Donation leave policy (Minnesota): Free template

Donation leave policy (Minnesota)

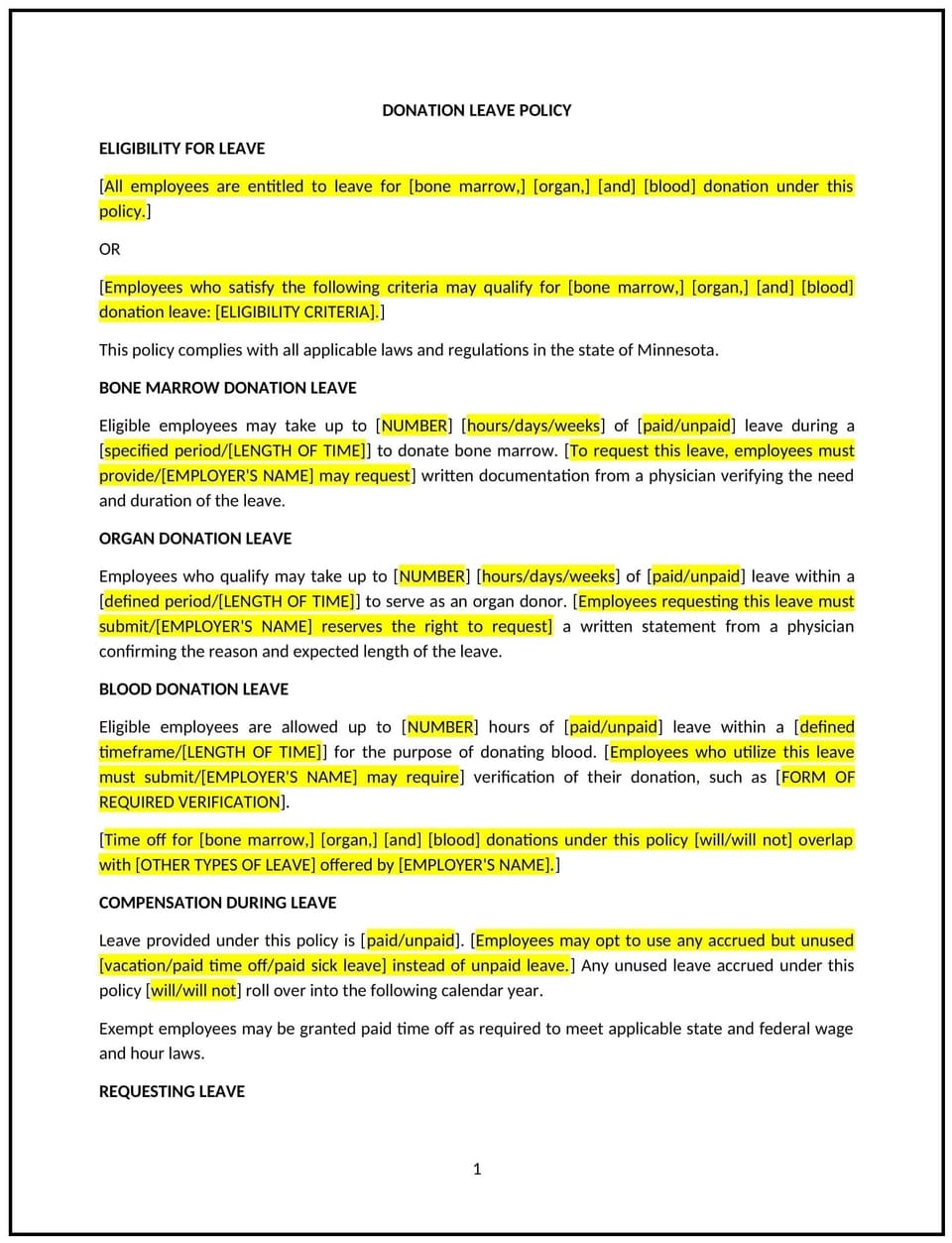

This donation leave policy is designed to help Minnesota businesses establish guidelines for allowing employees to take paid or unpaid leave to participate in charitable activities, such as volunteering, fundraising, or supporting causes aligned with the company’s values. It outlines the conditions under which donation leave can be taken, how much leave employees are eligible for, and the process for requesting leave.

