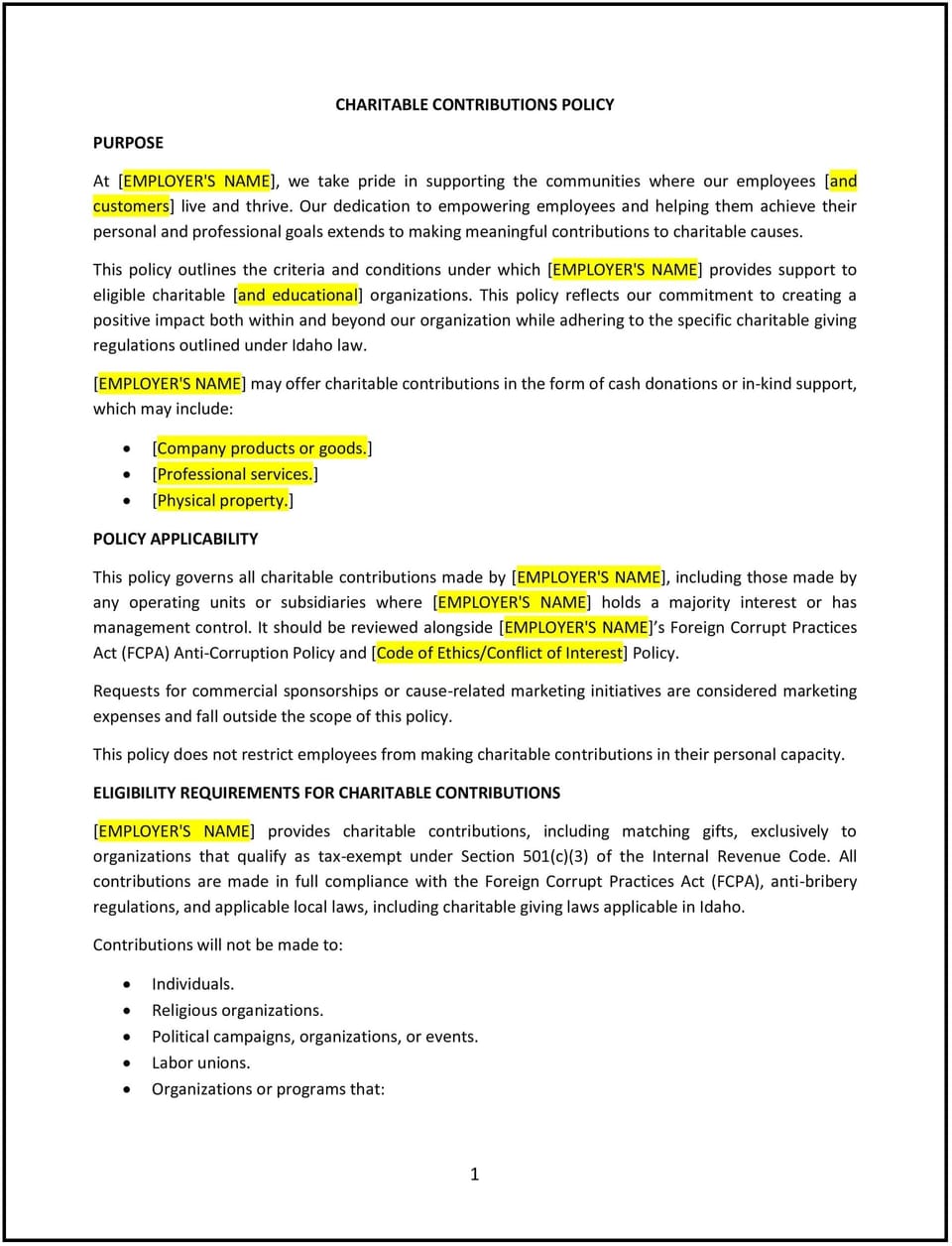

Charitable contributions policy (Idaho): Free template

Charitable contributions policy (Idaho)

A charitable contributions policy helps Idaho businesses establish guidelines for donating to charitable organizations, sponsoring community events, or supporting employee fundraising efforts. This policy outlines the types of contributions the business will consider, the approval process, and the criteria for selecting recipients. It reflects the business’s commitment to social responsibility and community engagement.

