Charitable contributions policy (Hawai'i): Free template

Charitable contributions policy (Hawaiʻi)

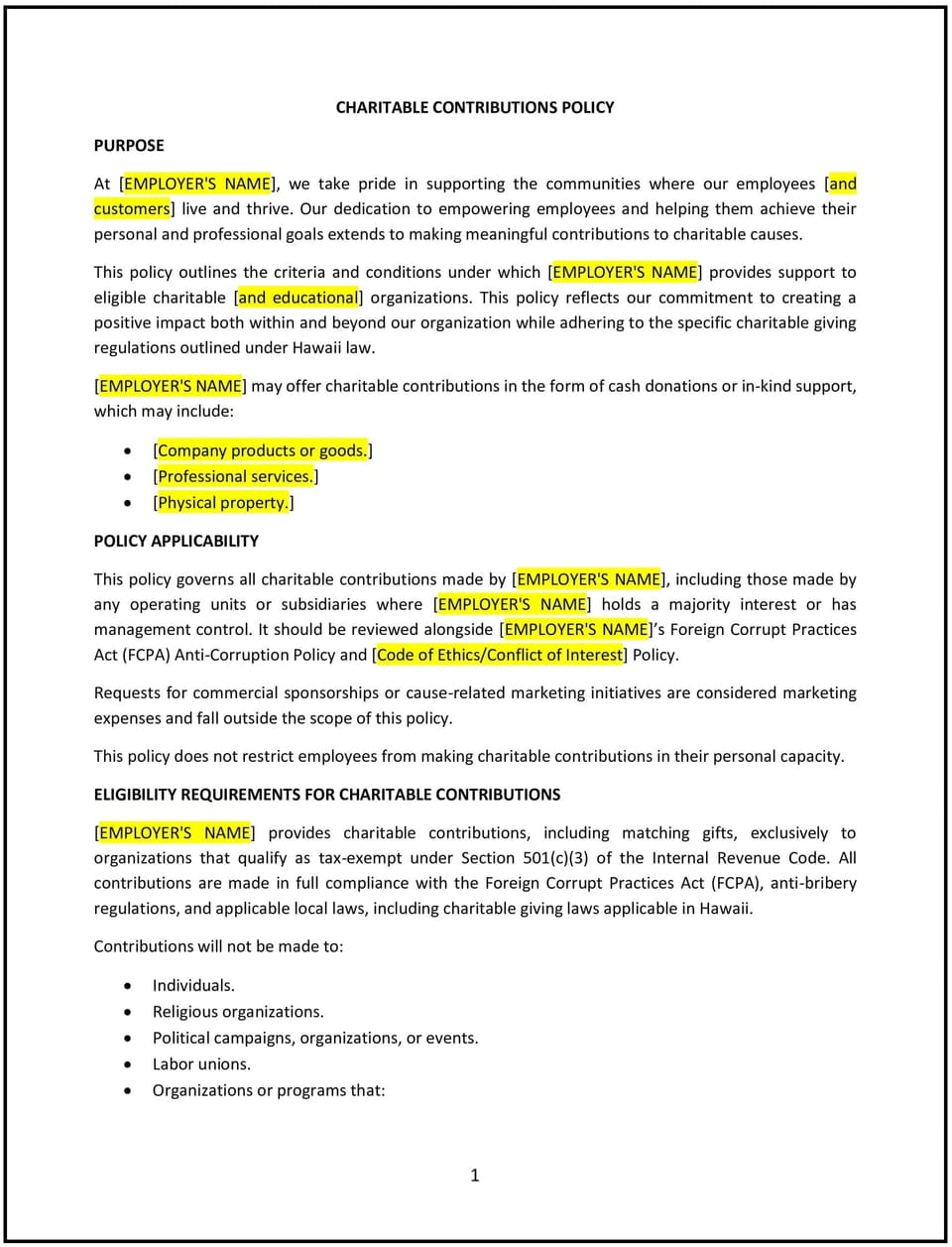

A charitable contributions policy helps Hawaiʻi businesses establish guidelines for donating to nonprofit organizations, community initiatives, or charitable causes. This policy outlines the types of contributions supported, approval processes, and criteria for selecting recipients. It is designed to align with Hawaiʻi’s unique cultural and community values, promote corporate social responsibility, and ensure transparency in charitable giving.