By implementing this policy, businesses can foster a culture of giving, increase employee engagement, and support the local community through charitable work.

How to use this donation leave policy (Minnesota)

- Define donation leave eligibility: Specify which employees are eligible for donation leave, including any requirements such as minimum tenure or full-time status.

- Set leave limits: Outline the maximum number of hours or days of donation leave employees can take annually, ensuring it aligns with company resources and business needs.

- Establish approved charitable activities: List the types of charitable activities that qualify for donation leave, such as volunteering for registered nonprofits, participating in fundraising events, or contributing to community service initiatives.

- Set the approval process: Define the steps for requesting donation leave, including how much notice employees must provide and any documentation needed to verify participation in charitable activities.

- Determine paid or unpaid leave: Clarify whether donation leave is paid or unpaid and the impact on benefits during the leave period.

- Communicate tracking and reporting: Set up a system for tracking donation leave requests and usage to ensure transparency and fairness.

Benefits of using a donation leave policy (Minnesota)

Implementing this policy provides several advantages for Minnesota businesses:

- Promotes employee engagement: Encourages employees to participate in community service and charitable activities, boosting morale and job satisfaction.

- Strengthens community ties: Helps the company build stronger relationships with local organizations and causes, improving its reputation within the community.

- Enhances corporate social responsibility: Demonstrates the company’s commitment to giving back and supporting local nonprofits and initiatives.

- Improves employee retention: By offering donation leave, businesses can foster goodwill, making employees feel valued and more likely to stay with the company.

- Reflects Minnesota-specific considerations: Adapts the policy to local values and community expectations in Minnesota, encouraging charitable involvement in the state.

Tips for using this donation leave policy (Minnesota)

- Communicate clearly: Ensure employees are aware of the donation leave policy, its benefits, and how to request leave for charitable activities.

- Track leave usage: Set up a simple tracking system to monitor donation leave requests and usage to ensure fairness and avoid potential misuse.

- Offer flexibility: Make it easy for employees to participate in charitable activities by offering flexible leave options, such as half-day leave or paid time off for volunteering.

- Encourage participation: Highlight opportunities for employees to get involved in charitable activities by partnering with local organizations or organizing company-wide volunteer events.

- Review regularly: Reassess the policy annually to ensure it meets employee needs and aligns with the company’s charitable goals and Minnesota-specific community initiatives.

Q: What types of activities qualify for donation leave?

A: Businesses should define the types of charitable activities that qualify for donation leave, such as volunteering for nonprofits, participating in community service, or contributing to charitable fundraising efforts.

Q: How many hours or days of donation leave are employees allowed?

A: The business should specify a limit on donation leave, such as a certain number of hours or days per year, based on business needs and available resources.

Q: Is donation leave paid or unpaid?

A: Businesses should clarify whether donation leave is paid or unpaid, and if paid, whether it is provided as part of the regular paid time off (PTO) or as a separate benefit.

Q: How do employees request donation leave?

A: Employees should submit a request to HR or their supervisor, specifying the charitable activity, the time they plan to take, and any necessary documentation to verify their participation.

Q: Can donation leave be used for activities outside of Minnesota?

A: Businesses should specify whether donation leave can be used for charitable activities outside of Minnesota or if it should be focused on local community initiatives.

Q: Are there any restrictions on how donation leave can be used?

A: Businesses should establish guidelines to ensure that donation leave is used for legitimate charitable activities and not for personal or non-charitable purposes.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or whenever there are significant changes to the company’s charitable goals, employee benefits, or Minnesota-specific regulations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.