Charitable contributions policy (Missouri): Free template

Charitable contributions policy (Missouri)

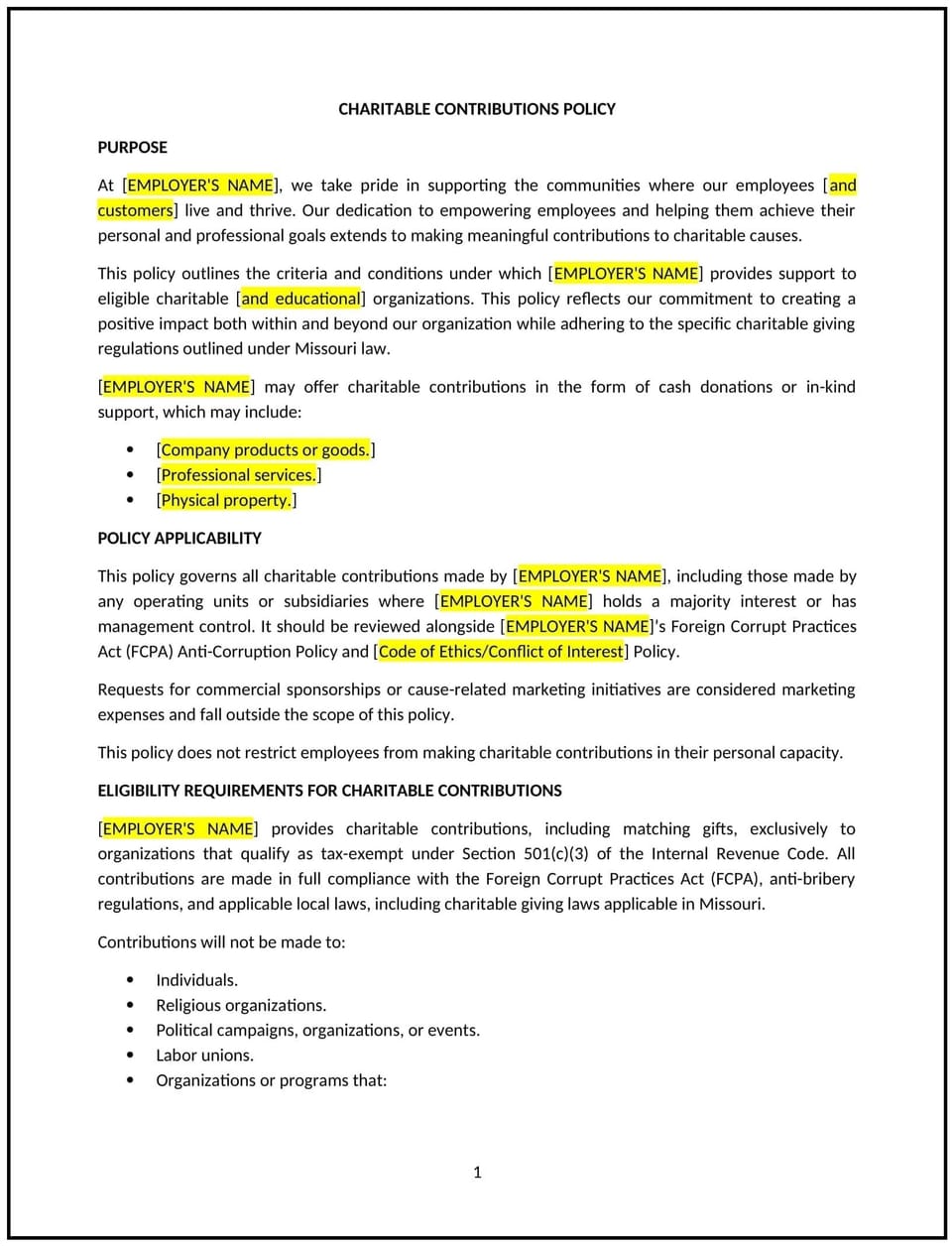

A charitable contributions policy helps businesses in Missouri outline their approach to giving back to the community through financial or in-kind donations. This policy provides clear guidelines for supporting charitable causes, including employee-driven initiatives, corporate sponsorships, and corporate matching programs. It is designed to reflect the business’s commitment to social responsibility while promoting transparency and consistency in charitable giving.

