Charitable contributions policy (California): Free template

Charitable contributions policy (California)

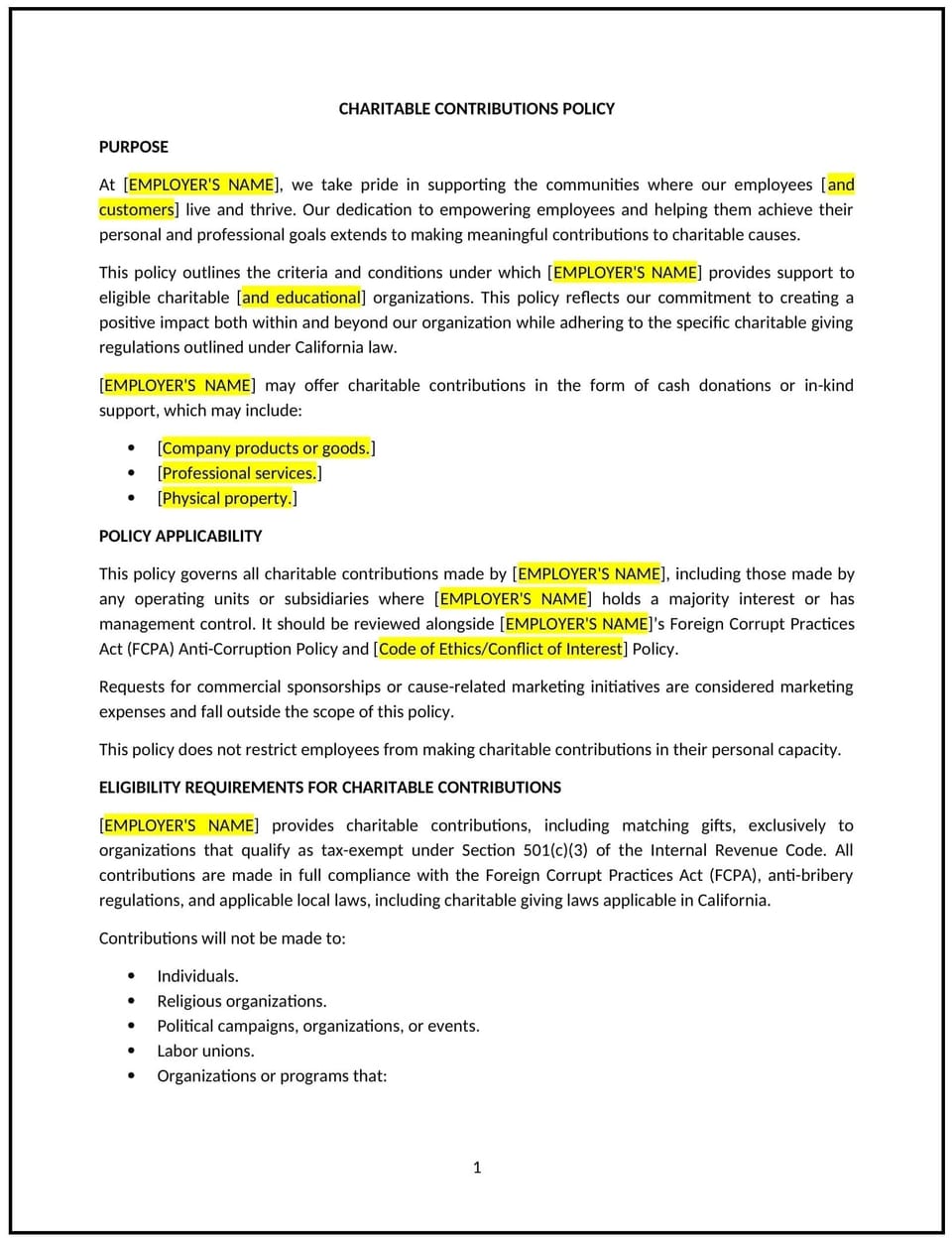

In California, a charitable contributions policy provides businesses with guidelines for managing donations and support for charitable organizations. This policy ensures that contributions align with the business’s values, maintain transparency, and comply with California laws regarding charitable activities and corporate giving.

This policy outlines the types of charitable contributions permitted, approval processes, and criteria for selecting beneficiaries. By implementing this policy, California businesses can foster goodwill, support community engagement, and enhance their reputation.

How to use this charitable contributions policy (California)

- Define permitted contributions: Specify the types of support allowed, such as monetary donations, in-kind contributions, or employee volunteer programs.

- Establish approval procedures: Provide steps for requesting and approving contributions, including any required documentation or budget constraints.

- Set criteria for beneficiaries: Outline the standards for selecting charitable organizations, such as alignment with the business’s mission or community impact.

- Communicate expectations: Ensure employees and stakeholders understand the policy and how contributions will be managed.

- Maintain records: Keep detailed documentation of all contributions to support transparency and accountability.

Benefits of using this charitable contributions policy (California)

This policy offers several advantages for California businesses:

- Supports compliance: Reflects California laws regarding charitable giving, including regulations for corporate donations.

- Enhances reputation: Demonstrates the business’s commitment to social responsibility and community support.

- Promotes consistency: Establishes clear guidelines for managing contributions, reducing ambiguity and potential conflicts.

- Encourages employee engagement: Provides opportunities for employees to participate in charitable activities, boosting morale.

- Improves transparency: Ensures contributions are tracked and reported accurately, fostering trust with stakeholders.

Tips for using this charitable contributions policy (California)

- Address California-specific laws: Reflect state regulations, such as requirements for corporate donations or partnerships with nonprofits.

- Train employees: Educate staff on the policy to ensure compliance and alignment with the business’s charitable goals.

- Align with strategy: Select beneficiaries that support the business’s mission, values, or community priorities.

- Monitor contributions: Use tools to track donations and measure the impact of charitable activities on the community and business goals.

- Review regularly: Update the policy to reflect changes in California laws, business priorities, or charitable giving trends.

Q: How does this policy benefit the business?

A: This policy supports compliance with California laws, enhances the business’s reputation, and provides a structured approach to charitable giving.

Q: What types of contributions are allowed under this policy?

A: Permitted contributions may include monetary donations, in-kind support, or employee volunteer programs, as outlined in the policy.

Q: How does this policy support compliance with California laws?

A: The policy reflects California regulations on corporate donations and charitable partnerships, supporting lawful and transparent giving practices.

Q: What steps should employees take to propose a charitable contribution?

A: Employees should submit a formal request, including details of the proposed contribution and the beneficiary, following the policy’s approval procedures.

Q: How can the business ensure contributions align with its values?

A: The business can establish clear criteria for selecting beneficiaries and require contributions to align with its mission and community priorities.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.