Charitable contributions policy (Alaska): Free template

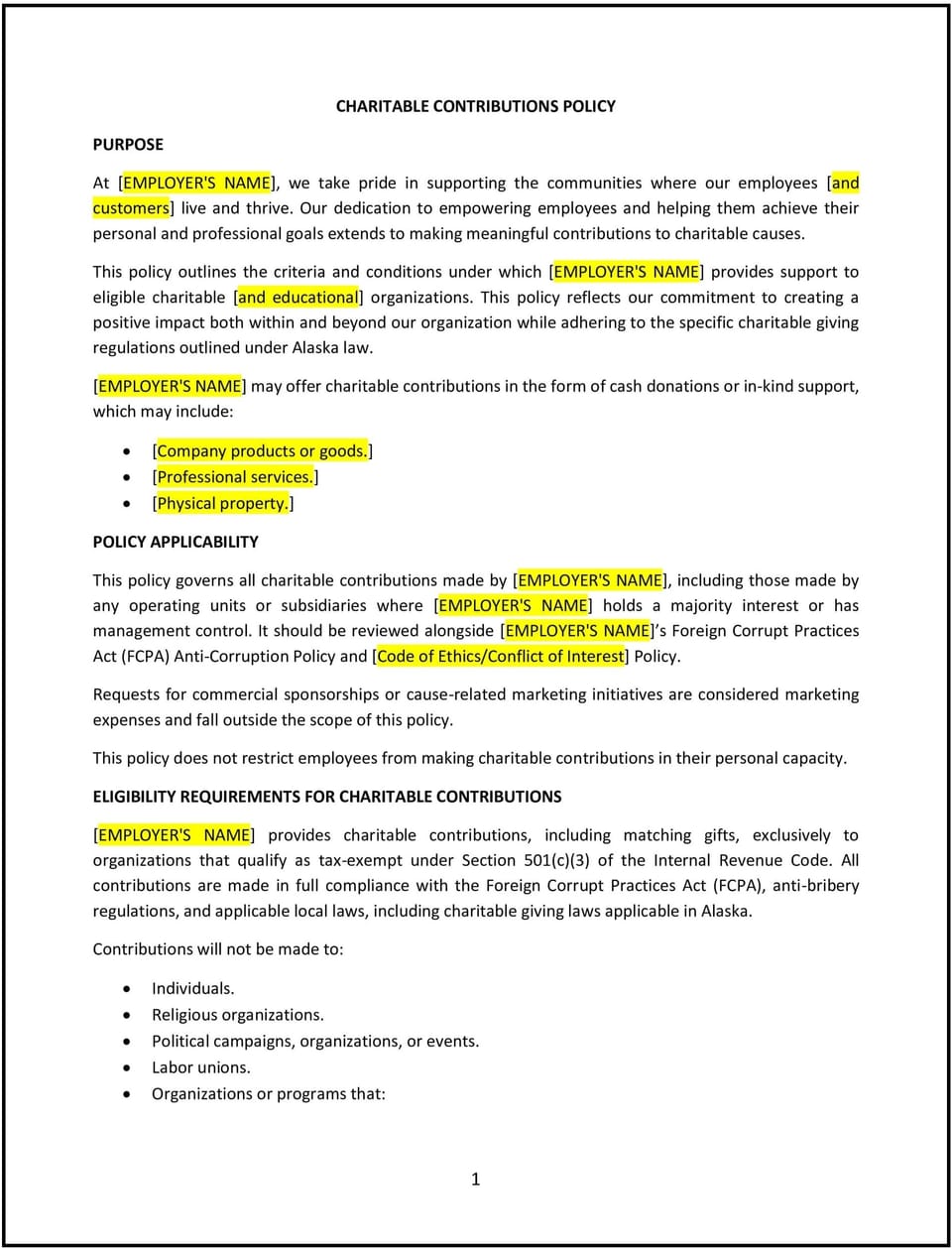

Charitable contributions policy (Alaska)

In Alaska, a charitable contributions policy helps businesses establish clear guidelines for donating to nonprofits, community programs, and other charitable organizations. This policy outlines the company’s approach to supporting causes, including criteria for selecting beneficiaries, budgeting, and employee involvement. By implementing this policy, businesses can contribute to their communities while maintaining transparency and accountability in their philanthropic efforts.

Given Alaska’s unique social and economic environment, businesses may tailor the policy to address local needs, such as supporting rural communities, indigenous organizations, or environmental conservation efforts.

How to use this charitable contributions policy (Alaska)

- Define contribution criteria: Specify the types of organizations or causes eligible for contributions, such as nonprofits with a focus on education, healthcare, or environmental sustainability.

- Set a budget: Establish an annual or project-specific budget for charitable contributions to ensure financial planning and accountability.

- Include employee involvement: Provide options for employees to suggest causes or participate in matching donation programs, volunteer efforts, or fundraising activities.

- Ensure transparency: Outline procedures for reviewing and approving contributions, ensuring all decisions are documented and align with the company’s mission and values.

- Communicate the policy: Share the policy with employees, stakeholders, and beneficiaries to promote awareness and encourage alignment with the company’s philanthropic goals.

Benefits of using a charitable contributions policy (Alaska)

A charitable contributions policy provides several advantages for businesses in Alaska. Here’s how it helps:

- Strengthens community ties: Demonstrates the company’s commitment to supporting local communities and causes, enhancing its reputation and fostering goodwill.

- Encourages employee engagement: Provides employees with opportunities to participate in charitable efforts, boosting morale and teamwork.

- Supports compliance: Helps ensure contributions are made in line with applicable laws and regulations, reducing risks of misuse or mismanagement.

- Enhances transparency: Promotes accountability by documenting decisions and processes related to charitable giving.

- Builds brand reputation: Positions the company as a socially responsible organization, appealing to clients, customers, and potential employees.

Tips for using a charitable contributions policy (Alaska)

- Focus on local needs: Prioritize causes that address Alaska-specific challenges, such as supporting indigenous communities or rural healthcare initiatives.

- Establish clear processes: Define how requests for contributions are submitted, reviewed, and approved to ensure consistency and fairness.

- Encourage matching programs: Consider offering donation matching programs to amplify employees’ personal contributions and engagement.

- Review annually: Evaluate the effectiveness of the policy and adjust it to reflect changes in company goals, community needs, or financial capacity.

- Promote partnerships: Build long-term relationships with selected organizations to create a more meaningful and sustained impact.

Q: How should I choose which causes to support under this policy?

A: Select causes that align with your company’s mission, values, and goals. Prioritize local organizations or programs that address community-specific needs in Alaska.

Q: What budget should I allocate for charitable contributions?

A: The budget depends on your company’s financial capacity and goals. Consider setting a percentage of profits or a fixed annual amount for contributions.

Q: How can I ensure transparency in charitable giving?

A: Document all contribution decisions, communicate them to stakeholders, and conduct periodic reviews to ensure the policy is followed consistently.

Q: Can employees suggest causes to support?

A: Yes, many companies encourage employees to propose causes or participate in donation matching programs, fostering greater engagement and teamwork.

Q: How do I evaluate the impact of charitable contributions?

A: Regularly review the outcomes of contributions by seeking feedback from beneficiary organizations and assessing the alignment with your company’s goals.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.