Charitable contributions policy (Maine): Free template

Charitable contributions policy (Maine): Free template

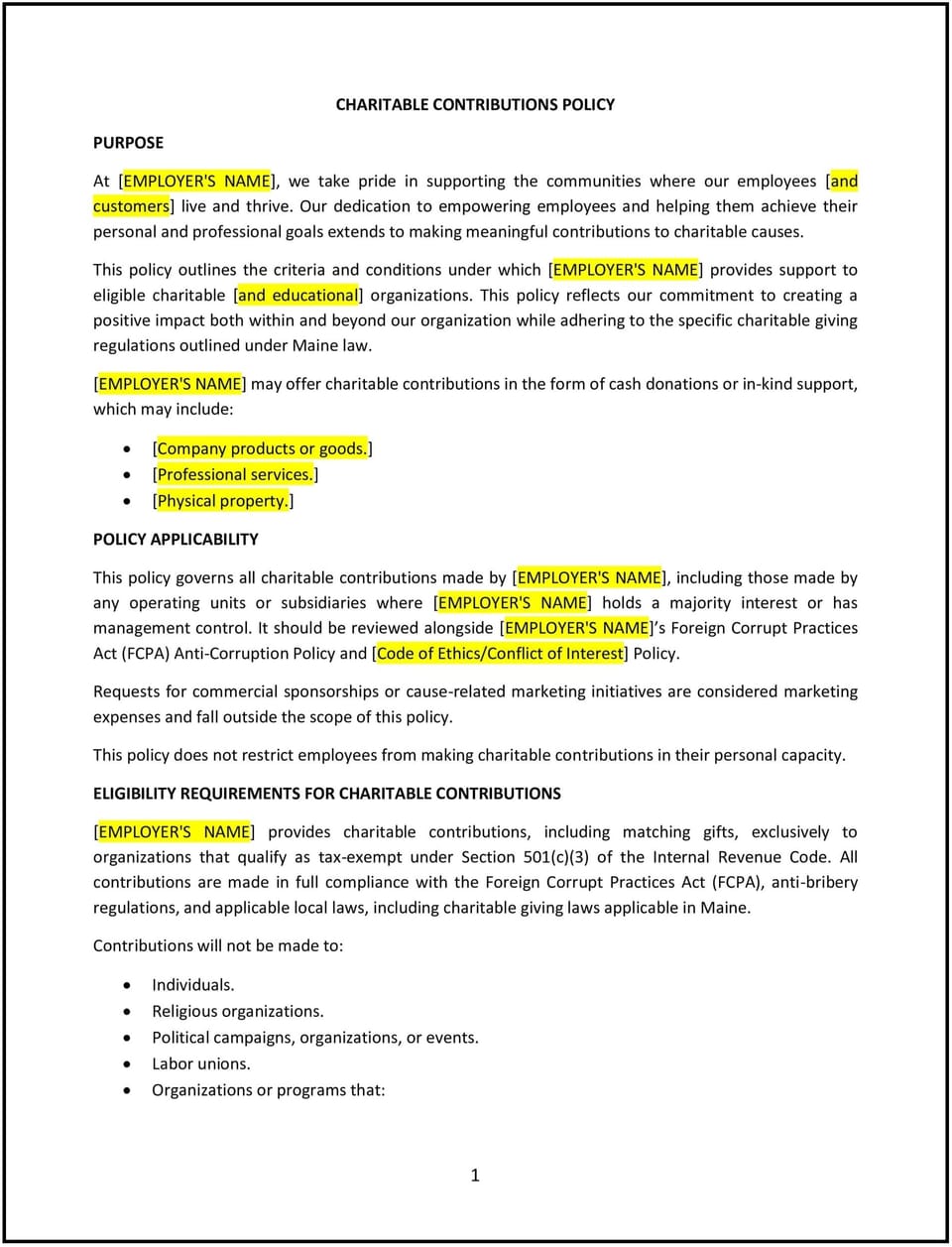

This charitable contributions policy is designed to help Maine businesses establish clear guidelines for supporting charitable organizations and community initiatives. It outlines the criteria for donations, employee involvement, and the approval process, ensuring contributions align with the business’s values and community impact goals.

By implementing this policy, Maine businesses can promote corporate social responsibility, build community relationships, and enhance their reputation.

How to use this charitable contributions policy (Maine)

- Define contribution types: Specify the forms of charitable support allowed, such as monetary donations, in-kind contributions, or volunteer hours.

- Establish eligibility criteria: Outline the requirements for organizations to qualify for contributions, such as being a registered nonprofit or aligning with company values.

- Clarify approval processes: Detail the steps for proposing, reviewing, and approving charitable contributions, including any required documentation.

- Set budget limits: Specify the annual budget allocated for charitable contributions and any limits on individual donations.

- Encourage employee participation: Include opportunities for employees to nominate charities, participate in volunteer programs, or match their donations.

- Maintain transparency: Require record-keeping of all contributions to ensure accountability and compliance with financial regulations.

- Regularly review: Periodically assess the policy to ensure it aligns with Maine laws, business goals, and community needs.

Benefits of using this charitable contributions policy (Maine)

Implementing this policy provides several benefits for Maine businesses:

- Enhances community impact: Directs contributions toward meaningful causes that align with the business’s values.

- Promotes employee engagement: Encourages employees to participate in charitable activities and share their input.

- Builds reputation: Demonstrates a commitment to corporate social responsibility and community support.

- Ensures consistency: Provides a structured approach to managing contributions, minimizing favoritism or ad hoc decisions.

- Simplifies compliance: Ensures contributions align with financial and legal regulations in Maine.

Tips for using this charitable contributions policy (Maine)

- Communicate the policy: Share the policy with employees and ensure it is included in the employee handbook.

- Encourage nominations: Create a simple process for employees to suggest charities or community initiatives for support.

- Track contributions: Maintain detailed records of all donations to ensure compliance and measure impact.

- Evaluate impact: Regularly assess how contributions align with business goals and benefit the community.

- Offer matching programs: Consider implementing employee donation matching to encourage greater participation.

- Stay informed: Monitor changes in Maine laws and regulations affecting charitable contributions.

Q: What types of organizations qualify for contributions under this policy?

A: Businesses can specify that eligible organizations must be registered nonprofits or align with the business’s values and community goals.

Q: How can businesses ensure transparency in their charitable contributions?

A: Businesses should maintain detailed records of all contributions, including amounts, recipient organizations, and approval documentation.

Q: How often should businesses review their charitable contributions policy?

A: Businesses should review the policy annually or whenever there are changes in Maine laws or organizational goals.

Q: Can employees nominate charities for contributions?

A: Yes, businesses can encourage employees to nominate organizations, subject to approval based on the policy’s criteria.

Q: What limits should businesses place on charitable contributions?

A: Businesses can define annual budgets for contributions and set caps for individual donations to ensure consistent allocation of resources.

Q: Are in-kind contributions included under this policy?

A: Yes, businesses may include in-kind donations, such as goods or services, as part of their charitable contributions policy.

Q: How can businesses balance charitable contributions with financial priorities?

A: Businesses should allocate a specific budget for contributions and ensure donations align with both community impact and business goals.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.