Charitable contributions policy (Kentucky): Free template

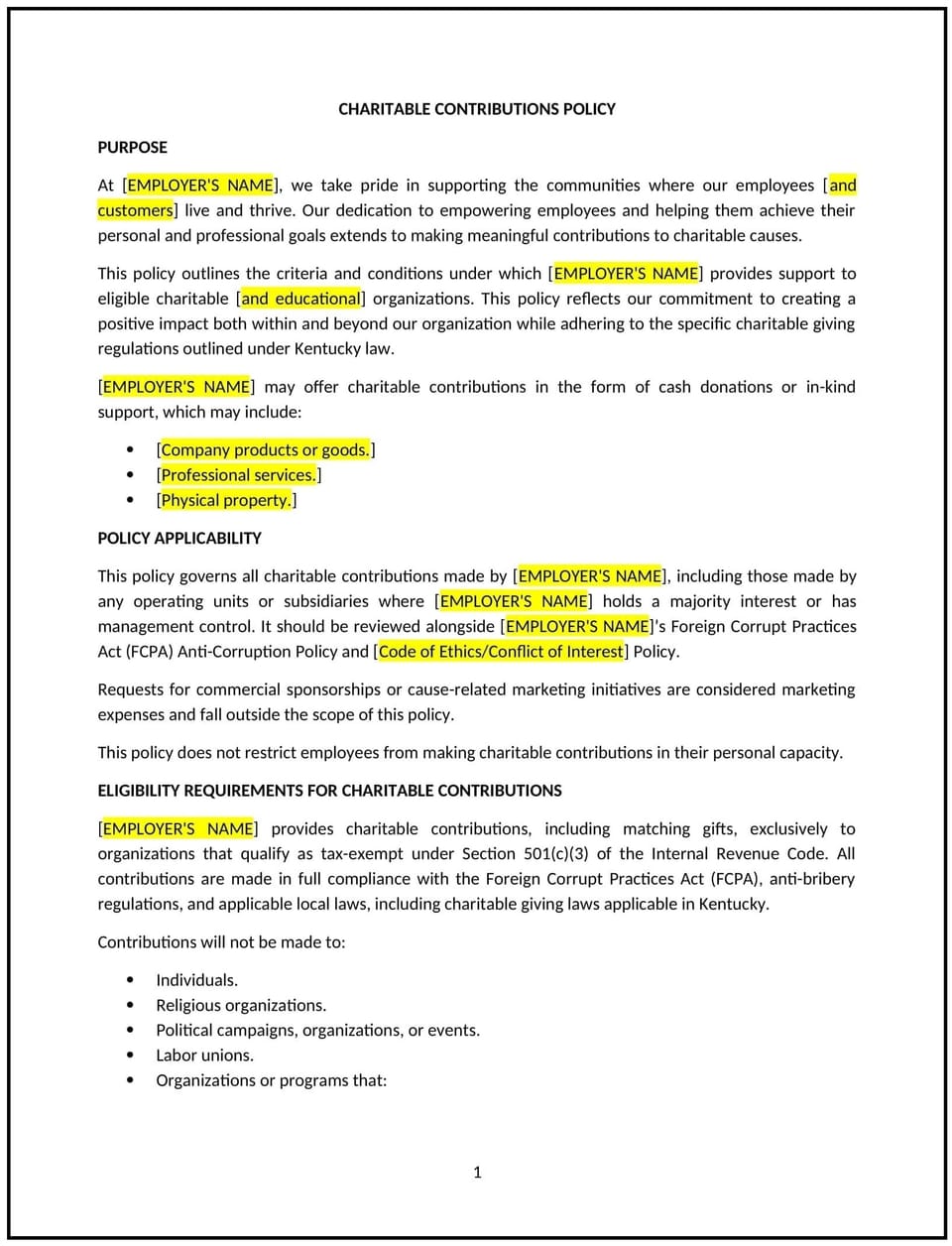

Charitable contributions policy (Kentucky)

A charitable contributions policy provides Kentucky businesses with guidelines for making donations to nonprofit organizations, charities, and community initiatives. This policy outlines the company’s approach to philanthropy, including eligibility criteria, approval processes, and reporting requirements, ensuring donations align with business values and objectives.

By adopting this policy, businesses can demonstrate social responsibility, build community connections, and foster a positive reputation.

How to use this charitable contributions policy (Kentucky)

- Define eligible recipients: Specify the types of organizations or causes that qualify for donations, such as registered nonprofits, community initiatives, or disaster relief efforts.

- Outline contribution limits: Set guidelines for the monetary or in-kind value of contributions and specify whether employees can request matching donations.

- Describe the approval process: Detail the steps for reviewing and approving charitable contributions, including documentation requirements and the involvement of management or a designated committee.

- Align with business values: Emphasize that contributions should reflect the company’s mission, values, or industry focus, and avoid controversial or unrelated causes.

- Include employee participation: Outline opportunities for employees to suggest charities or participate in workplace giving programs.

- Provide compliance guidelines: Ensure contributions adhere to Kentucky laws, federal tax regulations, and ethical standards to avoid conflicts of interest or improper use of funds.

- Address reporting and transparency: Specify how charitable contributions will be tracked and reported, including public disclosures or internal records as necessary.

Benefits of using this charitable contributions policy (Kentucky)

This policy provides several key benefits for Kentucky businesses:

- Promotes social responsibility: Demonstrates the business’s commitment to giving back to the community and supporting meaningful causes.

- Builds community relationships: Strengthens ties with local organizations and fosters goodwill among employees and stakeholders.

- Enhances employee engagement: Encourages employees to participate in philanthropic efforts, boosting morale and team spirit.

- Provides clear guidance: Establishes a consistent framework for managing donations, reducing ambiguity or mismanagement.

- Reflects business values: Aligns charitable contributions with the company’s mission and objectives, ensuring meaningful and strategic support.

Tips for using this charitable contributions policy (Kentucky)

- Communicate the policy: Share the policy with employees and stakeholders to encourage participation and understanding of the company’s philanthropic efforts.

- Monitor contributions: Track donations to ensure they align with the policy’s criteria and reflect positively on the business.

- Encourage employee involvement: Create opportunities for employees to suggest charities or volunteer with supported organizations.

- Review compliance: Regularly verify that contributions meet legal and tax requirements, avoiding conflicts of interest or unethical practices.

- Update the policy as needed: Adjust the policy to reflect changes in Kentucky laws, community needs, or business priorities.

Q: What is the purpose of a charitable contributions policy?

A: The policy provides guidelines for businesses to make responsible donations to charities or community initiatives, ensuring alignment with company values and legal standards.

Q: What types of organizations are eligible for contributions?

A: Eligible recipients may include registered nonprofits, community groups, or causes aligned with the company’s mission and values.

Q: How are contribution decisions made?

A: Decisions are typically made through an approval process involving management or a designated committee, following the criteria outlined in the policy.

Q: Can employees suggest charities for contributions?

A: Yes, many policies allow employees to recommend organizations or participate in workplace giving programs.

Q: Are there limits on contribution amounts?

A: The policy specifies monetary or in-kind contribution limits, which may vary based on the organization or cause.

Q: How are contributions tracked and reported?

A: Contributions are documented internally and may be disclosed publicly as part of the company’s commitment to transparency.

Q: How does the policy ensure compliance with laws?

A: The policy includes guidelines for adhering to Kentucky laws, federal tax regulations, and ethical standards when making contributions.

Q: How often should the charitable contributions policy be reviewed?

A: The policy should be reviewed annually or as needed to reflect changes in laws, business priorities, or community needs.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.