Pay advances and loan policy (Arkansas): Free template

Pay advances and loan policy (Arkansas)

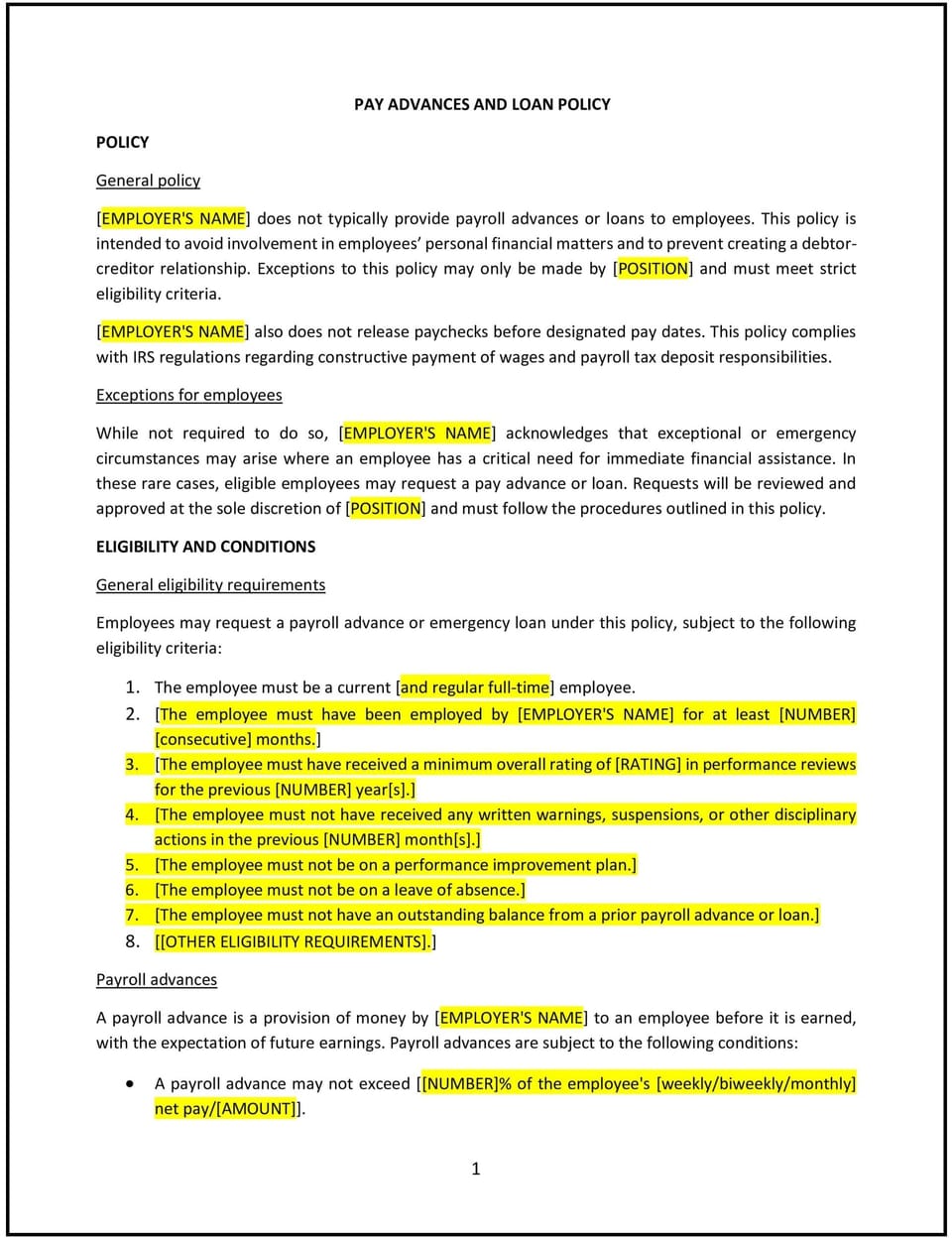

In Arkansas, a pay advances and loan policy provides businesses with clear guidelines for handling employee requests for financial assistance through salary advances or business-issued loans. This policy ensures consistent decision-making, protects business resources, and supports compliance with applicable financial and employment regulations.

This policy outlines eligibility criteria, approval processes, and repayment terms for pay advances and loans. By implementing this policy, Arkansas businesses can manage employee financial assistance requests effectively while maintaining transparency and accountability.

How to use this pay advances and loan policy (Arkansas)

- Define eligibility: Clearly outline which employees qualify for pay advances or loans, specifying criteria such as tenure or financial need.

- Establish limits: Set caps on the amount of advances or loans that can be provided, ensuring alignment with the business’s financial capacity.

- Outline approval processes: Provide step-by-step procedures for requesting and approving financial assistance, including required documentation.

- Specify repayment terms: Clearly state repayment methods, timelines, and consequences for missed payments to ensure accountability.

- Maintain records: Document all pay advances or loans, including terms and repayment progress, to maintain transparency and compliance.

Benefits of using this pay advances and loan policy (Arkansas)

This policy offers several advantages for Arkansas businesses:

- Promotes fairness: Ensures consistent handling of employee requests for financial assistance, reducing the risk of perceived favoritism.

- Protects resources: Establishes guidelines to safeguard the business’s financial stability while offering support to employees.

- Supports compliance: Aligns with Arkansas labor and financial regulations, minimizing legal risks.

- Enhances transparency: Provides clear expectations and processes for both employees and management, avoiding misunderstandings.

- Builds trust: Demonstrates the business’s commitment to supporting employees during financial challenges.

Tips for using this pay advances and loan policy (Arkansas)

- Address Arkansas-specific considerations: Incorporate any state-specific laws or financial practices relevant to pay advances or loans.

- Train managers: Provide training on how to handle requests, evaluate eligibility, and ensure consistency in decision-making.

- Review financial capacity: Regularly assess the business’s ability to offer advances or loans without compromising operations.

- Communicate clearly: Ensure employees understand the policy, including repayment obligations and potential consequences of non-repayment.

- Update regularly: Revise the policy to reflect changes in financial regulations, business resources, or employee needs.

Q: How does this policy benefit the business?

A: This policy protects the business’s financial stability, promotes fairness in handling employee requests, and supports compliance with Arkansas laws governing financial practices.

Q: What limits should the business set for pay advances or loans?

A: The business should establish reasonable caps based on financial capacity and ensure these limits are clearly communicated to employees.

Q: How does this policy support compliance with laws?

A: The policy aligns with Arkansas-specific labor and financial regulations, ensuring that advances and loans are managed lawfully and transparently.

Q: What documentation should the business require for pay advances or loans?

A: The business should collect signed agreements detailing the terms of the advance or loan, including repayment schedules and any applicable conditions.

Q: How can the business enforce repayment terms?

A: The business can deduct repayments from future wages as permitted by Arkansas law or use other agreed-upon methods outlined in the policy.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.