Charitable contributions policy (Indiana): Free template

Charitable contributions policy (Indiana): Free template

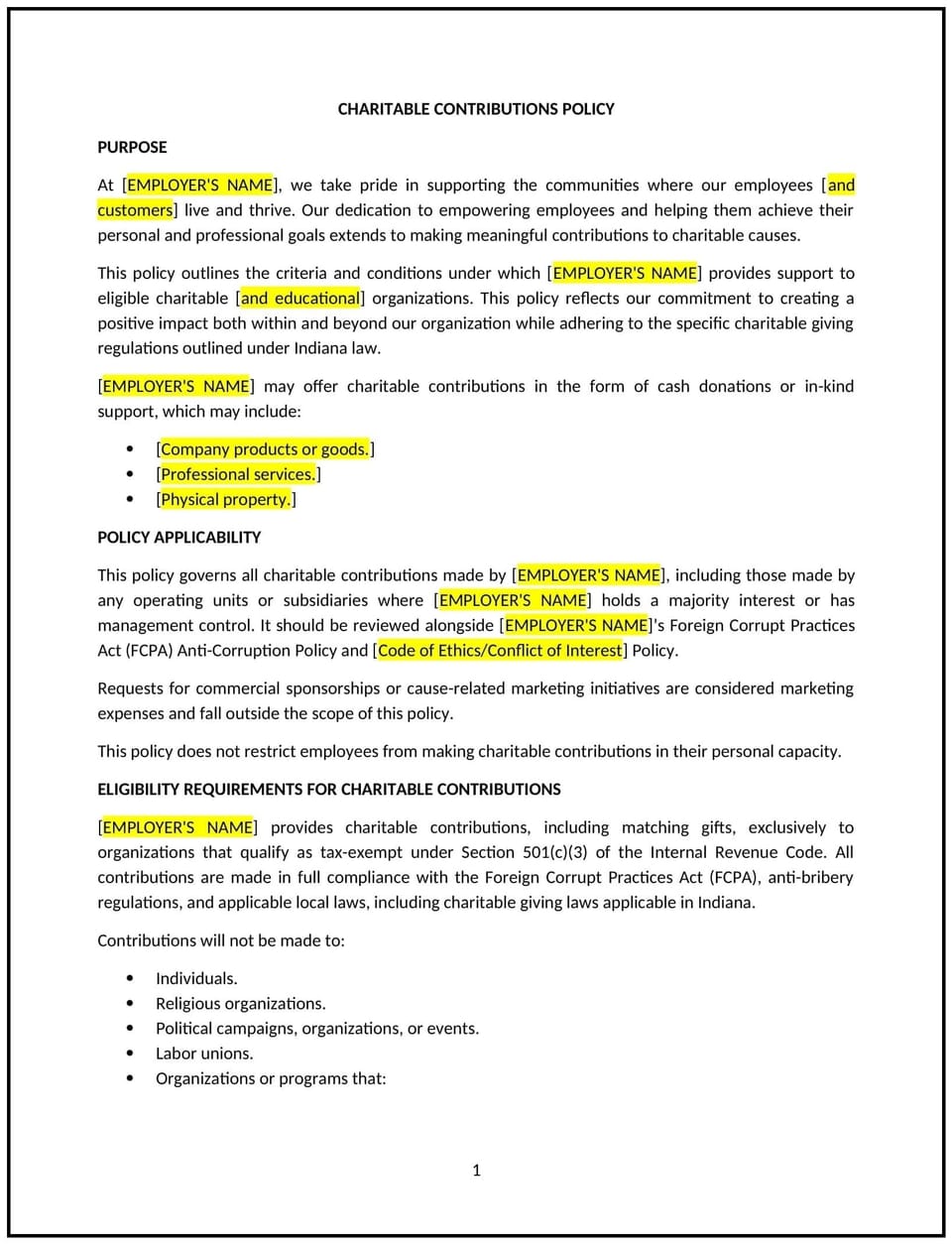

The charitable contributions policy helps Indiana businesses establish guidelines for making donations to charitable organizations and supporting employee involvement in charitable activities. This policy outlines how the business will allocate resources for charitable causes, sets limits on contributions, and provides a clear process for employees to request company support for charitable initiatives. By using this template, businesses can foster a culture of giving, align charitable activities with company values, and ensure that contributions are managed responsibly and transparently.

By implementing this policy, Indiana businesses can demonstrate corporate social responsibility, support the community, and enhance employee satisfaction by encouraging charitable involvement both within and outside the organization.

How to use this charitable contributions policy (Indiana)

- Define eligible charitable organizations: Clearly state which types of organizations are eligible for donations, such as 501(c)(3) tax-exempt organizations, local community groups, and causes aligned with the company’s values. The policy should specify any restrictions on types of organizations or causes the company will support.

