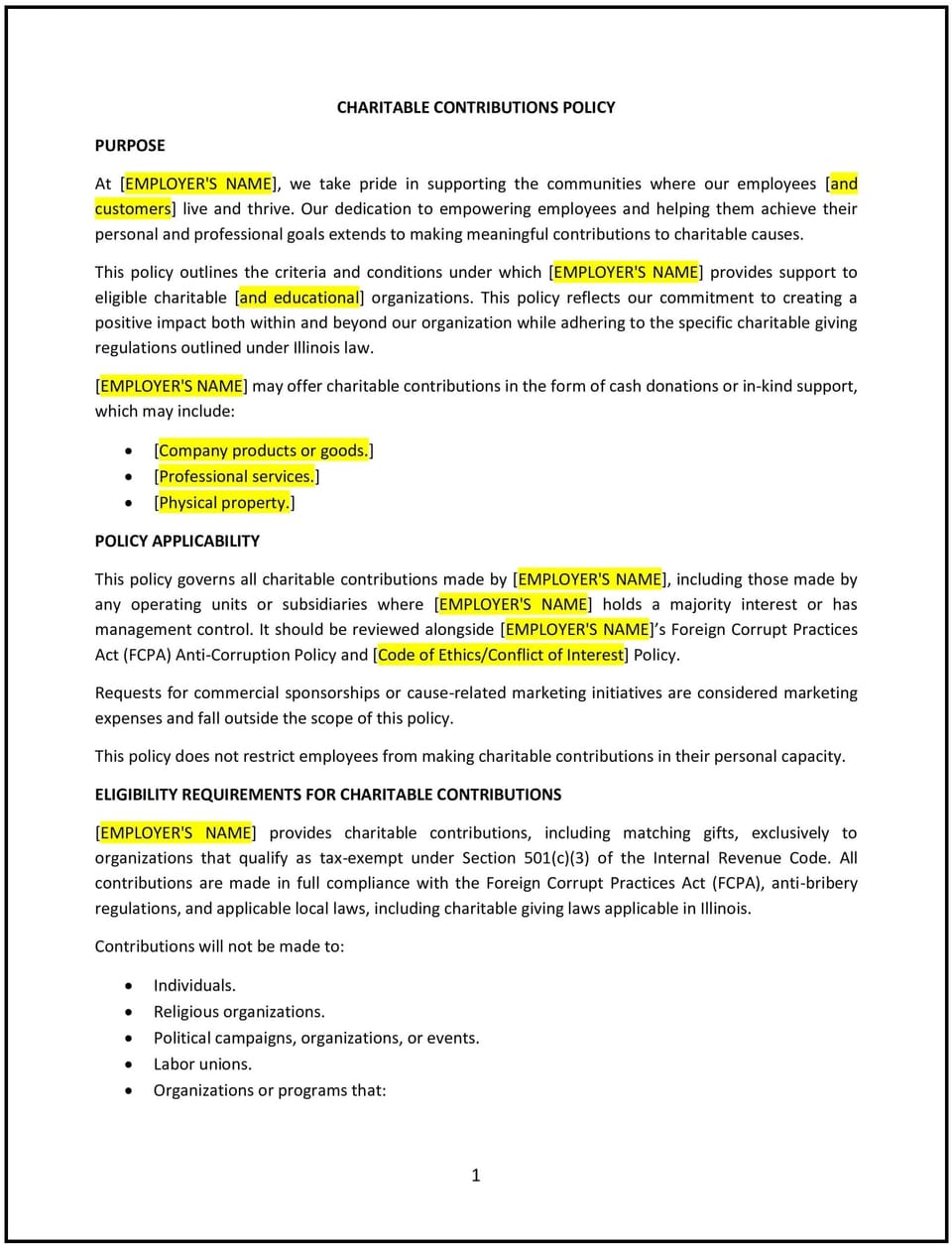

Charitable contributions policy (Illinois): Free template

Charitable contributions policy (Illinois)

This charitable contributions policy is designed to help Illinois businesses manage and support charitable giving efforts. It establishes guidelines for selecting charities, approving contributions, and encouraging employee involvement while maintaining transparency and alignment with the company’s values.

By adopting this policy, businesses can promote corporate social responsibility, enhance their reputation, and foster employee engagement in community initiatives.

How to use this charitable contributions policy (Illinois)

- Define objectives: Clarify the purpose of the company’s charitable contributions, such as supporting local communities, advancing education, or addressing specific social issues.

- Establish selection criteria: Specify how charities will be chosen, including alignment with company values, impact, and accountability of the organization.

- Outline contribution types: Define the forms of contributions allowed, such as monetary donations, sponsorships, in-kind gifts, or volunteer hours.

- Set approval procedures: Require contributions to be reviewed and approved by designated individuals or committees to ensure consistency and fairness.

- Encourage employee participation: Provide opportunities for employees to nominate charities, participate in donation drives, or volunteer for company-supported initiatives.

- Maintain transparency: Document all contributions and provide regular updates to stakeholders on the company’s charitable activities.

- Ensure compliance: Align the policy with Illinois laws, including regulations on tax-deductible contributions and corporate giving.

- Monitor impact: Evaluate the outcomes of charitable contributions to assess their effectiveness and alignment with company goals.

Benefits of using this charitable contributions policy (Illinois)

This policy provides several benefits for Illinois businesses:

- Promotes corporate social responsibility: Demonstrates the company’s commitment to giving back to the community and addressing social issues.

- Enhances reputation: Builds trust with customers, employees, and stakeholders by aligning charitable efforts with company values.

- Encourages employee engagement: Involves employees in meaningful initiatives, fostering a sense of purpose and connection to the company.

- Ensures fairness: Establishes clear and consistent guidelines for approving and managing contributions.

- Supports compliance: Aligns charitable giving practices with Illinois laws and regulations to avoid legal or financial risks.

Tips for using this charitable contributions policy (Illinois)

- Communicate the policy: Share the policy with employees and stakeholders to promote awareness and participation.

- Involve employees: Encourage employees to suggest charities or volunteer for supported initiatives to enhance engagement.

- Document contributions: Keep detailed records of all charitable activities to ensure transparency and accountability.

- Evaluate partnerships: Regularly assess supported charities to ensure they align with the company’s goals and deliver measurable impact.

- Update regularly: Revise the policy as needed to reflect changes in Illinois laws, company priorities, or community needs.

Q: What types of contributions are covered under this policy?

A: Contributions may include monetary donations, sponsorships, in-kind gifts, or volunteer time, as outlined in this policy.

Q: How are charities selected for support?

A: Charities are chosen based on alignment with company values, impact, and accountability. Employees may also nominate charities for consideration.

Q: Who approves charitable contributions?

A: Contributions are reviewed and approved by designated individuals or committees to ensure consistency and compliance.

Q: Can employees participate in charitable initiatives?

A: Yes, employees are encouraged to participate by volunteering, donating, or nominating charities for support.

Q: Are contributions tax-deductible under this policy?

A: Contributions may be tax-deductible, depending on the type of donation and the status of the recipient organization. Consult a tax advisor for details.

Q: How does the company ensure transparency in charitable contributions?

A: The company maintains detailed records of all contributions and provides regular updates to stakeholders on its charitable activities.

Q: How often is this policy reviewed?

A: This policy is reviewed annually or whenever significant changes occur in Illinois laws or company priorities.

Q: What happens if a charity no longer aligns with company values?

A: The company may discontinue support for a charity if it no longer aligns with its values or goals, as determined by the designated approval committee.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.