Charitable contributions policy (Louisiana): Free template

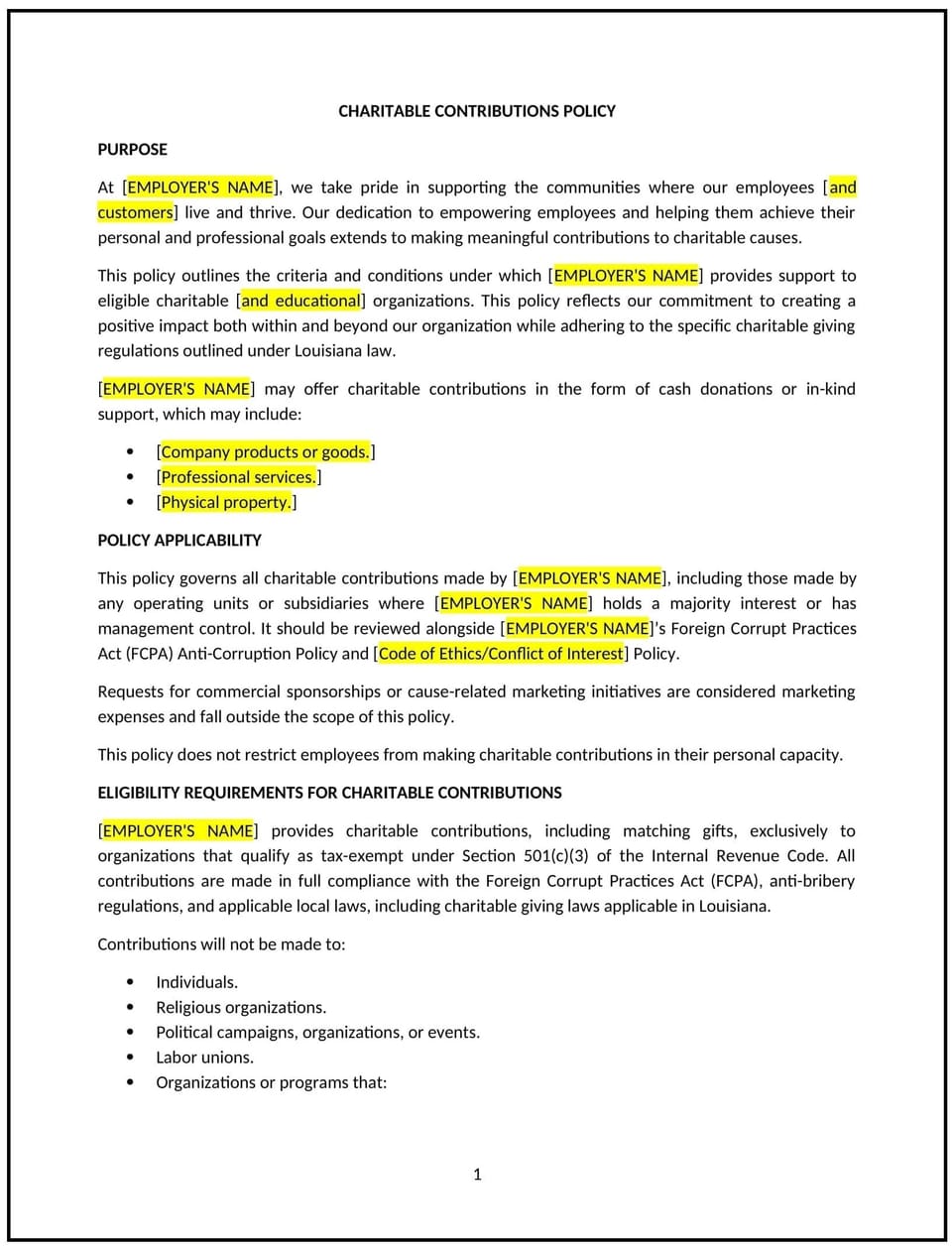

Charitable contributions policy (Louisiana)

This charitable contributions policy is designed to help Louisiana businesses establish clear guidelines for supporting charitable organizations. It outlines the process for selecting causes, approving contributions, and ensuring that donations align with the company’s values and goals.

By implementing this policy, businesses can foster community engagement, enhance their reputation, and ensure a structured approach to philanthropic efforts.

How to use this charitable contributions policy (Louisiana)

- Define contribution criteria: Specify the types of organizations or causes eligible for support, such as local nonprofits or initiatives aligned with the company’s mission.

- Establish approval processes: Outline how charitable contributions are proposed, reviewed, and approved, including required documentation.

- Set contribution limits: Define financial or resource-based limits for charitable donations to ensure budget alignment.

- Address employee involvement: Clarify how employees can suggest or participate in charitable initiatives, such as volunteering or fundraising.

- Track contributions: Establish procedures for maintaining records of donations and assessing their impact.

- Communicate externally: Provide guidelines for promoting charitable contributions publicly while maintaining professionalism.

Benefits of using a charitable contributions policy (Louisiana)

Implementing this policy provides several advantages for Louisiana businesses:

- Enhances community engagement: Builds strong relationships with local communities through targeted support.

- Promotes transparency: Provides a structured approach to managing charitable contributions.

- Aligns with business goals: Ensures donations reflect the company’s mission and values.

- Boosts employee morale: Encourages participation in meaningful initiatives, fostering a sense of purpose.

- Strengthens reputation: Demonstrates a commitment to social responsibility, enhancing brand perception.

Tips for using this charitable contributions policy (Louisiana)

- Align contributions with company values: Select causes that reflect the organization’s mission and resonate with employees and stakeholders.

- Encourage employee input: Involve employees in identifying charitable opportunities to foster engagement and support.

- Monitor budget allocation: Regularly review the budget for charitable contributions to balance generosity with financial prudence.

- Evaluate impact: Assess the outcomes of donations to determine their effectiveness and alignment with company goals.

- Update as needed: Revise the policy to reflect changes in community priorities or organizational objectives.

Q: What types of organizations are eligible for contributions under this policy?

A: Eligible organizations typically include registered nonprofits, local community groups, and initiatives aligned with the company’s mission and values.

Q: How can businesses manage requests for charitable contributions?

A: Businesses should establish a formal process for submitting requests, including documentation such as the organization’s mission, impact reports, and funding needs.

Q: Can businesses set limits on charitable contributions?

A: Yes, businesses should define financial or resource-based limits in the policy to maintain budget control and ensure fairness in allocation.

Q: How should businesses track charitable contributions?

A: Businesses can maintain records of all contributions, including donation amounts, recipient organizations, and intended outcomes, to monitor impact and ensure accountability.

Q: What role can employees play in charitable initiatives?

A: Employees can suggest organizations, participate in fundraising or volunteering efforts, and help promote company-supported causes.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or when changes in community priorities or business goals occur.

Q: How can businesses communicate their charitable contributions?

A: Businesses can share information about their contributions through newsletters, press releases, or social media while maintaining a focus on professionalism and the supported cause.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.