Contract review and approval policy (Iowa): Free template

Contract review and approval policy (Iowa)

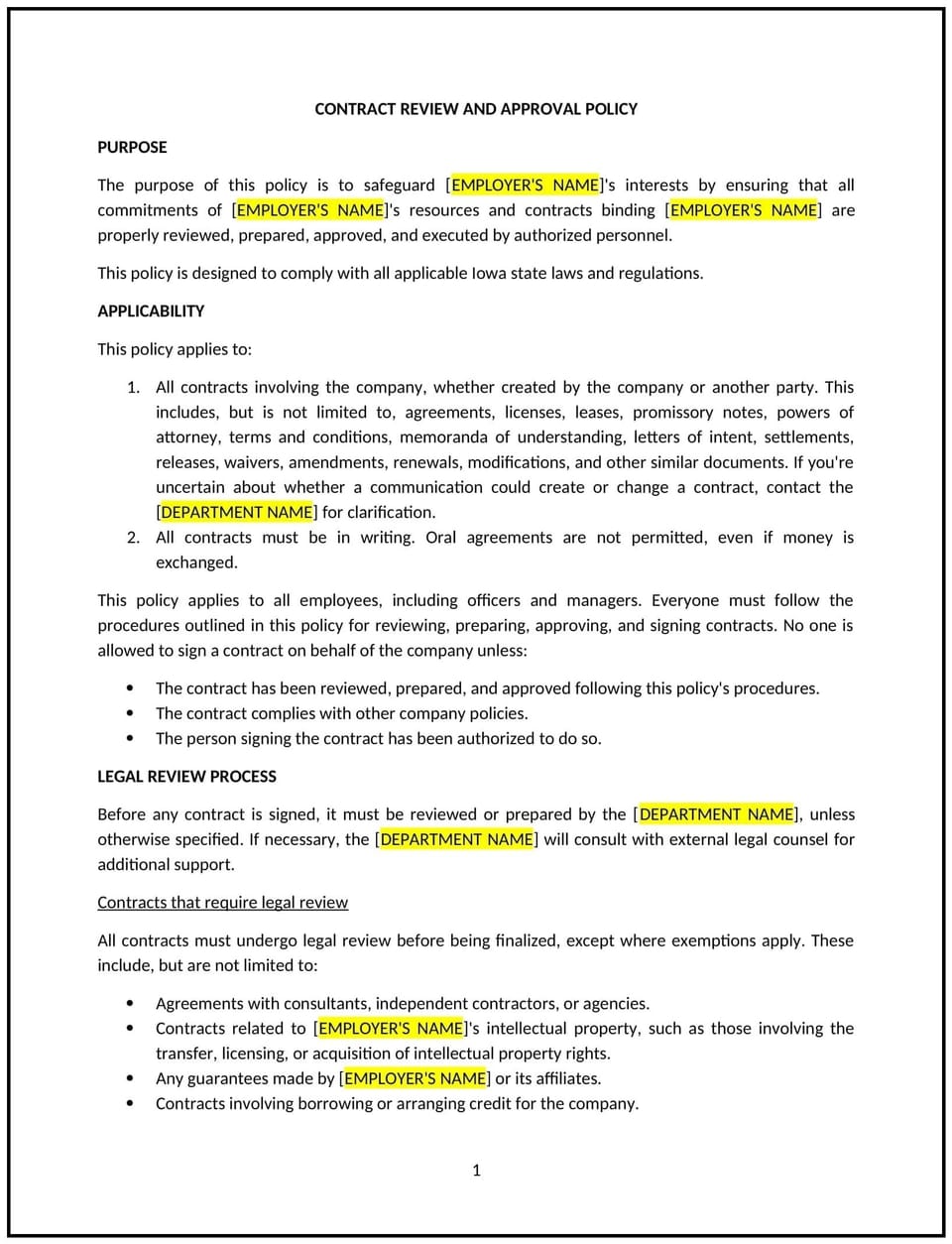

A contract review and approval policy helps Iowa businesses establish clear procedures for evaluating, negotiating, and approving contracts before they are signed. Proper contract management helps businesses reduce risks, clarify obligations, and prevent legal or financial issues.

