Pay advance and loan policy (California): Free template

Pay advance and loan policy (California)

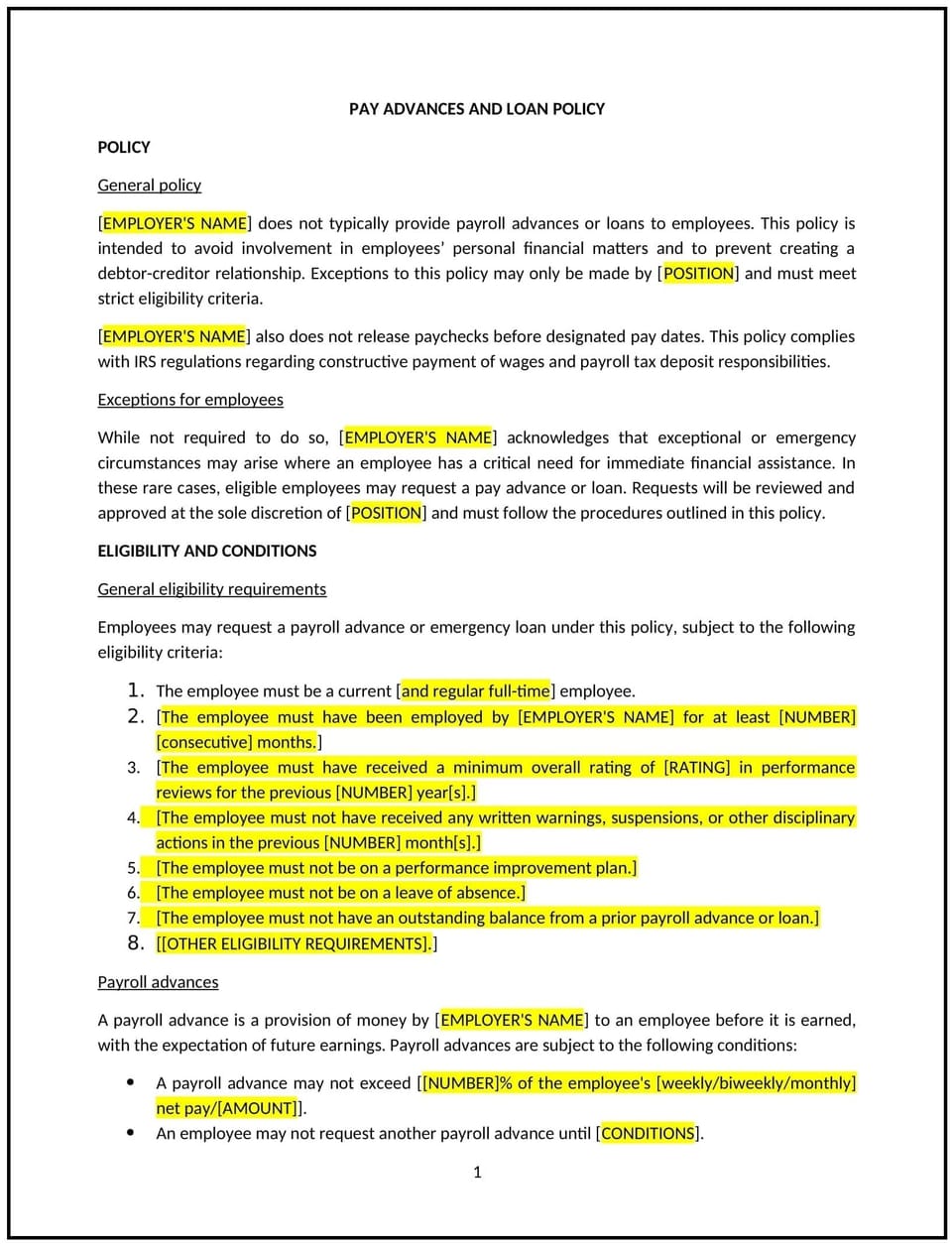

In California, a pay advance and loan policy provides businesses with guidelines for offering financial assistance to employees in the form of salary advances or loans. This policy supports compliance with California labor laws, such as those governing wage deductions, while ensuring transparency and fairness in financial transactions between the business and employees.

This policy outlines eligibility criteria, procedures for requesting pay advances or loans, repayment terms, and the business’s expectations for managing these arrangements. By implementing this policy, California businesses can support employee well-being while maintaining proper financial controls.

How to use this pay advance and loan policy (California)

- Define eligibility: Specify the circumstances under which employees may request a pay advance or loan, such as emergencies or unanticipated expenses.

- Outline request procedures: Provide steps for submitting requests, including documentation requirements and approval workflows.

- Establish repayment terms: Clearly state repayment methods, timelines, and any conditions, ensuring compliance with California laws prohibiting unauthorized wage deductions.

- Communicate limits: Define maximum amounts for advances or loans to manage financial risks for the business.

- Document agreements: Require written agreements outlining the terms and conditions of the advance or loan, signed by both the business and the employee.

Benefits of using this pay advance and loan policy (California)

This policy offers several advantages for California businesses:

- Supports compliance: Reflects California labor laws, including those governing wage deductions and financial agreements with employees.

- Promotes fairness: Provides consistent guidelines for all employees, ensuring equitable access to financial assistance.

- Enhances morale: Demonstrates the business’s commitment to supporting employees during financial challenges.

- Reduces risks: Mitigates potential disputes by documenting terms and adhering to lawful repayment practices.

- Improves financial planning: Helps the business manage cash flow and minimize risks associated with advances or loans.

Tips for using this pay advance and loan policy (California)

- Reflect California-specific laws: Ensure compliance with state regulations on wage deductions, including written consent requirements.

- Train managers: Educate supervisors and HR personnel on handling pay advance and loan requests lawfully and consistently.

- Monitor repayment: Implement systems to track repayments and ensure timely reconciliation of outstanding balances.

- Communicate limits: Set clear caps on advance or loan amounts to align with the business’s financial capabilities.

- Review regularly: Update the policy to reflect changes in California laws or business practices.

Q: How does this policy benefit the business?

A: This policy supports compliance with California labor laws, provides financial assistance to employees, and ensures clear repayment terms.

Q: What types of situations qualify for a pay advance or loan?

A: Qualifying situations may include emergencies, medical expenses, or other unanticipated financial needs, as outlined in the policy.

Q: How does this policy support compliance with California laws?

A: The policy reflects state regulations, including requirements for written agreements and limitations on wage deductions.

Q: What steps should employees take to request a pay advance or loan?

A: Employees should submit a formal request to HR, provide any required documentation, and agree to the repayment terms outlined in writing.

Q: How can the business ensure repayment of advances or loans?

A: The business can establish clear repayment schedules, document agreements, and ensure deductions comply with California laws.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.