Charitable contributions policy (Florida): Free template

Charitable contributions policy (Florida)

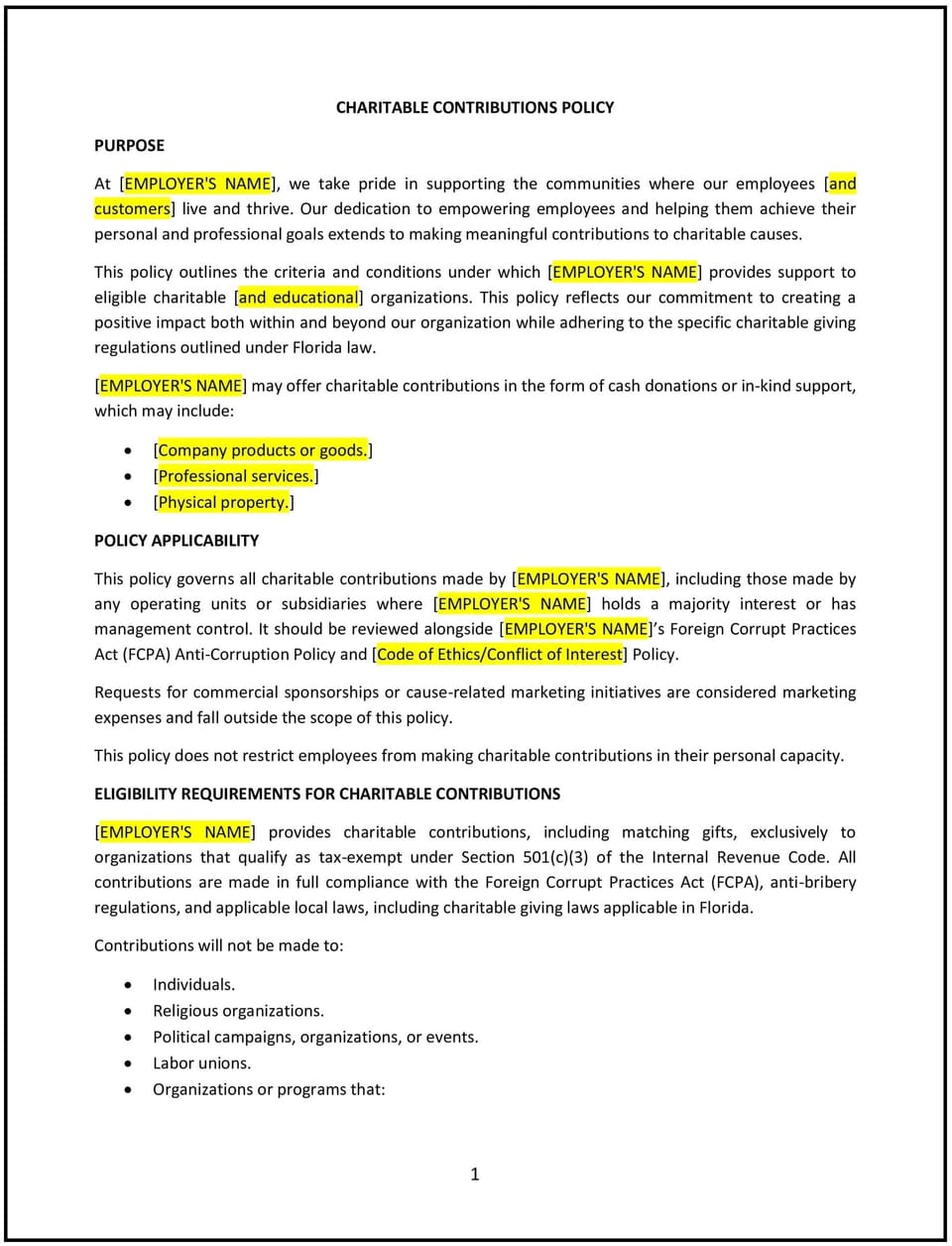

A charitable contributions policy helps Florida businesses establish guidelines for supporting charitable causes, including employee donations, corporate donations, and participation in fundraising activities. This policy outlines the company’s approach to charitable giving, the types of organizations or causes the business supports, and the procedures for employees to request donations or participate in company-sponsored charitable events.

