Pay advances and loan policy (Delaware): Free template

Pay advances and loan policy (Delaware)

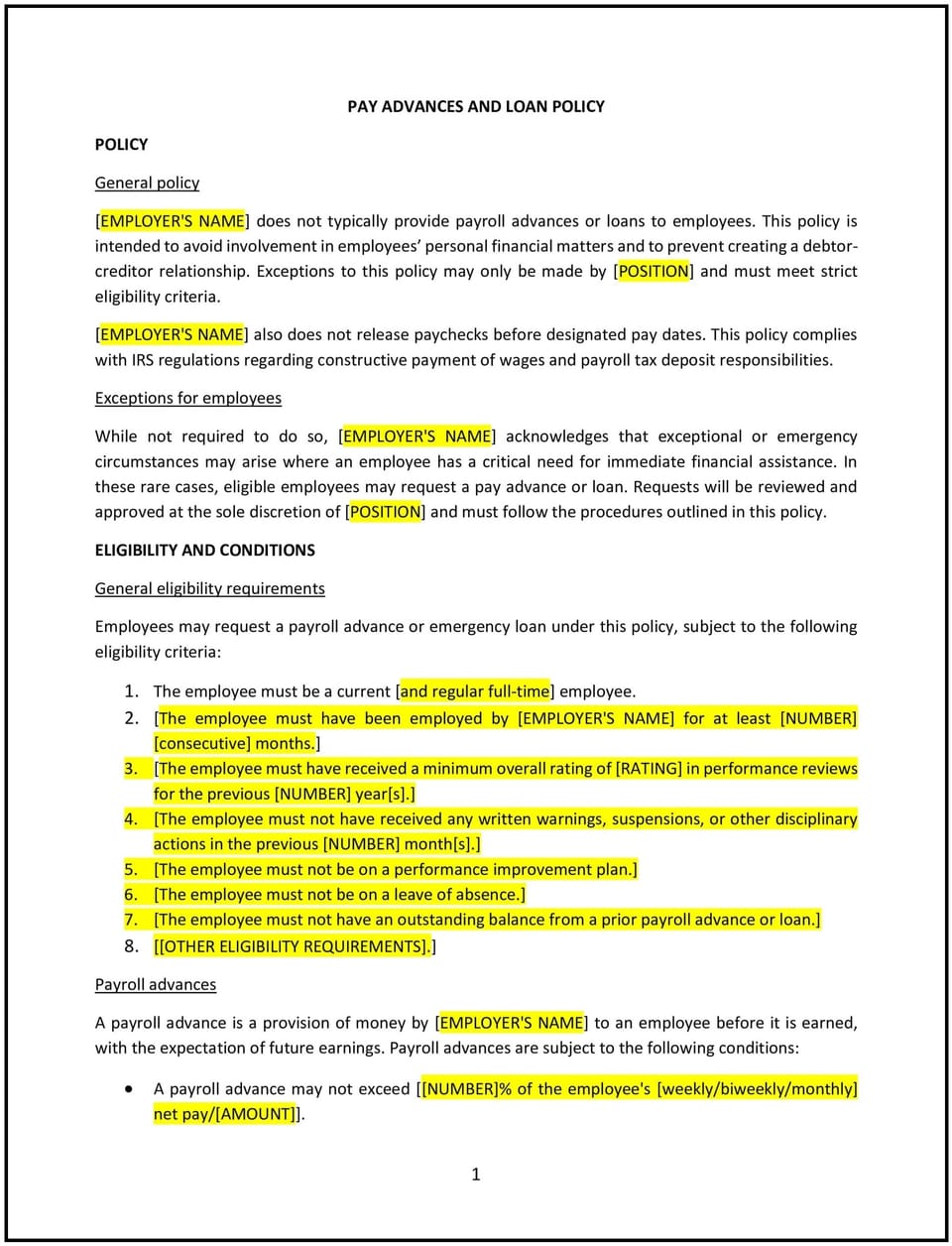

A pay advances and loan policy helps Delaware businesses provide employees with temporary financial assistance in the form of advances on future wages or company-provided loans. This policy outlines eligibility criteria, repayment terms, and application procedures to ensure fair and transparent practices while protecting the company’s financial stability.

By implementing this policy, businesses can support employees in managing financial emergencies while maintaining compliance with Delaware labor laws.

How to use this pay advances and loan policy (Delaware)

- Define eligibility: Specify which employees qualify for pay advances or loans, such as full-time employees who have completed a minimum period of employment.

- Establish limits: Outline the maximum amount that can be advanced or loaned and any restrictions on the frequency of requests.

- Provide application procedures: Detail the steps employees must take to request an advance or loan, including completing an application form and providing documentation of the need, if required.

- Clarify repayment terms: Include repayment options, such as deductions from future paychecks, and ensure compliance with Delaware wage deduction laws.

- Address confidentiality: Emphasize that all requests and related information will be handled discreetly and only shared with authorized personnel.

- Monitor and track: Maintain accurate records of all advances or loans issued and their repayment schedules.

Benefits of using this pay advances and loan policy (Delaware)

This policy offers several benefits for Delaware businesses:

- Supports employees: Provides a safety net for employees facing financial emergencies, improving morale and loyalty.

- Promotes transparency: Establishes clear guidelines for pay advances and loans, reducing misunderstandings and disputes.

- Manages financial risks: Ensures that advances and loans are granted responsibly, protecting the company’s financial stability.

- Enhances retention: Demonstrates the company’s commitment to supporting employees, fostering trust and engagement.

- Ensures compliance: Aligns with Delaware labor laws regarding wage deductions and employee rights.

Tips for using this pay advances and loan policy (Delaware)

- Communicate the policy clearly: Ensure employees understand the criteria, terms, and procedures for requesting pay advances or loans.

- Train managers and HR: Provide training to ensure consistent application of the policy and compliance with Delaware labor laws.

- Use written agreements: Require employees to sign a written agreement outlining the repayment terms and conditions to avoid disputes.

- Monitor repayment: Regularly review repayment schedules to ensure timely collections and maintain accurate financial records.

- Review regularly: Update the policy as needed to reflect changes in Delaware laws, company practices, or employee needs.

Q: Why is a pay advances and loan policy important for my business?

A: This policy provides employees with financial support during emergencies while protecting the company’s financial stability and ensuring compliance with Delaware laws.

Q: Who is eligible for pay advances or loans under this policy?

A: Eligibility typically includes full-time employees who have completed a minimum period of employment, as outlined in the policy.

Q: What are the repayment terms for pay advances or loans?

A: Repayment terms may include deductions from future paychecks over a specified period, with terms clearly defined in a written agreement.

Q: Can employees request multiple pay advances or loans?

A: The policy should specify limits on the frequency and amount of requests to ensure fairness and manage financial risk for the company.

Q: How often should this policy be reviewed?

A: This policy should be reviewed annually or whenever Delaware labor laws or company practices regarding pay advances and loans change to ensure continued relevance and compliance.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.