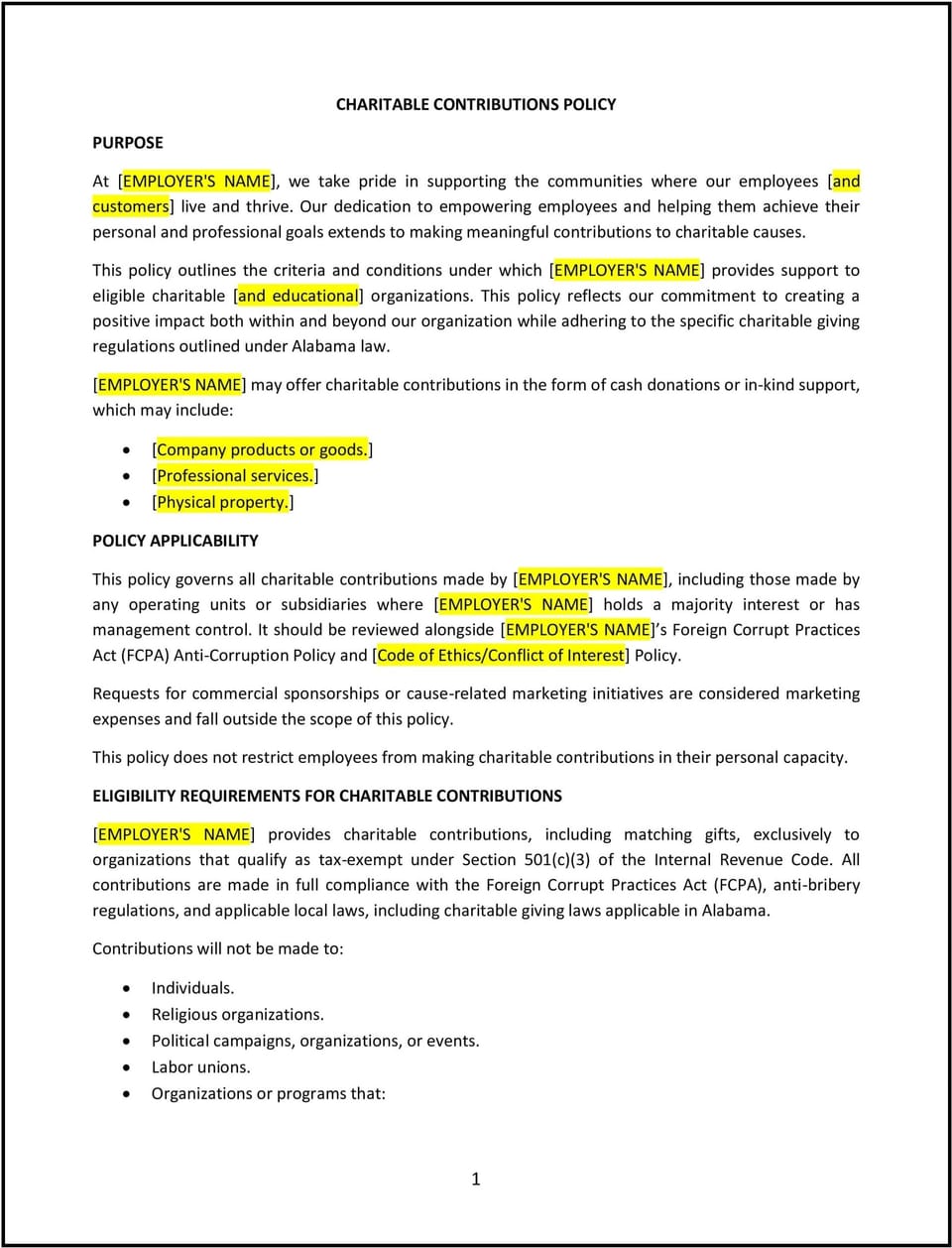

Charitable contributions policy (Alabama): Free template

Charitable contributions policy (Alabama)

A charitable contributions policy provides clear guidelines for supporting nonprofit organizations, charities, and educational initiatives. For SMBs in Alabama, this policy helps align your company’s giving efforts with your values while ensuring transparency and consistency. Tailoring this policy allows you to manage contributions effectively and comply with applicable tax laws and regulations.

How to use this charitable contributions policy (Alabama)

- Define eligible organizations: Specify the types of charities, nonprofits, or educational institutions your business supports, such as those registered under 501(c)(3).

- Set contribution limits: Establish guidelines for the amount or percentage of revenue allocated to charitable efforts.

- Create an approval process: Outline how employees or organizations can request donations, including required documentation or proposals.

- Align with Alabama-specific needs: Consider focusing contributions on causes relevant to your local community, such as disaster relief or education in rural areas.

- Communicate internally: Share the policy with employees to encourage involvement and ensure clarity about the process.

Benefits of using a charitable contributions policy (Alabama)

A structured charitable contributions policy supports your business’s philanthropic goals while maintaining accountability. Here's how it helps:

- Enhances community impact: Focuses your contributions on meaningful causes, strengthening your relationship with the local community.

- Promotes transparency: Provides a clear framework for how charitable decisions are made and managed.

- Builds brand reputation: Positions your business as socially responsible and committed to giving back.

- Ensures compliance: Aligns with Alabama tax laws and federal regulations governing charitable contributions.

- Encourages employee engagement: Inspires your team to participate in philanthropic initiatives.

Tips for implementing a charitable contributions policy (Alabama)

- Focus on local impact: Prioritize causes that directly benefit Alabama communities, such as education, healthcare, or disaster recovery.

- Involve employees: Encourage staff to suggest organizations or participate in volunteer opportunities alongside contributions.

- Document contributions: Maintain detailed records of donations to ensure compliance with tax regulations and to measure impact.

- Set an annual review: Regularly evaluate the effectiveness of your contributions and update the policy as needed.

- Highlight contributions publicly: Share your philanthropic efforts through social media or local events to build goodwill and inspire others.

Q: Why does my SMB need a charitable contributions policy?

A: A policy ensures consistency, transparency, and alignment with your business’s values while maximizing the impact of your giving.

Q: What types of organizations should I support?

A: Focus on 501(c)(3) charities or causes aligned with your mission, such as educational programs, community initiatives, or disaster relief efforts.

Q: Are charitable contributions tax-deductible in Alabama?

A: Yes, contributions to eligible organizations can typically be deducted, but consult a tax advisor to ensure compliance with federal and state laws.

Q: How can employees get involved?

A: Employees can nominate charities for consideration, participate in volunteer events, or assist with organizing fundraising efforts.

Q: How much should my business allocate to charitable contributions?

A: This depends on your revenue and goals, but many SMBs set a percentage of profits or a fixed annual budget for donations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.