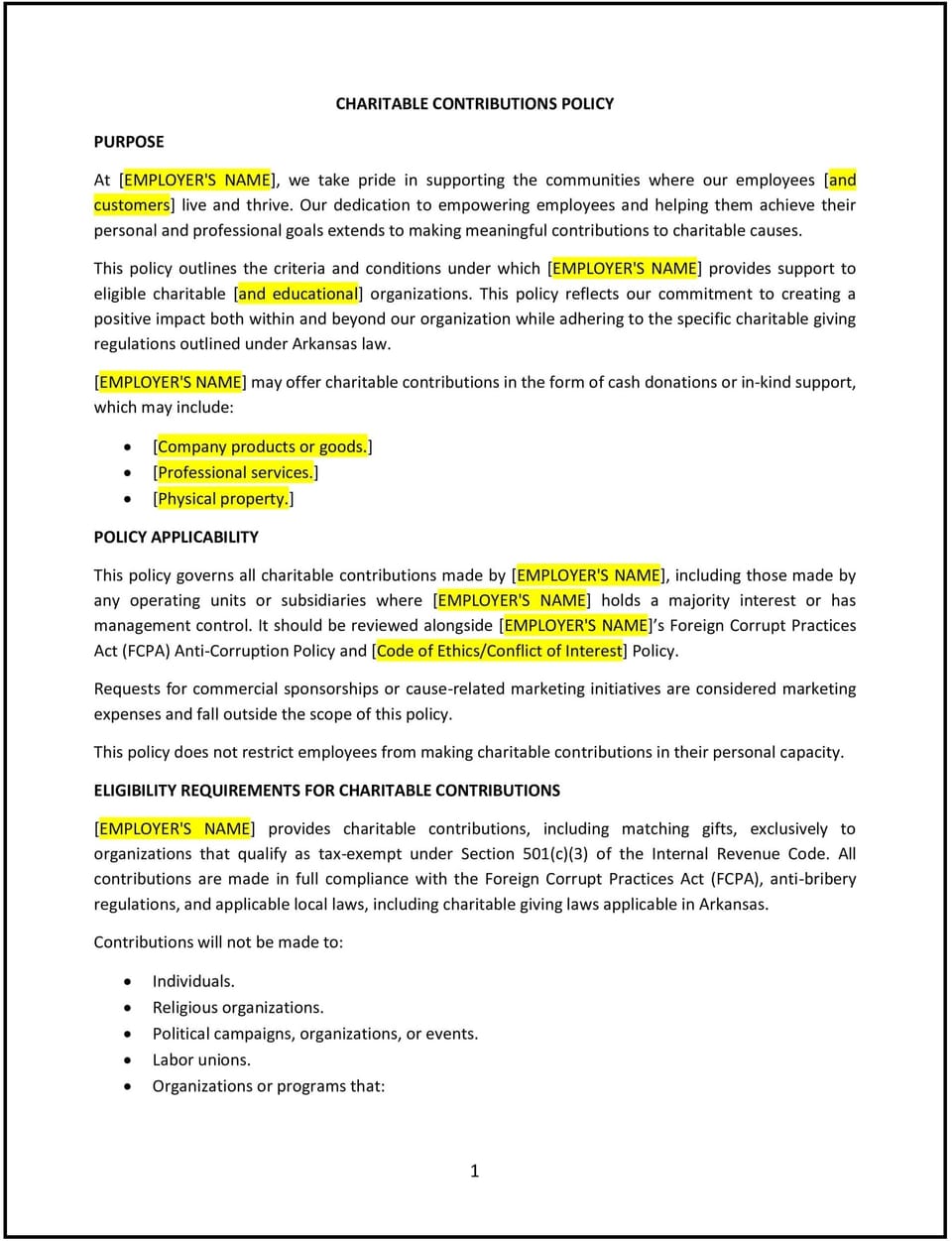

Charitable contributions policy (Arkansas)

Charitable contributions policy (Arkansas)

In Arkansas, a charitable contributions policy provides businesses with clear guidelines for making donations and supporting charitable organizations. This policy ensures transparency, aligns contributions with the business’s values, and promotes ethical and compliant giving practices.

This policy outlines the approval process for donations, criteria for selecting charitable organizations, and reporting requirements. By implementing this policy, Arkansas businesses can strengthen community ties, enhance their reputation, and support compliance with relevant laws and regulations.

How to use this charitable contributions policy (Arkansas)

- Define eligible contributions: Specify the types of charitable contributions the business will support, such as monetary donations, sponsorships, or in-kind gifts, and ensure alignment with the company’s values.

- Establish approval procedures: Outline the process for reviewing and approving donation requests, including the roles of managers or executives in decision-making.

- Set selection criteria: Provide guidelines for selecting organizations to ensure donations are directed toward reputable, tax-exempt charities that align with the business’s objectives.

- Monitor and document contributions: Maintain accurate records of all donations, including amounts, recipient details, and purpose, to ensure transparency and compliance with tax regulations.

- Communicate expectations: Ensure employees understand the policy and their role in supporting charitable activities through workplace programs or volunteer opportunities.

Benefits of using this charitable contributions policy (Arkansas)

This policy offers several advantages for Arkansas businesses:

- Enhances community impact: Focuses charitable efforts on causes that align with the business’s values and priorities, amplifying the positive impact on local communities.

- Strengthens reputation: Demonstrates the business’s commitment to social responsibility, building goodwill among customers, employees, and stakeholders.

- Ensures transparency: Provides clear guidelines for approving and documenting contributions, reducing the risk of misuse or conflicts of interest.

- Supports compliance: Aligns with Arkansas and federal tax laws, ensuring that charitable giving practices meet legal and regulatory requirements.

- Promotes employee engagement: Encourages employees to participate in charitable initiatives, boosting morale and fostering a sense of purpose.

Tips for using this charitable contributions policy (Arkansas)

- Address Arkansas-specific considerations: Incorporate any state-specific tax laws or regulations related to charitable donations.

- Review regularly: Update the policy periodically to reflect changes in tax laws, community needs, or the business’s strategic goals.

- Provide training: Educate employees on the importance of responsible giving practices and the process for proposing charitable initiatives.

- Partner with reputable organizations: Vet charities thoroughly to ensure they align with the business’s values and meet tax-exempt requirements under federal and state laws.

- Document all donations: Keep comprehensive records to support compliance with tax regulations and to demonstrate the business’s charitable impact.

Q: How does this policy benefit the business?

A: This policy strengthens the business’s reputation, ensures responsible giving practices, and supports compliance with Arkansas and federal tax laws, enhancing community impact and stakeholder trust.

Q: How should the business evaluate charitable organizations?

A: The business should assess organizations based on their mission, financial transparency, and tax-exempt status, ensuring they align with the company’s values and goals.

Q: How does this policy support compliance with Arkansas laws?

A: The policy aligns with state and federal tax regulations, ensuring that all charitable contributions are documented and meet the criteria for tax deductions.

Q: What steps should the business take to document contributions?

A: The business should maintain detailed records of all donations, including receipts, correspondence, and reports on the purpose and impact of the contributions.

Q: Can employees propose charitable initiatives?

A: Yes, employees can suggest charitable initiatives by submitting proposals through the process outlined in the policy, subject to management review and approval.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.