By implementing this policy, businesses can foster a culture of giving, enhance their corporate social responsibility (CSR), and build strong relationships with the community, while ensuring that contributions align with company values and objectives.

How to use this charitable contributions policy (Florida)

- Define eligible charities: Specify the types of organizations or causes the company is willing to support, such as those that align with the company’s mission, values, or local community needs. Include any criteria for selecting charities, such as 501(c)(3) status or alignment with business goals.

- Set contribution limits: Outline any limits on the amount the company is willing to contribute, either as a monetary donation or in-kind support. This may include annual donation caps or guidelines for matching employee donations.

- Establish employee involvement: Clarify how employees can get involved in charitable activities, including donating a portion of their paycheck, organizing fundraisers, or volunteering for company-sponsored events.

- Create procedures for requesting donations: Define the process employees must follow to request charitable contributions or sponsorships, including any approval or review process, required documentation, and timelines for submitting requests.

- Address matching gifts: Specify whether the company offers matching gifts for employee donations, including any limitations or restrictions on the matching program.

- Promote transparency: Ensure that the policy is communicated to all employees and that donations and charitable activities are tracked and reported transparently.

- Ensure compliance: Ensure that charitable contributions comply with all relevant Florida laws, federal regulations, and IRS requirements, including tax deduction guidelines and restrictions on political contributions.

Benefits of using this charitable contributions policy (Florida)

This policy offers several benefits for Florida businesses:

- Strengthens community relationships: Charitable contributions allow businesses to give back to the community, improving relationships with local organizations, customers, and stakeholders.

- Enhances corporate social responsibility: A clear charitable contributions policy demonstrates the company’s commitment to social responsibility, attracting socially conscious employees and customers.

- Boosts employee morale and engagement: By involving employees in charitable initiatives, businesses create a sense of purpose and pride, leading to higher morale and job satisfaction.

- Provides tax benefits: Charitable donations may be eligible for tax deductions, helping the company reduce its taxable income and improve financial efficiency.

- Improves brand image: Supporting charitable causes can enhance the company’s reputation and brand image, demonstrating a commitment to social good and community support.

Tips for using this charitable contributions policy (Florida)

- Communicate the policy clearly: Ensure all employees are aware of the company’s charitable contributions policy, including the types of donations supported, how to participate, and the process for requesting donations.

- Track contributions: Keep accurate records of all charitable contributions, including employee donations, corporate donations, and sponsorships, to ensure transparency and compliance.

- Encourage employee involvement: Actively encourage employees to participate in charitable activities and promote company-sponsored events that align with business values and goals.

- Review the policy periodically: Regularly review the policy to ensure it aligns with changes in Florida laws, company priorities, and employee interests, and to maintain its effectiveness and relevance.

- Monitor and report impact: Track the outcomes of charitable contributions and employee engagement, and report on the impact the company is making in the community, either internally or through external communications.

Q: Why is a charitable contributions policy important for my business?

A: This policy ensures that charitable contributions are made in a consistent, transparent, and compliant manner. It helps businesses give back to the community, improve employee morale, and enhance their reputation while also benefiting from potential tax advantages.

Q: What types of charities does the company support?

A: The policy should specify which types of charities or causes the company supports, such as those that align with the business’s values, mission, or local community needs. Charities must typically meet certain criteria, such as being registered as 501(c)(3) organizations.

Q: How can employees get involved in charitable activities?

A: Employees can participate by donating a portion of their paycheck, volunteering their time, organizing fundraising events, or submitting requests for charitable contributions to be considered by the company.

Q: Does the company match employee donations?

A: If applicable, the policy should clarify whether the company offers a matching gift program, the terms and conditions for matching donations, and any limits on the amount the company will match for each employee.

Q: How do employees request charitable donations from the company?

A: Employees can request donations by submitting a formal application to HR or the designated department, following the guidelines outlined in the policy. Requests should include details about the organization or event, the type of contribution requested, and any supporting documentation.

Q: How often should this policy be reviewed?

A: This policy should be reviewed periodically, at least annually, or whenever there are changes in Florida laws, company priorities, or employee feedback to ensure it remains effective, compliant, and aligned with the company’s goals.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.