Charitable contributions policy (Delaware): Free template

Charitable contributions policy (Delaware)

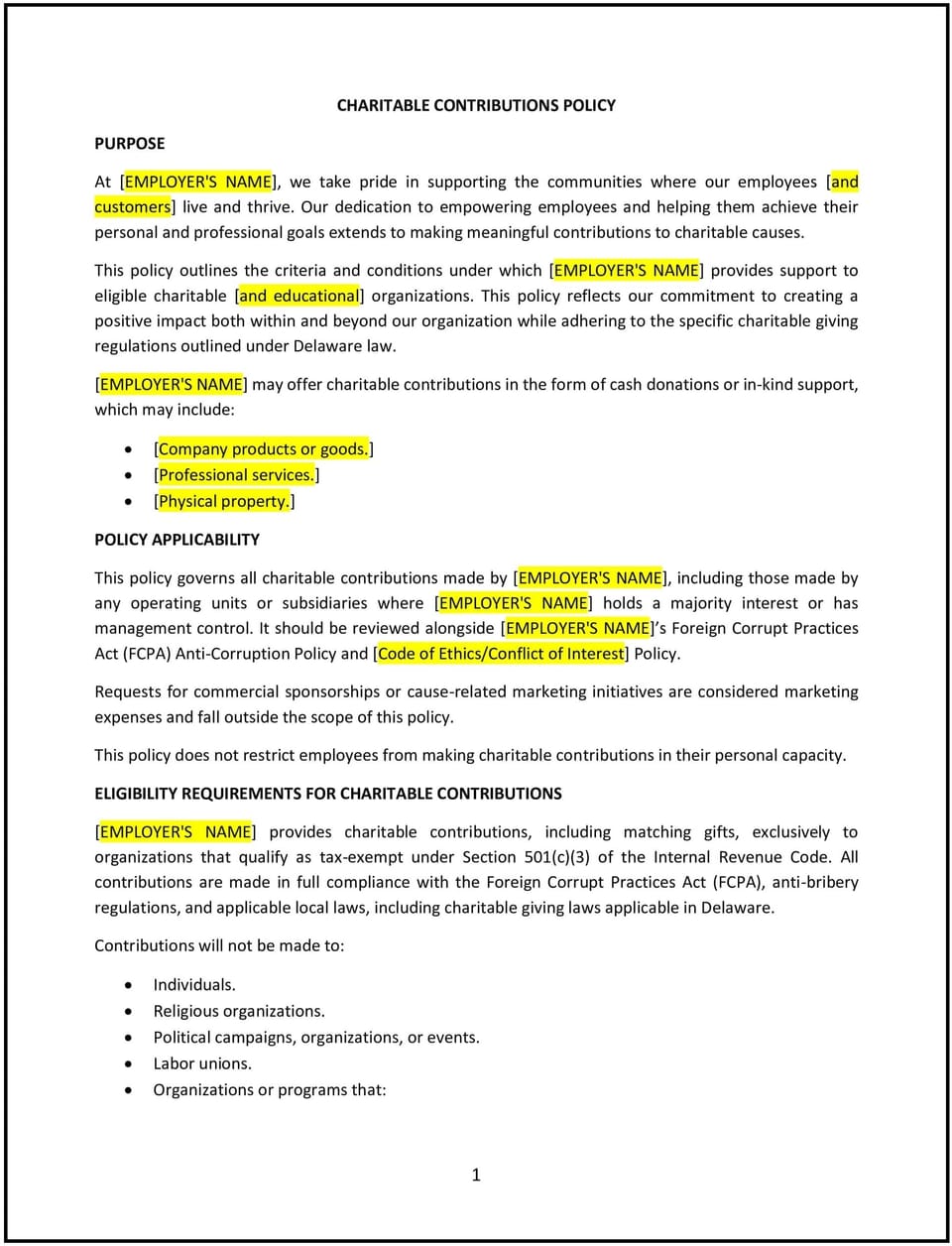

A charitable contributions policy helps Delaware businesses establish guidelines for donating to charitable organizations or supporting community initiatives. This policy outlines the company’s approach to contributions, eligibility criteria for organizations, and procedures for requesting or approving donations.

By implementing this policy, businesses can ensure transparency, align contributions with corporate values, and foster community engagement.

How to use this charitable contributions policy (Delaware)

- Define contribution goals: Clarify the company’s objectives for charitable giving, such as supporting local communities, environmental initiatives, or education programs.

- Establish eligibility criteria: Specify the types of organizations or causes eligible for contributions, ensuring alignment with company values and Delaware laws.

- Set contribution limits: Outline any financial or in-kind donation limits, including approval levels for larger contributions.

- Develop an application process: Provide a clear process for organizations or employees to submit donation requests, including required documentation.

- Monitor impact: Encourage follow-ups with recipient organizations to assess the impact of contributions and ensure accountability.

- Maintain transparency: Document all contributions and ensure compliance with Delaware laws and regulations regarding charitable giving.

Benefits of using this charitable contributions policy (Delaware)

This policy offers several benefits for Delaware businesses:

- Enhances community engagement: Strengthens the company’s connection with local communities and supports meaningful causes.

- Promotes transparency: Establishes clear guidelines for charitable giving, ensuring accountability and reducing potential conflicts.

- Aligns with corporate values: Ensures donations are consistent with the company’s mission and goals.

- Improves reputation: Demonstrates the company’s commitment to social responsibility, enhancing its public image.

- Encourages employee participation: Provides a structured way for employees to engage in charitable initiatives, boosting morale and satisfaction.

Tips for using this charitable contributions policy (Delaware)

- Communicate the policy clearly: Ensure employees and eligible organizations understand the process for requesting and approving contributions.

- Align with company goals: Focus contributions on causes that align with the company’s mission and strategic priorities.

- Encourage employee involvement: Consider employee-driven initiatives, such as matching gift programs or volunteer opportunities.

- Track and evaluate: Maintain records of contributions and periodically assess the policy’s effectiveness in achieving corporate social responsibility goals.

- Review regularly: Update the policy to reflect changes in Delaware laws, industry trends, or company priorities.

Q: Why is a charitable contributions policy important for my business?

A: This policy ensures transparency, aligns contributions with corporate values, and helps businesses support meaningful causes while fostering community engagement and goodwill.

Q: What types of organizations are eligible for contributions?

A: Eligible organizations typically include registered charities, non-profits, and community initiatives that align with the company’s values and meet Delaware legal requirements.

Q: How can organizations or employees request contributions?

A: Requests can be submitted through the process outlined in the policy, which may include completing an application form and providing supporting documentation.

Q: Are there limits on the amount the company can contribute?

A: Yes, the policy should specify financial or in-kind contribution limits and outline approval levels for larger donations to ensure consistency and accountability.

Q: How does the company ensure transparency in charitable giving?

A: The policy requires maintaining detailed records of all contributions, conducting follow-ups with recipient organizations, and adhering to Delaware laws regarding charitable donations.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or whenever there are updates to Delaware laws, company goals, or industry practices to ensure continued relevance and compliance.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.