Charitable contributions policy (Iowa): Free template

Charitable contributions policy (Iowa)

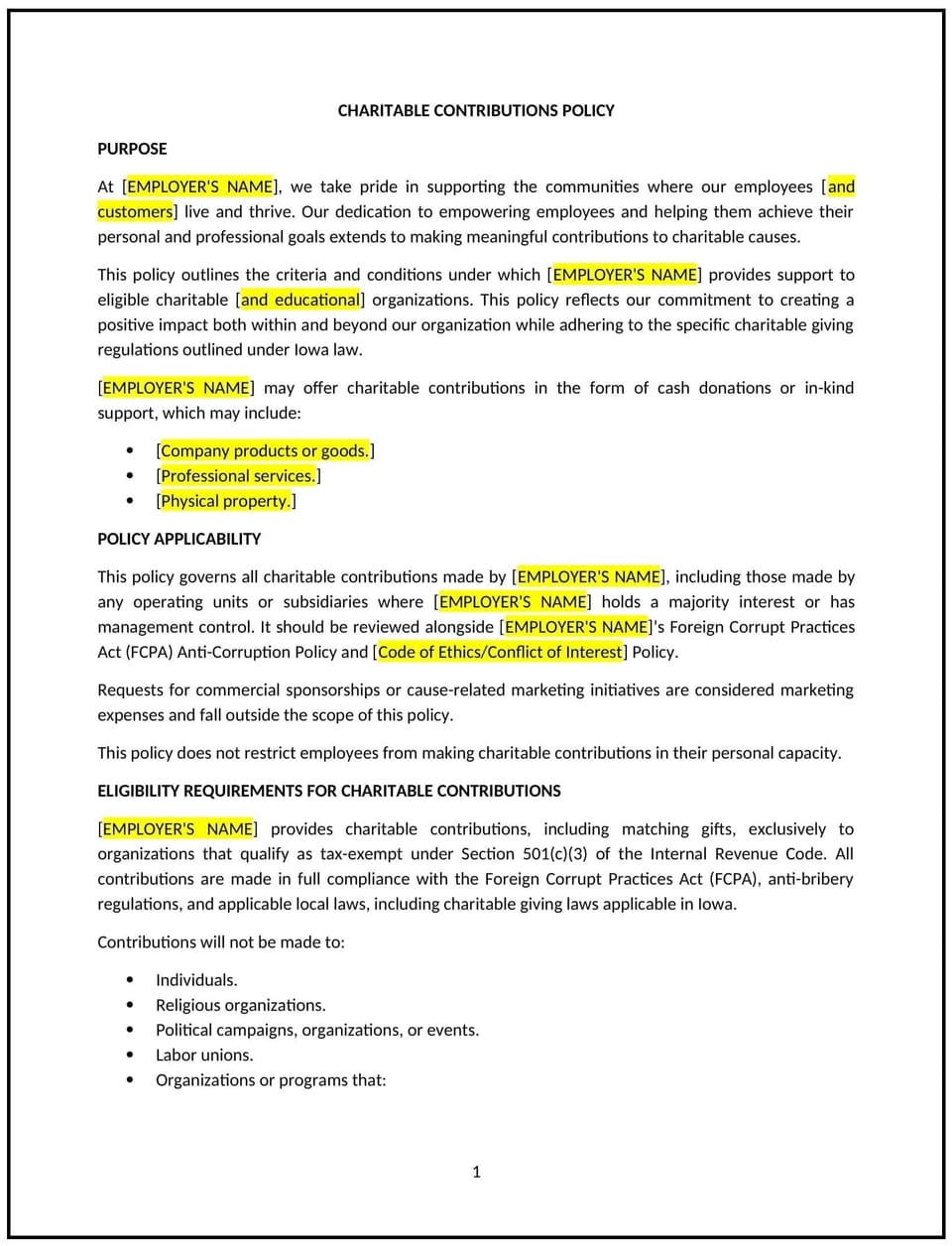

A charitable contributions policy helps Iowa businesses establish guidelines for donating to nonprofit organizations, community initiatives, and social causes. Charitable giving can enhance a company’s reputation, strengthen community ties, and align with corporate values. However, businesses need clear procedures for evaluating and approving contributions to ensure consistency and impact.

This policy outlines donation criteria, employee involvement, and record-keeping requirements. It helps businesses balance philanthropic efforts with financial and operational priorities while promoting ethical giving practices.

By implementing this policy, businesses in Iowa can support meaningful causes, enhance community engagement, and create a structured approach to charitable giving.

How to use this charitable contributions policy (Iowa)

- Define contribution eligibility: Establish criteria for organizations eligible to receive donations, such as registered nonprofits or local community initiatives.

- Set donation limits: Determine contribution amounts and whether donations are made as one-time gifts or ongoing commitments.

- Establish an approval process: Require businesses to evaluate requests through a designated review committee or approval authority.

- Encourage employee participation: Provide opportunities for employees to nominate charities, volunteer, or participate in matching gift programs.

- Maintain financial oversight: Track charitable contributions through accounting records to ensure transparency.

- Outline sponsorship opportunities: Specify whether contributions include event sponsorships, grants, or in-kind donations.

- Communicate giving priorities: Align contributions with company values, industry focus, or specific community needs.

- Review and update: Periodically assess the policy to align with evolving business and community priorities.

Benefits of using this charitable contributions policy (Iowa)

This policy offers several advantages for Iowa businesses:

- Strengthens community ties: Supports local organizations and initiatives that align with business values.

- Enhances company reputation: Demonstrates a commitment to corporate social responsibility.

- Encourages employee engagement: Allows employees to contribute to causes they care about.

- Provides financial clarity: Establishes structured guidelines for charitable spending.

- Aligns giving with business strategy: Ensures contributions support long-term business and community objectives.

- Improves transparency: Creates a clear process for evaluating and approving donation requests.

Tips for using this charitable contributions policy (Iowa)

- Define giving priorities: Businesses should focus contributions on causes that align with company values and community needs.

- Set clear approval guidelines: Businesses should require a structured review process for donation requests.

- Track financial contributions: Businesses should maintain records of all donations to monitor impact and budget allocations.

- Encourage employee involvement: Businesses should create volunteer programs or donation-matching opportunities.

- Balance philanthropy with operations: Businesses should ensure charitable contributions fit within financial and strategic goals.

- Review giving effectiveness: Businesses should assess whether contributions are making a measurable impact.

Q: Why should Iowa businesses implement a charitable contributions policy?

A: Businesses should establish this policy to create a structured, transparent approach to charitable giving while aligning with corporate values.

Q: How should businesses determine which charities to support?

A: Businesses should select organizations based on alignment with company values, local community impact, and employee recommendations.

Q: Can businesses set a budget for charitable contributions?

A: Businesses should determine an annual budget for donations to maintain financial oversight and strategic planning.

Q: How can businesses involve employees in charitable giving?

A: Businesses should encourage employees to nominate charities, participate in volunteer programs, or take advantage of donation-matching initiatives.

Q: Should businesses publicly disclose their charitable contributions?

A: Businesses should decide whether to share donation details based on branding strategy and stakeholder engagement goals.

Q: Can businesses support political organizations through this policy?

A: Businesses should clarify whether contributions extend to political causes or remain focused on nonprofit and community-based initiatives.

Q: How should businesses evaluate the impact of their charitable contributions?

A: Businesses should track outcomes through financial reports, community feedback, and measurable project results.

Q: How often should businesses review their charitable contributions policy?

A: Businesses should reassess the policy annually to ensure alignment with financial resources and community priorities.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.