Pay advances and loan policy (Connecticut): Free template

Pay advances and loan policy (Connecticut)

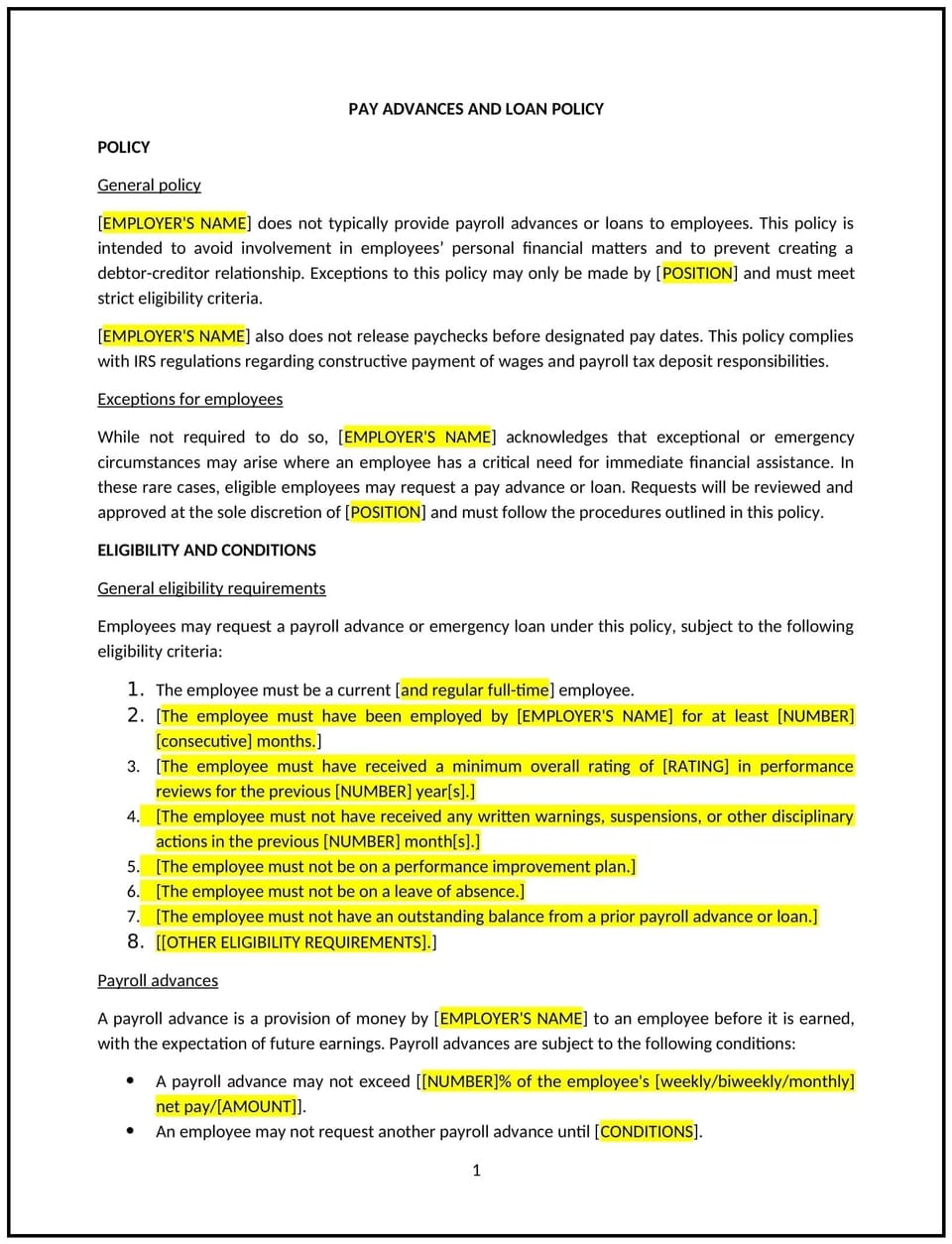

A pay advances and loan policy helps Connecticut businesses manage employee requests for financial assistance through advances on wages or company-provided loans. This policy outlines the process for requesting pay advances or loans, the terms and conditions under which these requests are granted, and how repayment will be managed to ensure fairness and transparency.

