Company car policy (Florida): Free template

Company car policy (Florida)

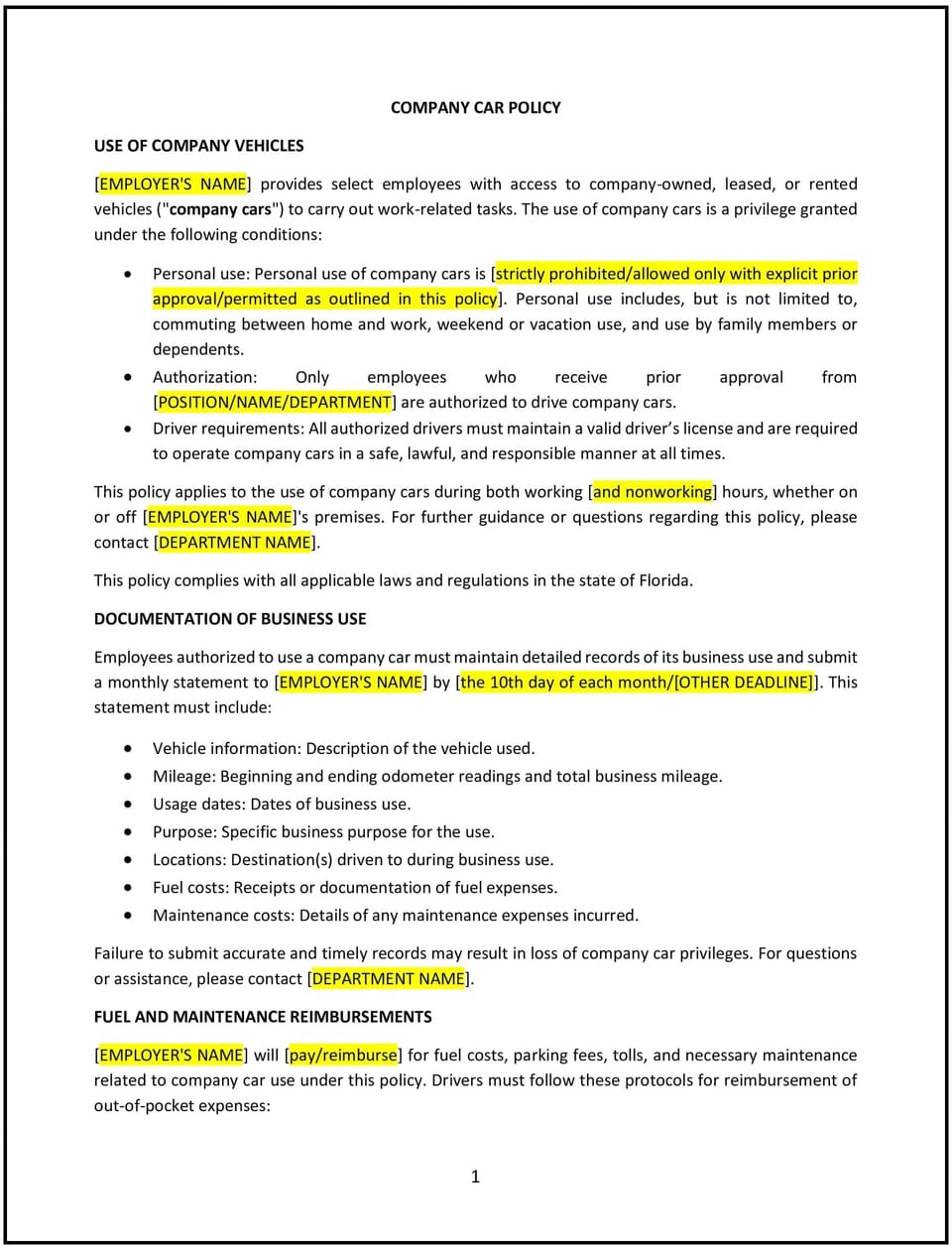

A company car policy helps Florida businesses regulate the use of company-owned vehicles by employees, outlining the terms, conditions, and responsibilities for using a company car. This policy specifies who is eligible for a company car, the allowable personal and business use, maintenance expectations, and the procedures for reporting damages, accidents, or violations of the policy.

By implementing this policy, businesses can ensure that company vehicles are used responsibly, reduce liability risks, and maintain consistency and fairness in vehicle distribution and usage among employees.

