Pay advances and loan policy (Arizona): Free template

Pay advances and loan policy (Arizona)

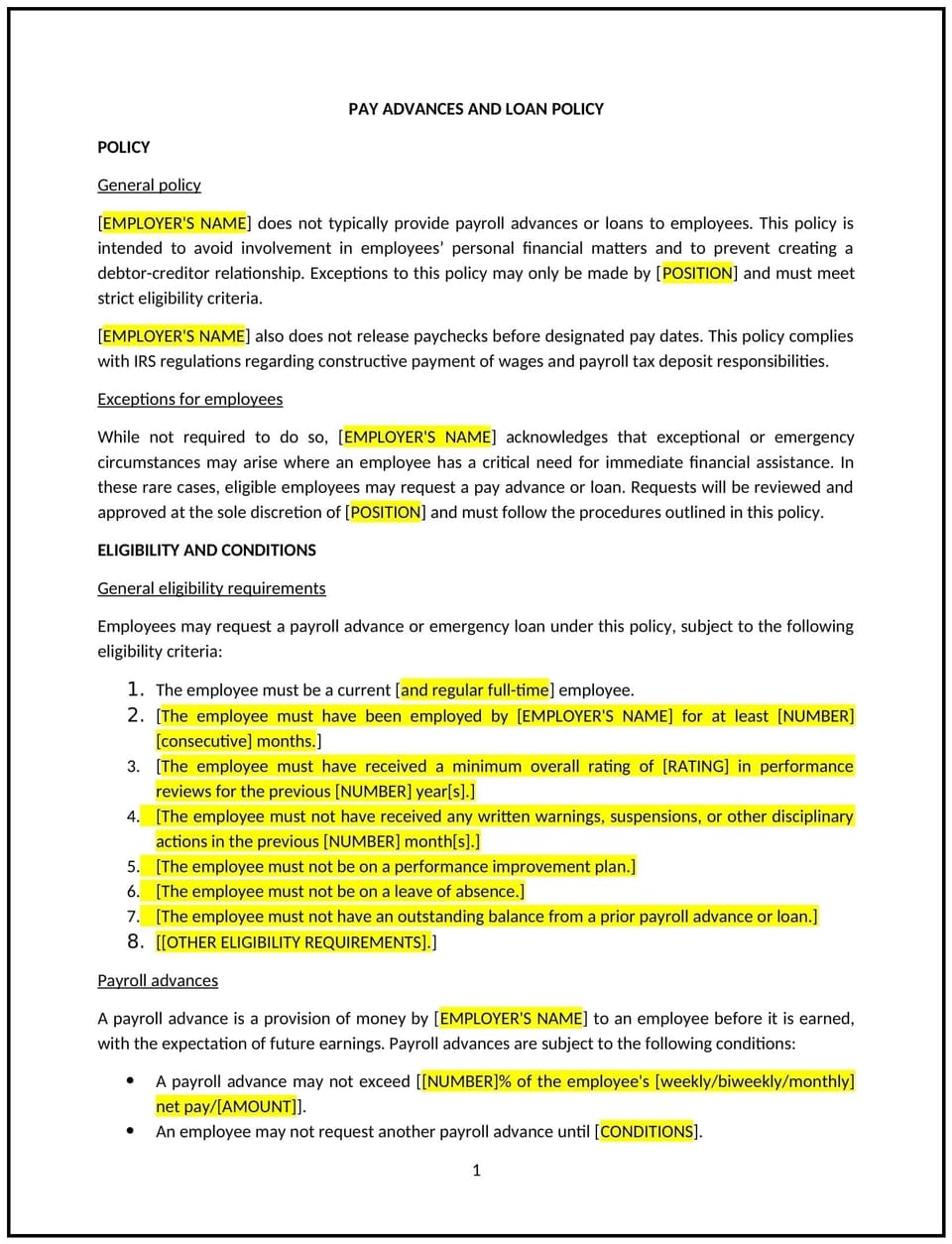

In Arizona, a pay advances and loan policy provides employees with guidelines for requesting financial assistance from their employer in the form of salary advances or short-term loans. This policy helps businesses support employees in times of financial need while maintaining transparency and clear repayment terms.

This policy outlines eligibility, application procedures, repayment terms, and restrictions. By implementing this policy, Arizona businesses can foster employee trust and well-being while protecting the company’s financial interests.

How to use this pay advances and loan policy (Arizona)

- Define eligibility: Specify the criteria employees must meet to qualify for pay advances or loans, such as length of employment or financial hardship.

- Establish application procedures: Include steps for submitting requests, such as completing a form and providing supporting documentation.

- Outline repayment terms: Clearly state repayment schedules, methods (e.g., payroll deductions), and any applicable fees or interest.

- Set limitations: Define the maximum amounts available and restrictions on the frequency of requests.

- Maintain confidentiality: Ensure all requests and related discussions are handled discreetly to protect employee privacy.

Benefits of using a pay advances and loan policy (Arizona)

This policy offers several advantages for Arizona businesses:

- Supports employee well-being: Provides financial relief during emergencies, helping employees focus on their work.

- Promotes transparency: Establishes clear and consistent procedures for handling requests, reducing misunderstandings.

- Protects the business: Minimizes risks by defining repayment terms and setting limits on advances or loans.

- Enhances trust: Demonstrates the company’s commitment to supporting employees in times of need.

- Maintains compliance: Aligns with Arizona wage laws and federal regulations to ensure proper handling of payroll and deductions.

Tips for using a pay advances and loan policy (Arizona)

- Address Arizona-specific considerations: Reflect the state’s wage laws and economic landscape when setting limits or terms.

- Educate employees: Provide clear communication about eligibility, repayment terms, and application procedures during onboarding or policy updates.

- Monitor repayment: Use payroll systems to track repayments and ensure compliance with agreed-upon schedules.

- Avoid overextension: Limit the total amount of outstanding loans or advances to protect the company’s financial stability.

- Review regularly: Update the policy to reflect changes in state laws, financial practices, or business needs.

Q: Who is eligible to request a pay advance or loan under this policy?

A: Eligibility is typically limited to employees who have completed a specified period of employment and demonstrate a legitimate financial need.

Q: How are repayment terms determined?

A: Repayment terms are defined in the agreement and often involve payroll deductions over a set period, with no excessive burden on the employee.

Q: Is there a limit on the amount that can be requested?

A: Yes, the policy sets a maximum amount for advances or loans to ensure financial stability for both the employee and the company.

Q: Can employees request multiple advances or loans?

A: Employees may request additional advances or loans only after fully repaying previous ones and adhering to any restrictions on frequency.

Q: How does this policy ensure compliance with Arizona laws?

A: The policy aligns with Arizona wage laws and federal regulations to handle payroll deductions and ensure fair practices in providing financial assistance.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.