Company car policy (Connecticut): Free template

Company car policy (Connecticut)

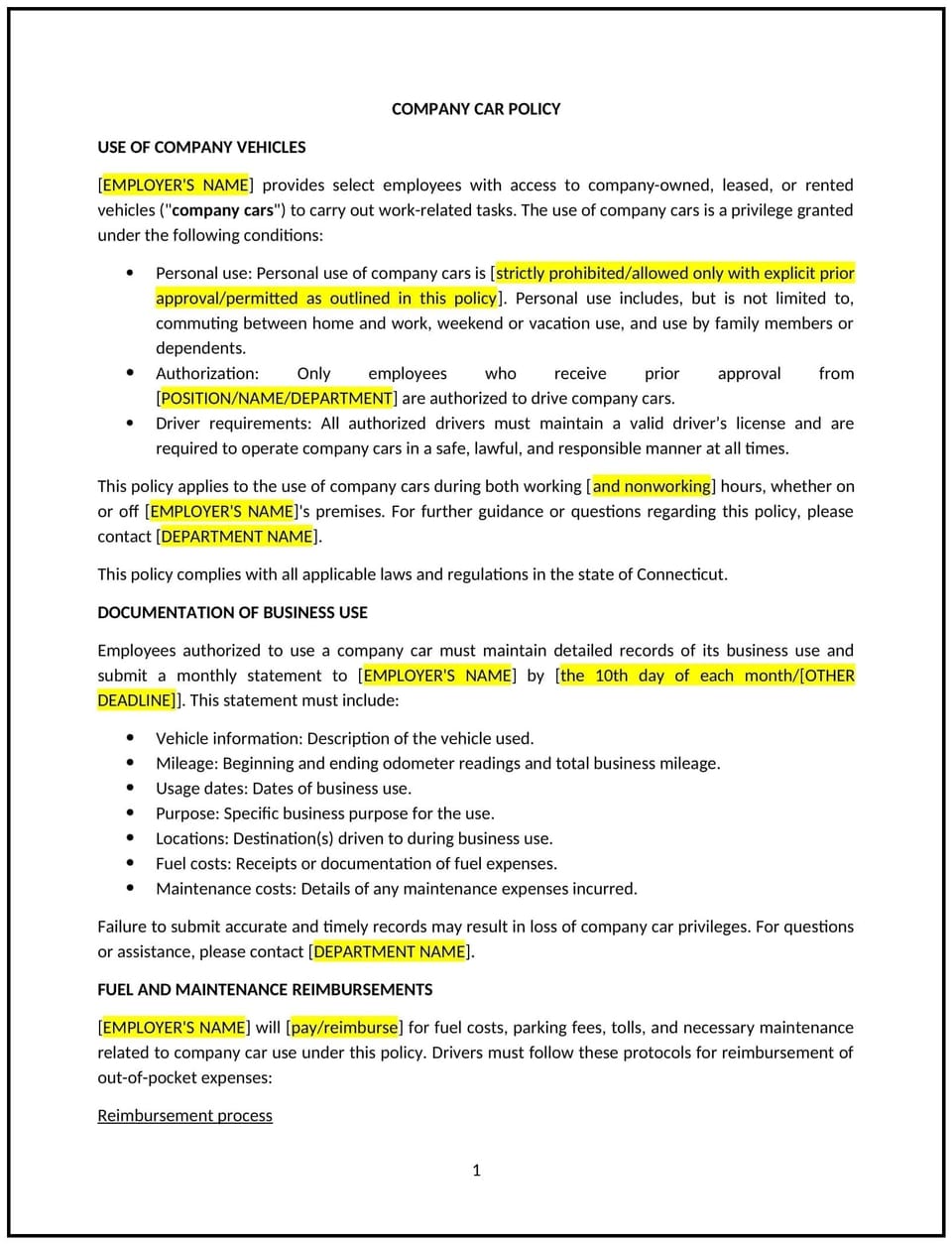

A company car policy helps Connecticut businesses define the terms under which employees are provided with company-owned vehicles for work-related purposes. This policy outlines eligibility, permitted use, maintenance responsibilities, and the process for requesting a company car, ensuring clarity and consistency in its implementation.

By implementing this policy, businesses can manage company car usage effectively, reduce risks, and ensure compliance with relevant state regulations.

How to use this company car policy (Connecticut)

- Define eligibility: Specify which employees are eligible to receive a company car, such as those with a particular job title, responsibility, or frequency of travel.

- Outline permissible use: Clearly state the acceptable uses for the company car, such as work-related travel, client meetings, or business errands.

- Set maintenance and care responsibilities: Establish guidelines for the employee’s responsibility to maintain the car, including regular servicing, upkeep, and reporting any damage or issues.

- Address personal use: Clarify whether personal use of the company car is allowed, and if so, the limits and tax implications associated with personal use.

- Outline insurance and liability: Specify the insurance coverage provided by the company and any responsibilities the employee has in case of an accident or damage.

- Set return procedure: Provide instructions for employees on how to return the car, including conditions for inspection, cleaning, and maintenance at the end of the usage period.

Benefits of using this company car policy (Connecticut)

This policy offers several benefits for Connecticut businesses:

- Provides clear guidelines: Establishes a transparent framework for employees to understand the terms and conditions surrounding the use of a company car.

- Reduces risks: Minimizes the risks of misuse or accidents by setting clear rules for maintenance, usage, and liability.

- Ensures compliance: Helps the business meet regulatory and insurance requirements related to company-owned vehicles.

- Improves employee satisfaction: Provides employees with a valuable benefit that can enhance job satisfaction, especially for those with frequent travel requirements.

- Supports efficient operations: Helps employees carry out work-related tasks efficiently while maintaining a high standard of professionalism.

Tips for using this company car policy (Connecticut)

- Communicate expectations: Ensure all employees who are eligible for a company car understand their responsibilities regarding usage, maintenance, and insurance.

- Monitor usage: Regularly review the use of company cars to ensure compliance with the policy, particularly regarding personal use and maintenance.

- Keep records: Maintain detailed records of company car allocation, maintenance schedules, and any incidents involving company vehicles.

- Consider tax implications: Ensure employees understand the tax implications of using a company car, particularly if personal use is allowed.

- Review periodically: Update the policy as needed to reflect changes in Connecticut laws, insurance requirements, or business practices.

Q: How does this policy benefit my business?

A: The policy provides clarity on company car usage, ensures compliance with legal requirements, reduces risks related to accidents or misuse, and enhances employee satisfaction.

Q: Who is eligible for a company car under this policy?

A: Eligibility is typically based on job requirements, such as employees who travel frequently for business purposes. The policy should outline the specific roles or criteria for eligibility.

Q: Can employees use company cars for personal use?

A: The policy should specify whether personal use is allowed and, if so, any limitations or tax implications related to such use. Clear guidelines help avoid confusion and potential misuse.

Q: What happens if the company car is involved in an accident?

A: The policy should specify the procedure for reporting accidents, the insurance coverage provided, and the employee’s responsibility in case of damage or liability. Employees should be required to report incidents promptly.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or whenever changes occur in Connecticut laws, insurance regulations, or business practices related to company car use.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.