Charitable contributions policy (Connecticut): Free template

Charitable contributions policy (Connecticut)

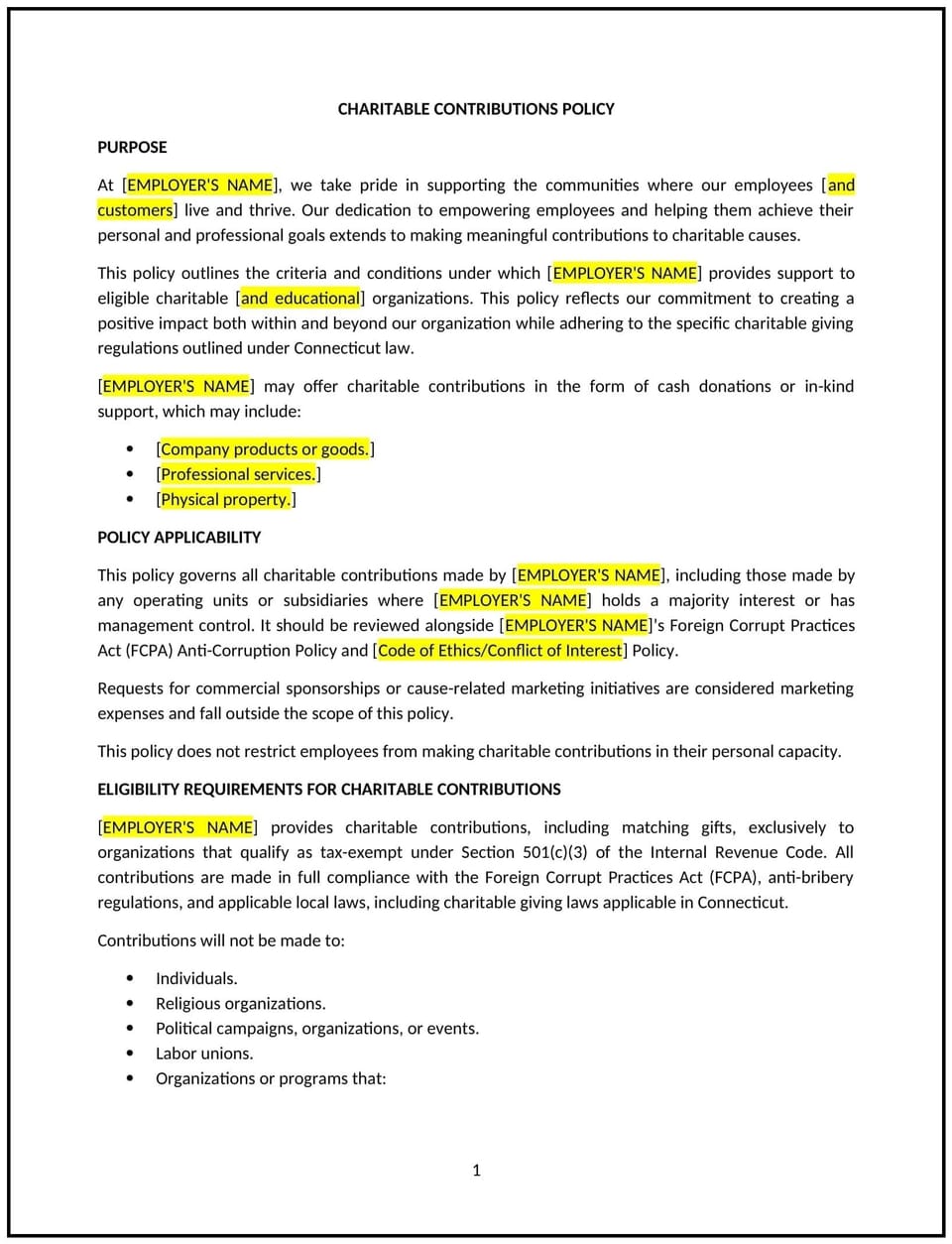

A charitable contributions policy helps Connecticut businesses establish clear guidelines for making financial or in-kind donations to nonprofit organizations. This policy outlines the criteria for choosing recipients, the approval process, and the types of contributions the company is willing to support, while ensuring alignment with the company’s values and compliance with state laws.

By implementing this policy, businesses can demonstrate social responsibility, foster employee engagement, and build positive relationships within the community.

How to use this charitable contributions policy (Connecticut)

- Define eligibility: Specify which types of organizations are eligible for contributions, such as 501(c)(3) nonprofits, local community groups, or causes aligned with the company’s values.

- Set approval procedures: Establish a clear process for submitting and approving charitable contribution requests, including necessary documentation and a review process.

- Establish contribution limits: Set clear guidelines for the maximum contribution amount, either per organization or annually, to maintain budget control.

- Encourage employee involvement: Include provisions for matching employee donations or supporting volunteer efforts, if applicable.

- Ensure compliance: Align the policy with Connecticut’s state laws regarding charitable donations, tax deductions, and reporting requirements.

Benefits of using this charitable contributions policy (Connecticut)

This policy offers several benefits for Connecticut businesses:

- Supports social responsibility: Demonstrates the company’s commitment to giving back to the community and supporting meaningful causes.

- Enhances employee morale: Encourages employees to engage with the company’s charitable initiatives, fostering a sense of pride and purpose.

- Improves company reputation: Strengthens the company’s public image by showing it cares about societal issues and community welfare.

- Provides tax benefits: Donations to qualifying organizations can lead to tax deductions, benefiting both the business and the nonprofit community.

- Aligns with business values: Helps the company support causes that are aligned with its values and mission, reinforcing brand identity.

Tips for using this charitable contributions policy (Connecticut)

- Communicate clearly: Ensure employees and stakeholders understand the policy and how to participate in charitable giving programs.

- Maintain transparency: Provide regular updates on the charitable contributions made by the business and the impact they are having on the community.

- Monitor contributions: Track all donations and related activities to ensure the company stays within the policy’s limits and complies with Connecticut’s legal requirements.

- Align with values: Prioritize causes that align with the company’s mission and values to maintain consistency and strengthen the brand.

- Review periodically: Update the policy to reflect changes in charitable giving laws or business priorities, ensuring it remains relevant and effective.

Q: How does this policy benefit my business?

A: The policy helps the business engage in meaningful charitable activities, build a positive reputation, and foster employee engagement, all while ensuring compliance with state laws and maintaining control over contributions.

Q: What types of organizations can receive donations under this policy?

A: Eligible organizations typically include 501(c)(3) nonprofits, community groups, and charities aligned with the company’s values. The policy should specify any exclusions or preferences.

Q: How do employees get involved in charitable contributions?

A: Employees can participate through company-sponsored donation programs, fundraising efforts, or volunteer opportunities. The policy may also include provisions for matching employee donations.

Q: Are there limits on how much the company can donate?

A: Yes, the policy should specify annual or per-organization limits on charitable contributions to ensure budget control and fair distribution.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or whenever there are changes in Connecticut laws, business priorities, or charitable giving practices to keep it relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.