Charitable contributions policy (Georgia): Free template

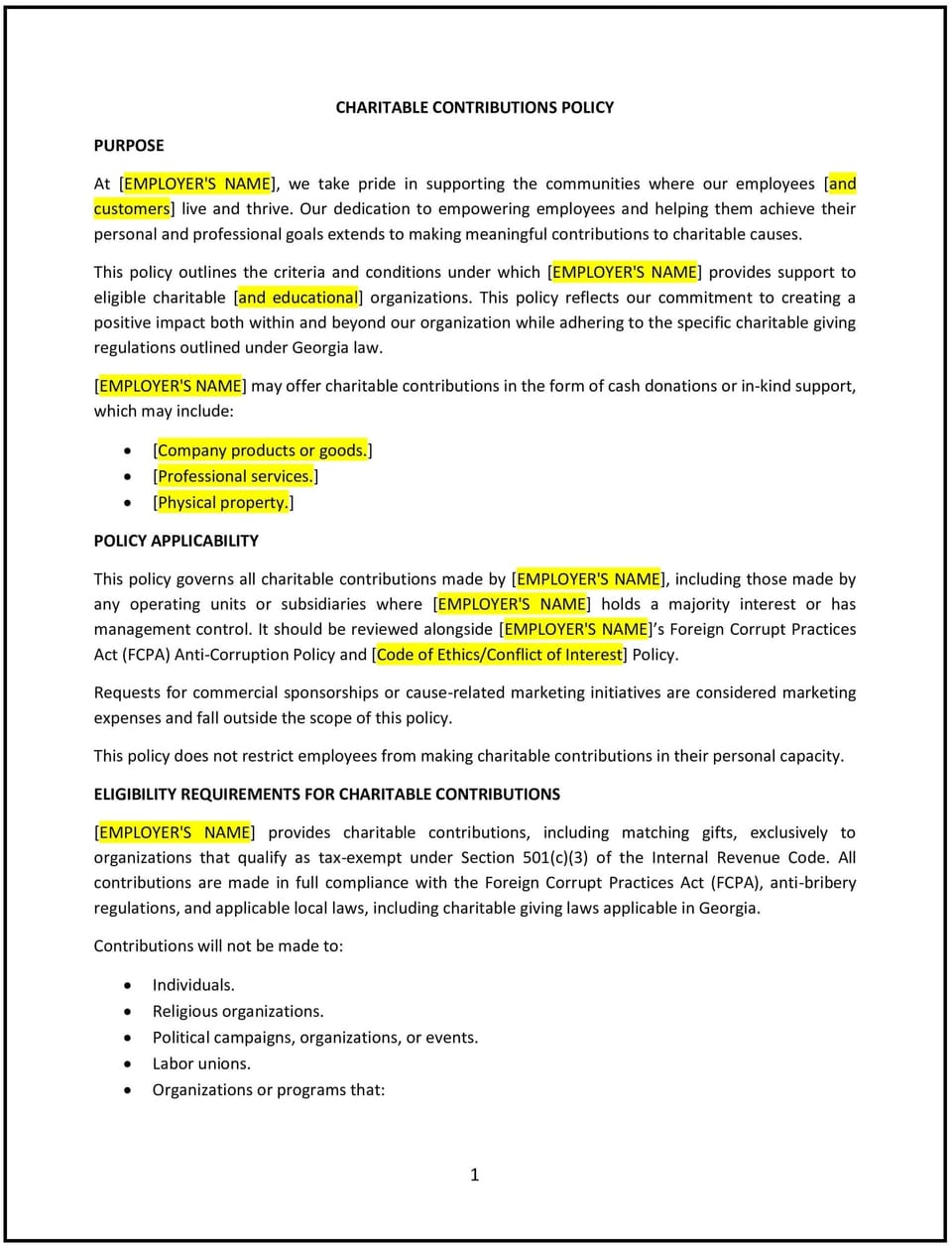

Charitable contributions policy (Georgia)

This charitable contributions policy is designed to help Georgia businesses establish guidelines for making donations to charitable organizations. The policy outlines the purpose of contributions, criteria for selecting recipients, and the process for approving and managing donations, ensuring contributions align with the business’s values and goals.

By implementing this policy, businesses can support community initiatives, promote goodwill, and enhance their reputation while maintaining accountability.

How to use this charitable contributions policy (Georgia)

- Define contribution goals: Clearly state the goals of the business’s charitable contributions, such as supporting local communities, advancing social causes, or aligning with company values.

- Establish eligibility criteria: Outline the criteria for selecting charitable organizations, such as being a registered nonprofit, operating in Georgia, or focusing on specific issues relevant to the business’s mission.

- Set contribution limits: Specify financial or non-financial limits for contributions, ensuring they align with the company’s budget and resources.

- Outline the approval process: Describe how contributions are approved, including the roles of management, committees, or designated decision-makers.

- Include employee involvement: Allow employees to suggest charitable organizations or participate in fundraising efforts, fostering a sense of engagement and purpose.

- Address non-monetary contributions: Provide guidelines for non-financial donations, such as volunteer time, goods, or services, and how they are managed.

- Ensure transparency: Maintain detailed records of all charitable contributions, including amounts, recipients, and purposes, to demonstrate accountability.

- Review and update regularly: Periodically review the policy to reflect changes in company priorities, community needs, or Georgia-specific regulations.

Benefits of using this charitable contributions policy (Georgia)

Implementing this policy provides several advantages for Georgia businesses:

- Builds community relationships: Charitable contributions foster goodwill and strengthen ties with local communities and organizations.

- Enhances brand reputation: Supporting social causes and nonprofits demonstrates the business’s commitment to corporate social responsibility.

- Encourages employee engagement: Involving employees in charitable initiatives increases job satisfaction and loyalty.

- Promotes accountability: Clear guidelines and record-keeping ensure contributions are managed responsibly and align with business goals.

- Reflects Georgia-specific values: Tailoring the policy to local cultural and community priorities enhances its relevance and impact.

Tips for using this charitable contributions policy (Georgia)

- Communicate priorities: Clearly share the company’s charitable focus areas with employees and stakeholders to align efforts with shared goals.

- Encourage employee participation: Create opportunities for employees to suggest organizations or volunteer for charitable initiatives.

- Monitor impact: Regularly assess the outcomes of contributions to ensure they achieve meaningful results and reflect positively on the business.

- Stay consistent: Apply the policy consistently to all contributions to maintain fairness and transparency in decision-making.

- Partner with trusted organizations: Work with reputable nonprofits or community groups to ensure contributions are used effectively and responsibly.

Q: What types of charitable contributions are included in this policy?

A: Contributions may include monetary donations, volunteer time, goods or services, or sponsorships. Businesses should specify the types of support they will provide.

Q: How can employees suggest charitable organizations?

A: Employees should submit suggestions to their supervisor or the designated committee, providing information about the organization’s mission and how it aligns with the business’s goals.

Q: Are there limits on the amount of contributions?

A: Businesses should set clear financial or non-financial limits to ensure contributions are within budget and align with the company’s resources.

Q: How are recipients selected?

A: Recipients are selected based on criteria such as nonprofit status, alignment with company values, and their impact on local communities or social causes.

Q: Can employees participate in charitable initiatives?

A: Yes, businesses should encourage employees to volunteer or support fundraising events to promote engagement and teamwork.

Q: What records should businesses keep for contributions?

A: Businesses should maintain records of all contributions, including amounts, recipients, and purposes, to demonstrate accountability and transparency.

Q: How often should the policy be reviewed?

A: The policy should be reviewed annually or whenever there are significant changes in company goals, community needs, or Georgia regulations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.