By implementing this policy, businesses in Hawaiʻi can strengthen community relationships, enhance their reputation, and contribute to meaningful causes that reflect their values.

How to use this charitable contributions policy (Hawaiʻi)

- Define the scope of contributions: Specify the types of contributions supported, such as monetary donations, in-kind gifts, or volunteer hours, and any limitations on amounts or frequency.

- Establish eligibility criteria: Outline the requirements for organizations or causes to qualify for contributions, such as nonprofit status, alignment with business values, or local impact.

- Create an approval process: Provide clear steps for employees or departments to request charitable contributions, including required documentation and approval authority.

- Prioritize local initiatives: Emphasize support for Hawaiʻi-based organizations or causes that address community needs, such as education, environmental conservation, or cultural preservation.

- Communicate the policy: Share the policy with employees, stakeholders, and the community to ensure transparency and awareness of the business’s charitable efforts.

- Track and report contributions: Maintain records of donations and their impact, and consider sharing this information in annual reports or public communications.

- Review and update the policy: Regularly assess the policy’s effectiveness and make adjustments as needed to reflect changes in community needs, business priorities, or legal requirements.

Benefits of using this charitable contributions policy (Hawaiʻi)

This policy offers several advantages for Hawaiʻi businesses:

- Strengthens community relationships: Supporting local organizations and initiatives fosters goodwill and strengthens ties with the community.

- Enhances corporate reputation: A commitment to charitable giving demonstrates social responsibility, improving the business’s reputation among customers, employees, and partners.

- Promotes employee engagement: Encouraging employees to participate in charitable activities can boost morale, teamwork, and job satisfaction.

- Aligns with cultural values: Prioritizing local and culturally relevant causes reflects Hawaiʻi’s community-oriented values and traditions.

- Provides tax benefits: Charitable contributions may qualify for tax deductions, offering financial advantages for the business.

- Encourages transparency: A clear policy ensures accountability and builds trust with stakeholders by demonstrating how contributions are allocated.

Tips for using this charitable contributions policy (Hawaiʻi)

- Communicate the policy effectively: Share the policy with employees, stakeholders, and the community through internal communications, websites, or public announcements.

- Prioritize local impact: Focus on supporting Hawaiʻi-based organizations or causes that address pressing community needs and align with the business’s values.

- Involve employees: Encourage employees to suggest charitable initiatives or participate in volunteer activities to foster engagement and teamwork.

- Track contributions: Maintain detailed records of donations, including amounts, recipients, and outcomes, to ensure transparency and measure impact.

- Be transparent: Share information about charitable contributions in annual reports, newsletters, or social media to build trust and demonstrate accountability.

- Review the policy periodically: Update the policy as needed to reflect changes in community needs, business priorities, or legal requirements.

Q: Why should Hawaiʻi businesses adopt a charitable contributions policy?

A: Businesses should adopt this policy to strengthen community relationships, enhance their reputation, and demonstrate a commitment to social responsibility.

Q: What types of contributions are typically supported?

A: Contributions may include monetary donations, in-kind gifts, or volunteer hours, depending on the business’s resources and priorities.

Q: How should businesses select charitable recipients?

A: Businesses should establish criteria for selecting recipients, such as nonprofit status, alignment with business values, or local impact, and prioritize Hawaiʻi-based organizations.

Q: What is the approval process for charitable contributions?

A: The policy should outline clear steps for requesting and approving contributions, including required documentation and approval authority.

Q: How can businesses track the impact of their contributions?

A: Businesses should maintain records of donations, including amounts, recipients, and outcomes, and consider sharing this information in reports or public communications.

Q: Should businesses involve employees in charitable activities?

A: Businesses should encourage employees to suggest initiatives or participate in volunteer activities to foster engagement and teamwork.

Q: How often should the policy be reviewed?

A: The policy should be reviewed annually or as needed to reflect changes in community needs, business priorities, or legal requirements.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.