By implementing this policy, businesses can offer a structured way to address financial emergencies while protecting both the company’s interests and the financial well-being of employees.

How to use this pay advances and loan policy (Connecticut)

- Define eligibility: Specify the criteria employees must meet to be eligible for a pay advance or loan, such as employment duration, performance, or other relevant factors.

- Outline the types of financial assistance: Clarify whether the company offers pay advances, loans, or both, and define the terms for each, including the maximum amount available and any restrictions.

- Establish the approval process: Provide a clear procedure for employees to request pay advances or loans, including necessary documentation, such as the reason for the request, repayment plans, and any required approvals from management or HR.

- Set repayment terms: Define the repayment structure for pay advances or loans, including how deductions will be made from future paychecks, repayment schedules, and interest (if applicable).

- Address consequences of non-repayment: Outline the actions the company may take if an employee fails to repay a loan or pay advance, including possible deductions from final paychecks or legal action.

- Comply with state and federal regulations: Ensure the policy complies with Connecticut state laws and federal regulations, including wage and hour laws, and avoid potential legal risks related to pay advances and loans.

Benefits of using this pay advances and loan policy (Connecticut)

This policy offers several benefits for Connecticut businesses:

- Reduces financial risk: Establishes clear guidelines for offering pay advances or loans, helping to avoid misunderstandings or disputes between employees and the company.

- Promotes transparency: Provides employees with a clear understanding of how pay advances and loans work, including eligibility, repayment terms, and any applicable consequences.

- Improves employee satisfaction: Offering financial assistance for emergencies can boost employee morale and retention by demonstrating that the company cares about employees' financial well-being.

- Prevents abuse: Ensures that pay advances and loans are used responsibly by outlining clear criteria for approval and repayment, helping to avoid misuse of company resources.

- Maintains legal compliance: Helps ensure compliance with Connecticut and federal wage laws, preventing legal challenges related to pay advances or loans.

Tips for using this pay advances and loan policy (Connecticut)

- Communicate the policy clearly: Ensure that all employees understand the policy and the procedure for requesting pay advances or loans, as well as the terms and conditions associated with these financial options.

- Review requests carefully: Assess each request for a pay advance or loan on a case-by-case basis to ensure fairness and consistency, and verify that repayment terms are realistic.

- Monitor repayment: Keep track of repayment schedules to ensure that employees are meeting their obligations, and take action if payments fall behind.

- Offer alternative solutions: Consider offering financial wellness programs or emergency funds as an alternative to pay advances or loans, which may help prevent employees from needing to request financial assistance.

- Review periodically: Regularly review the policy to ensure it complies with changes in Connecticut laws, federal regulations, or business needs.

Q: How does this policy benefit my business?

A: The policy provides a clear framework for managing pay advances or loans, ensuring fairness, reducing financial risk, and promoting transparency, which improves employee satisfaction and helps maintain legal compliance.

Q: Who is eligible for a pay advance or loan?

A: Eligibility criteria may include factors such as length of employment, performance, and financial need. The policy should outline any specific requirements or restrictions for requesting financial assistance.

Q: How are pay advances or loans repaid?

A: Repayment is typically made through deductions from future paychecks. The policy should specify the repayment schedule and any interest charges (if applicable), ensuring that employees are aware of the terms before requesting assistance.

Q: Can an employee request multiple pay advances or loans?

A: The policy should specify whether employees can request multiple pay advances or loans, and under what circumstances. Establishing clear guidelines helps prevent potential abuse of the system.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or whenever there are changes to Connecticut laws, federal regulations, or business practices to ensure it remains effective and compliant.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.