By adopting this policy, businesses in Missouri can foster a positive reputation, build community relationships, and engage employees in meaningful causes.

How to use this charitable contributions policy (Missouri)

- Define eligible charities: Specify which types of organizations or causes qualify for charitable contributions, such as nonprofit organizations, educational institutions, or environmental causes.

- Set contribution limits: Establish a budget or contribution limit for charitable giving, whether on a yearly basis or per employee initiative.

- Outline employee involvement: Describe how employees can participate in charitable giving, including any corporate matching programs or opportunities for volunteering.

- Clarify approval process: Specify the approval process for charitable contributions, including who in the company has the authority to approve donations.

- Define matching contributions: If applicable, detail how the company will match employee contributions to eligible charities, including any limits or conditions.

- Communicate policy guidelines: Ensure that employees are aware of the company’s charitable giving guidelines, and make the policy accessible through employee handbooks or internal communications.

- Review regularly: Periodically review the policy to ensure it aligns with changes in Missouri law, corporate goals, and community needs.

Benefits of using this charitable contributions policy (Missouri)

This policy provides several benefits for businesses in Missouri:

- Enhances corporate reputation: Demonstrates a commitment to social responsibility, which can improve the company’s public image and strengthen community ties.

- Engages employees: Encourages employee involvement in charitable activities, fostering a sense of purpose and enhancing morale.

- Builds relationships: Helps the business connect with local organizations, strengthening relationships within the community.

- Supports charitable causes: Ensures that the business’s resources are directed towards meaningful causes, creating a positive impact on the community.

- Attracts top talent: A strong charitable giving program can make the business more appealing to prospective employees who value corporate social responsibility.

- Reflects Missouri values: Aligns with Missouri’s strong community and volunteerism culture, showing the business’s commitment to the state’s social and civic needs.

Tips for using this charitable contributions policy (Missouri)

- Clearly communicate the policy: Make sure all employees are informed about the charitable contributions policy, especially during onboarding or through internal communications.

- Encourage participation: Promote opportunities for employees to contribute to charitable causes, such as through volunteering or corporate matching programs.

- Set clear guidelines: Ensure that there is a clear process for approving and tracking charitable contributions to maintain transparency and fairness.

- Monitor and track donations: Regularly track the contributions to ensure the business stays within budget and that donations align with the policy guidelines.

- Align with business values: Ensure that charitable contributions reflect the company’s mission, values, and community involvement goals.

- Review and update the policy: Periodically assess the policy to ensure it meets the evolving needs of the business and the community.

Q: Why should businesses in Missouri adopt a charitable contributions policy?

A: Businesses should adopt this policy to formalize their approach to charitable giving, enhance their community involvement, and create a positive corporate reputation.

Q: How can employees participate in charitable giving?

A: Businesses should specify opportunities for employees to participate, such as through corporate matching programs, volunteering, or personal contributions to eligible charities.

Q: What types of organizations are eligible for charitable contributions?

A: Businesses should define the types of organizations eligible for donations, such as 501(c)(3) nonprofits, educational institutions, and other community-based causes.

Q: How much should businesses contribute to charitable causes?

A: Businesses should set clear contribution limits, whether on a yearly basis or per donation, and ensure that charitable giving aligns with company budgets and goals.

Q: How do employee matching contributions work?

A: Businesses should outline how matching contributions are handled, including whether there are limits on the amount matched and any requirements for employee participation.

Q: Who approves charitable contributions within the company?

A: Businesses should define the approval process for charitable contributions, designating who in the company has the authority to approve donations and matching contributions.

Q: How often should businesses review the charitable contributions policy?

A: Businesses should periodically review the policy, ensuring it stays aligned with company goals, Missouri laws, and the needs of the community.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.