount raised, number of investors, key achievements, and next steps.

Q: Should I personalize the letter?

A: Yes, addressing each investor by name and referencing their specific contribution demonstrates attentiveness and professionalism.

Q: Who typically sends this letter?

A: Founders, CEOs, or investor relations teams typically send this letter.

Q: How formal should this letter be?

A: The tone should be professional, respectful, and appreciative to foster trust and alignment.

Q: When should this letter be sent?

A: Send the letter promptly after the funding round’s closure to maintain transparency and engagement.

Q: Can this letter include a summary of the investment terms?

A: Yes, a brief mention of the terms can be included if relevant, but avoid overly detailed or confidential information.

Q: Is acknowledgment from the recipient required?

A: While not mandatory, requesting acknowledgment ensures the investor is aligned with the outlined next steps.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.