By implementing this policy, businesses can demonstrate their values, build stronger community relationships, and create a positive impact while maintaining transparency and accountability.

How to use this charitable contributions policy (Idaho)

- Define contribution types: Specify the types of contributions the business will consider, such as monetary donations, in-kind gifts, or employee volunteer programs.

- Establish approval process: Outline the steps for requesting and approving charitable contributions, including who has the authority to make decisions and any documentation required.

- Set selection criteria: Provide guidelines for selecting charitable organizations or causes, such as alignment with the business’s values, community impact, or employee interests.

- Communicate the policy: Share the policy with employees, stakeholders, and the public to ensure transparency and awareness of the business’s charitable efforts.

- Monitor and evaluate: Regularly review the impact of contributions and ensure they align with the business’s goals and community needs.

- Document contributions: Maintain records of all charitable donations, including the recipient organization, amount, and purpose, to ensure accountability.

- Review and update: Regularly review the policy to ensure it remains aligned with the business’s values, community needs, and any changes in Idaho laws.

Benefits of using this charitable contributions policy (Idaho)

This policy provides numerous benefits for Idaho businesses:

- Demonstrates social responsibility: A charitable contributions policy shows the business’s commitment to giving back to the community and supporting meaningful causes.

- Builds community relationships: Contributing to local organizations and events helps businesses build stronger ties with the community and enhance their reputation.

- Boosts employee morale: Supporting employee-driven charitable initiatives can increase engagement, pride, and loyalty among staff.

- Enhances brand image: A well-publicized charitable contributions policy can improve the business’s public image and attract customers who value social responsibility.

- Provides clarity: A clear policy ensures consistent and fair decision-making when selecting charitable recipients and allocating resources.

- Encourages transparency: Documenting contributions and their impact helps maintain accountability and trust with stakeholders.

- Aligns with business values: The policy ensures charitable efforts reflect the business’s mission, vision, and core values.

Tips for using this charitable contributions policy (Idaho)

- Communicate the policy effectively: Share the policy with employees, stakeholders, and the public through internal communications, the business’s website, and social media.

- Train decision-makers: Ensure those responsible for approving contributions understand the policy, selection criteria, and approval process.

- Encourage employee involvement: Invite employees to suggest charitable causes or participate in volunteer programs to foster a sense of ownership and engagement.

- Highlight contributions: Publicize charitable efforts through press releases, social media, or annual reports to demonstrate the business’s commitment to the community.

- Monitor impact: Regularly evaluate the outcomes of charitable contributions to ensure they align with the business’s goals and community needs.

- Review the policy regularly: Update the policy as needed to reflect changes in the business’s values, community priorities, or Idaho laws.

- Lead by example: Encourage leadership to actively participate in charitable initiatives and model the business’s commitment to social responsibility.

Q: Why should Idaho businesses have a charitable contributions policy?

A: A charitable contributions policy helps businesses demonstrate social responsibility, build community relationships, and align charitable efforts with their values.

Q: What types of contributions should businesses consider?

A: Businesses should consider monetary donations, in-kind gifts, employee volunteer programs, or sponsorships of community events.

Q: How should businesses select charitable organizations?

A: Businesses should establish selection criteria, such as alignment with their values, community impact, or employee interests, to guide decision-making.

Q: Who should approve charitable contributions?

A: Businesses should designate decision-makers, such as a committee or leadership team, to review and approve contribution requests.

Q: How can businesses involve employees in charitable efforts?

A: Businesses should encourage employees to suggest causes, participate in volunteer programs, or lead fundraising initiatives.

Q: How should businesses document charitable contributions?

A: Businesses should maintain records of all contributions, including the recipient organization, amount, and purpose, to ensure transparency and accountability.

Q: How often should the policy be reviewed?

A: The policy should be reviewed annually or as needed to reflect changes in the business’s values, community needs, or Idaho laws.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.