This policy outlines the steps for reviewing contracts, defining approval authority, and ensuring key terms are properly assessed before execution. It provides businesses with a structured approach to handling agreements while maintaining operational efficiency.

By implementing this policy, businesses in Iowa can improve contract oversight, minimize disputes, and create a consistent approval process for all agreements.

How to use this contract review and approval policy (Iowa)

- Define contract types: Identify which agreements require review, including vendor contracts, customer agreements, and partnership arrangements.

- Assign review responsibilities: Designate individuals or teams responsible for assessing contract terms, such as legal counsel, finance, or senior management.

- Establish approval thresholds: Determine approval authority based on contract value, duration, and business impact.

- Outline key review areas: Require evaluations of financial terms, obligations, liability limitations, termination rights, and dispute resolution clauses.

- Set documentation requirements: Ensure all contracts are properly recorded, stored, and tracked in a contract management system.

- Implement risk assessment guidelines: Identify potential risks in contract terms and provide recommendations for mitigation.

- Require final sign-off procedures: Define the process for obtaining signatures and confirming contract execution.

- Review and update: Regularly assess contract review processes to align with business needs and industry standards.

Benefits of using this contract review and approval policy (Iowa)

This policy offers several advantages for Iowa businesses:

- Reduces contractual risks: Helps businesses identify and mitigate unfavorable terms before signing.

- Improves financial oversight: Ensures contracts align with budget and financial planning.

- Enhances operational efficiency: Provides a structured process for handling agreements.

- Strengthens negotiation strategies: Encourages businesses to secure favorable terms in contract negotiations.

- Supports legal protection: Helps businesses identify liability concerns and obligations before executing contracts.

- Promotes accountability: Clearly defines who is responsible for contract approvals and risk assessments.

Tips for using this contract review and approval policy (Iowa)

- Standardize contract templates: Businesses should create standardized contract templates to streamline negotiations and reviews.

- Use a contract tracking system: Businesses should implement contract management software to monitor agreement statuses and renewal dates.

- Require multiple approval levels: Businesses should involve legal, finance, and operations teams in contract reviews for high-value agreements.

- Train employees on contract risks: Businesses should educate key personnel on identifying unfavorable contract terms and potential red flags.

- Establish escalation procedures: Businesses should define how to escalate contract concerns for further review when needed.

- Regularly audit contracts: Businesses should review active contracts periodically to assess performance, obligations, and renewal needs.

Q: Why should Iowa businesses implement a contract review and approval policy?

A: Businesses should establish this policy to create a structured review process, reduce risks, and ensure agreements align with business objectives.

Q: Who should be responsible for reviewing contracts?

A: Businesses should assign contract review responsibilities to designated personnel, such as legal counsel, finance teams, or senior management.

Q: What key terms should businesses evaluate during contract reviews?

A: Businesses should assess financial terms, termination clauses, liability limitations, confidentiality obligations, and dispute resolution mechanisms.

Q: How can businesses manage contract approvals efficiently?

A: Businesses should implement an approval workflow that defines authorization levels based on contract value, type, and risk factors.

Q: What should businesses do if they identify unfavorable terms in a contract?

A: Businesses should negotiate modifications, seek legal advice, or escalate concerns before finalizing the agreement.

Q: How often should businesses review their contract review and approval policy?

A: Businesses should reassess the policy annually or whenever significant legal, regulatory, or operational changes occur.

Q: Can businesses use electronic signatures for contract approvals?

A: Yes, businesses should determine when electronic signatures are acceptable and ensure they meet legal and contractual requirements.

Q: How should businesses store and track contracts after approval?

A: Businesses should maintain digital or physical records in a secure, organized system to track expiration dates, obligations, and renewals.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.