- Outline donation limits: Specify any limits on the amount of charitable contributions the company will make, either annually or per request. This may include setting a budget for donations and specifying any caps on individual contributions or matching funds.

- Provide a process for requesting donations: Establish a clear process for employees or external organizations to request charitable contributions. This should include submission deadlines, required documentation, and how the company will evaluate and approve or deny requests.

- Encourage employee involvement: Outline any company programs that support employee charitable involvement, such as matching gift programs, volunteer time off, or sponsored charity events. Employees should understand how the company supports their charitable endeavors.

- Ensure transparency and accountability: Set up procedures for tracking donations, ensuring transparency in how funds are allocated and used. This may include requiring reports or records of charitable contributions for audit purposes.

- Align with business values: The policy should ensure that donations and charitable activities are in line with the company’s mission, vision, and values. Contributions should support causes that reflect the business’s commitment to social responsibility and community engagement.

- Specify tax and legal considerations: Provide guidance on the tax implications of charitable contributions and ensure that donations meet legal requirements for deductibility and other relevant regulations.

Benefits of using this charitable contributions policy (Indiana)

Implementing this policy provides several key benefits for Indiana businesses:

- Demonstrates corporate social responsibility: A well-structured charitable contributions policy helps businesses show they care about the community and are dedicated to giving back, enhancing their public image.

- Engages employees: Supporting charitable causes helps foster a sense of purpose and engagement among employees, who feel proud to work for a company that aligns with their personal values.

- Enhances company reputation: By actively supporting charitable initiatives, businesses can build a positive reputation both within their local community and in the broader market, making them more attractive to customers, employees, and potential business partners.

- Promotes employee satisfaction and retention: Offering matching gift programs and volunteering opportunities shows employees that their company supports their interests and personal values, increasing job satisfaction and employee retention.

- Strengthens community ties: Contributions to local and global causes help businesses build strong relationships with the communities they serve, enhancing their role as responsible corporate citizens.

- Provides tax benefits: Charitable contributions may offer tax deductions for the business, helping to reduce the overall financial burden while supporting valuable causes.

Tips for using this charitable contributions policy (Indiana)

- Communicate the policy effectively: Ensure that all employees understand the charitable contributions policy, including how they can participate in donation programs, request contributions, or volunteer for charitable causes. Include the policy in employee handbooks, orientation materials, and internal communications.

- Track contributions and participation: Regularly track the company’s charitable contributions and employee participation in volunteer programs to ensure the policy is being followed and to measure the company’s impact on the community.

- Set clear criteria for donation requests: Ensure that donation requests are evaluated fairly and consistently. The policy should specify how the company will assess requests based on the cause’s alignment with company values and the available budget.

- Encourage employee involvement: Promote company programs that encourage employee charitable engagement, such as volunteer time off or matching gift programs. Employees should feel supported in their charitable efforts.

- Review the policy regularly: Periodically review the charitable contributions policy to ensure it remains aligned with company goals, legal regulations, and employee interests. Regular updates help keep the policy relevant and effective.

Q: What types of charitable organizations are eligible for company contributions?

A: Businesses typically select organizations that are tax-exempt under Section 501(c)(3) of the IRS code, as well as local community groups or causes aligned with their mission and values. It’s advisable to establish clear criteria for eligibility, such as excluding political or religious organizations, unless they align with the company’s core objectives.

Q: How can a business manage charitable donation requests?

A: A clear process should be set for reviewing donation requests. Businesses can require employees or external organizations to submit formal requests, including relevant details about the cause and how it aligns with company values. An approval committee may be helpful for consistency in decision-making.

Q: Can a business match employee charitable donations?

A: Many businesses offer matching gift programs to encourage employee charitable contributions. Typically, businesses contribute a percentage of the employee’s donation, up to a specified annual limit. It’s important for businesses to define the maximum match and outline the eligible causes.

Q: Are there limits on how much a business can contribute?

A: Yes, businesses often establish a budget or cap on charitable contributions. Setting annual donation limits ensures that giving aligns with company financial goals and that the donation process is equitable across different causes. Businesses may want to review the limits periodically based on overall performance.

Q: Should businesses allow employees to volunteer for charitable causes during work hours?

A: Businesses may offer volunteer time off (VTO) as part of their charitable engagement strategy. Providing time off for employees to volunteer not only supports charitable causes but can also improve employee satisfaction. Businesses should set clear guidelines regarding the amount of time employees can take for volunteering.

Q: How often should a business review its charitable contributions policy?

A: A business should review its charitable contributions policy regularly, at least annually, to ensure it remains aligned with company goals, legal requirements, and employee interests. This review helps ensure that the policy continues to meet the needs of the business while fostering a positive community impact.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.