Pay advances and loan policy (Alabama): Free template

Pay advances and loan policy (Alabama)

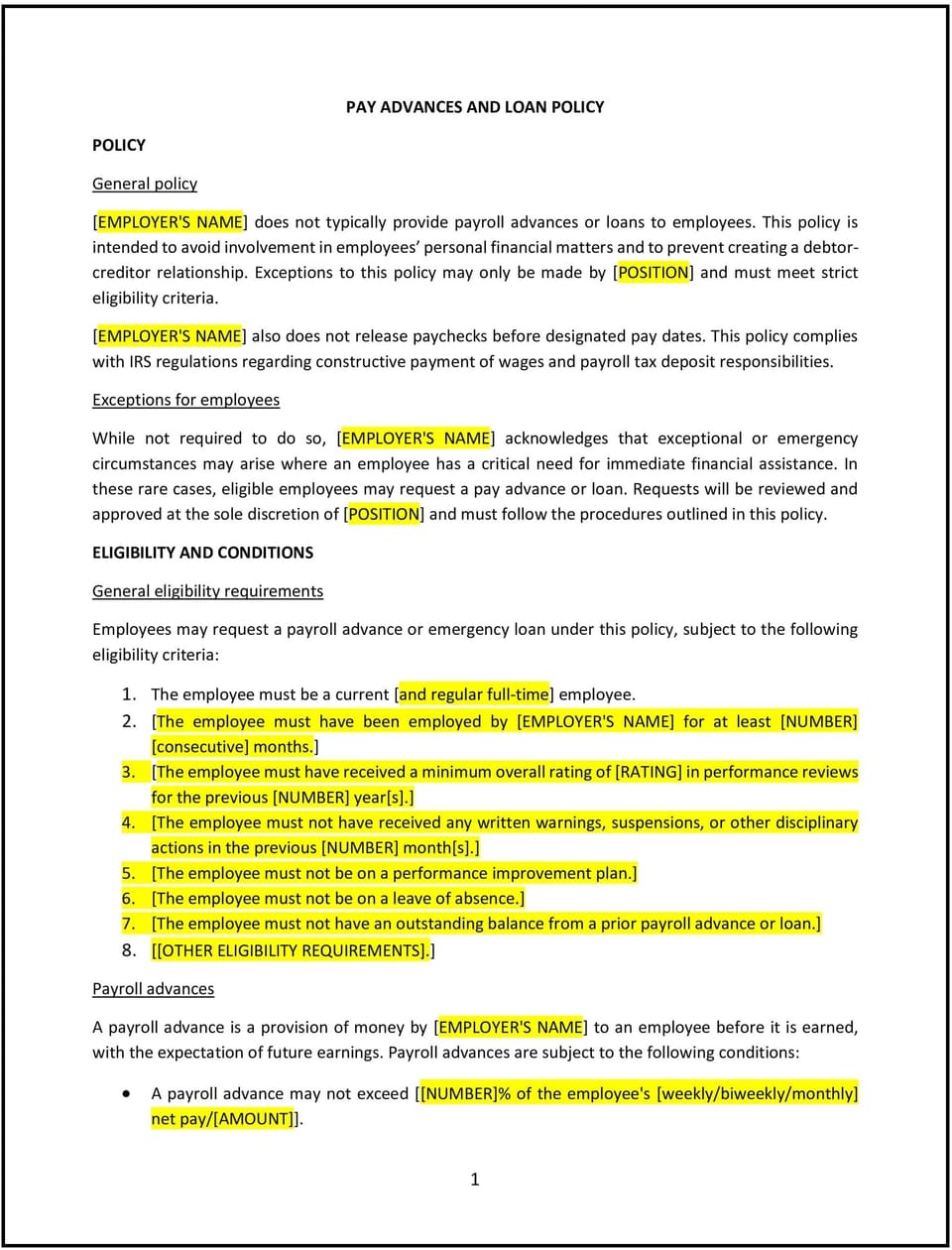

A pay advances and loan policy provides employees with clear guidelines for requesting and managing financial assistance from the company, such as early access to earned wages or short-term loans. For SMBs in Alabama, this policy helps employees navigate temporary financial hardships while maintaining transparency and accountability in the process.

This policy outlines eligibility, repayment terms, and the application process, ensuring consistency and fairness while protecting the company’s financial interests.

How to use this pay advances and loan policy (Alabama)

- Define pay advances and loans: Clarify the difference between wage advances (early access to earned wages) and company loans (financial assistance beyond earned wages).

- Specify eligibility: Outline criteria employees must meet to request a pay advance or loan, such as length of employment or a demonstrated financial need.

- Detail the application process: Provide steps for employees to formally request financial assistance, including required documentation and approval protocols.

- Explain repayment terms: Include repayment schedules, deductions from future paychecks, and any applicable interest or fees.

- Set limits: Establish maximum amounts for advances or loans to ensure the company can maintain financial stability.

Benefits of using a pay advances and loan policy (Alabama)

A pay advances and loan policy benefits both employees and the company by providing clear and structured financial assistance. Here’s how it helps:

- Supports employees: Provides financial relief for employees during emergencies or unexpected expenses.

- Promotes transparency: Ensures all employees understand the terms and conditions of financial assistance.

- Reduces workplace stress: Helps employees manage personal financial challenges, contributing to improved focus and productivity.

- Protects company resources: Establishes boundaries and repayment processes to safeguard the company’s financial stability.

- Encourages fairness: Creates a consistent framework for approving and managing requests, reducing perceptions of favoritism.

Tips for implementing a pay advances and loan policy (Alabama)

- Communicate the policy: Include this policy in employee handbooks and discuss it during onboarding or team meetings.

- Use written agreements: Require employees to sign formal agreements outlining repayment terms before receiving financial assistance.

- Monitor repayments: Set up systems to track deductions and ensure repayment schedules are adhered to.

- Limit frequency: Restrict the number of pay advances or loans employees can request within a specific time frame to maintain fairness and stability.

- Review periodically: Assess the policy’s effectiveness and update it as needed to reflect company practices or legal requirements.

Q: What is the difference between a pay advance and a loan?

A: A pay advance provides early access to earned wages, while a loan is financial assistance that may exceed earned wages and require a repayment agreement.

Q: Who is eligible to request a pay advance or loan?

A: Eligibility is typically based on factors such as employment duration, financial need, and the company’s financial capacity to provide assistance.

Q: How do employees apply for financial assistance?

A: Employees must submit a formal request to HR or their supervisor, including documentation of their financial need if required.

Q: Are pay advances or loans subject to interest?

A: Interest or fees may apply to company loans, but pay advances are usually provided without additional charges. The policy will specify applicable terms.

Q: How are repayments handled?

A: Repayments are typically deducted from future paychecks over an agreed-upon schedule, as outlined in the signed agreement.

Q: Can employees request multiple pay advances or loans?

A: The policy may limit the number of requests within a specific time frame to ensure fairness and financial stability for the company.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.