How to use this company car policy (Florida)

- Define eligibility: Specify which employees are eligible for a company car, such as those in certain job roles or those who need a vehicle for business purposes (e.g., sales representatives or executives). Include any criteria for eligibility, such as job level, travel requirements, or length of employment.

- Outline personal and business use: Clearly define the allowable use of company cars, such as whether they can be used for personal purposes, the frequency of personal use, and the need for employees to reimburse the company for personal mileage. Establish guidelines for acceptable business-related use.

- Set maintenance and fuel responsibilities: Specify who is responsible for maintaining the company car, including regular servicing, cleaning, and fuel costs. Outline whether employees are responsible for refueling the vehicle or if the company will cover fuel expenses.

- Address insurance and liability: Outline the company’s insurance coverage for the vehicle and specify the employee’s responsibilities in case of an accident, damage, or violation of traffic laws while driving the company car. Employees should also be informed of any deductibles or liabilities they may be responsible for.

- Set guidelines for reporting damages and accidents: Establish a clear procedure for reporting damages, accidents, or traffic violations involving company cars, including the required documentation (e.g., accident reports, insurance claims), and timelines for reporting.

- Establish the return process: Define the process for returning the company car, such as when an employee leaves the company, is no longer eligible for a company vehicle, or when the car is no longer needed for business purposes.

- Address vehicle safety: Emphasize the importance of driving safely and in compliance with all traffic laws. Include guidelines on seat belt use, avoiding distracted driving, and ensuring the vehicle is locked when unattended.

Benefits of using this company car policy (Florida)

This policy offers several benefits for Florida businesses:

- Reduces risk and liability: By setting clear guidelines for company car use and establishing the employee’s responsibilities, businesses can reduce liability risks associated with accidents, misuse, and damages.

- Ensures fair and consistent use: A formal policy ensures that company cars are distributed and used consistently across employees, helping to avoid favoritism or misunderstandings about eligibility and personal use.

- Protects company assets: The policy helps ensure that company vehicles are properly maintained and used responsibly, minimizing the risk of damage or unnecessary wear and tear on company assets.

- Increases employee accountability: Employees are held accountable for how they use company vehicles, ensuring that they understand their responsibilities and the potential consequences of misuse or negligence.

- Promotes cost savings: By specifying how fuel, maintenance, and other expenses are handled, the company can more effectively manage the costs associated with providing company cars to employees.

Tips for using this company car policy (Florida)

- Communicate the policy clearly: Ensure all employees who are eligible for a company car understand the policy, including their responsibilities, allowable use, and the procedures for maintenance and reporting.

- Monitor vehicle usage: Keep track of company vehicle usage, including mileage, fuel costs, and maintenance, to ensure compliance with the policy and to manage expenses effectively.

- Review eligibility regularly: Periodically review who qualifies for a company car to ensure that only those who need a vehicle for business purposes receive one.

- Enforce safety measures: Regularly remind employees about the importance of safe driving practices and ensure that company cars are used in accordance with all applicable laws and regulations.

- Review periodically: Regularly review and update the policy to ensure it remains aligned with changes in company practices, Florida laws, or employee needs.

Q: Why is a company car policy important for my business?

A: This policy ensures that company vehicles are used responsibly and consistently, reducing liability risks, protecting company assets, and promoting fairness in vehicle distribution among employees.

Q: Who is eligible to receive a company car?

A: The policy should specify eligibility criteria, such as employees in certain job roles or those who require a vehicle for business purposes. Eligibility can be based on factors such as job level, travel requirements, or length of employment.

Q: Can employees use the company car for personal purposes?

A: The policy should define whether personal use is allowed, under what conditions, and any reimbursement requirements for personal mileage. For example, employees may be allowed limited personal use, but they may need to reimburse the company for fuel or mileage.

Q: Who is responsible for the maintenance of the company car?

A: The policy should specify that employees are responsible for keeping the vehicle in good condition, including routine maintenance, cleaning, and reporting damages. The company may also specify who is responsible for covering maintenance costs.

Q: What happens if an employee gets into an accident while driving the company car?

A: The policy should outline the procedures for reporting accidents, including the need to notify the company immediately, file an accident report, and work with the company’s insurance provider to address damages or injuries.

Q: How often should this policy be reviewed?

A: This policy should be reviewed periodically, at least annually, or whenever there are changes in Florida laws, company practices, or employee needs, to ensure it remains effective and compliant.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.