Pay advances and loan policy (Georgia): Free template

Pay advances and loan policy (Georgia)

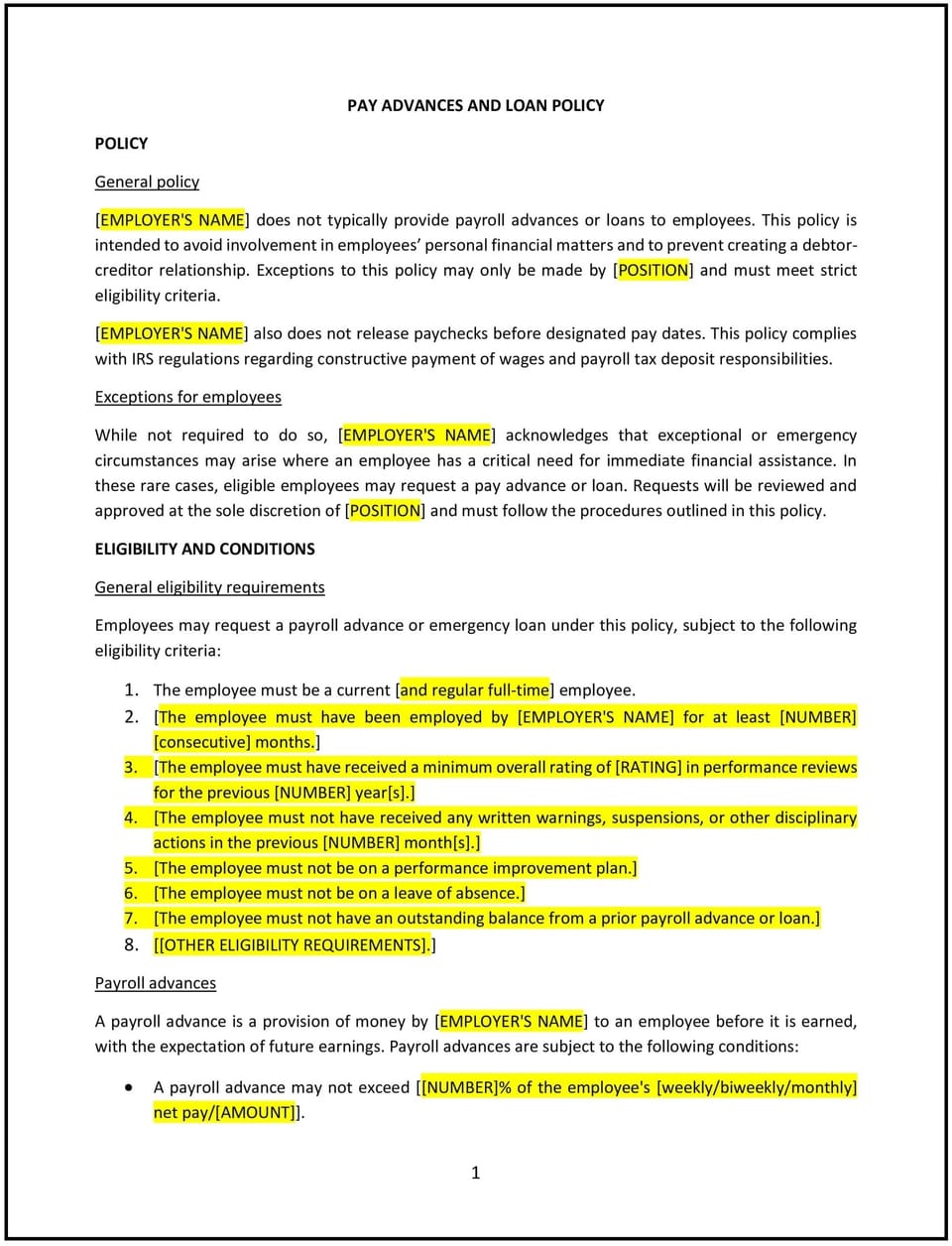

This pay advances and loan policy is designed to help Georgia businesses manage employee requests for financial assistance through pay advances or employer-provided loans. The policy outlines eligibility criteria, application procedures, repayment terms, and conditions to maintain transparency and fairness.

By implementing this policy, businesses can support employees’ financial needs while protecting organizational resources.

How to use this pay advances and loan policy (Georgia)

- Define eligibility: Specify which employees are eligible to request pay advances or loans, considering factors such as employment status or tenure.

- Establish application procedures: Outline the process for requesting financial assistance, including forms, required documentation, and submission timelines.

- Set repayment terms: Clearly state repayment conditions, such as deductions from future paychecks, interest rates (if any), and repayment schedules.

- Limit advance amounts: Specify maximum amounts for pay advances or loans, ensuring they are manageable for both employees and the business.

- Address frequency: Define how often employees can request financial assistance, such as limiting requests to once per calendar year.

- Prohibit misuse: Include guidelines to ensure pay advances and loans are used for legitimate financial needs, avoiding misuse or overreliance.

- Maintain confidentiality: Emphasize that requests and financial details will be handled discreetly to protect employee privacy.

- Review and update regularly: Periodically assess the policy to ensure it reflects changes in Georgia workplace practices or financial regulations.

Benefits of using this pay advances and loan policy (Georgia)

Implementing this policy provides several advantages for Georgia businesses:

- Supports employee well-being: Providing financial assistance helps employees manage unexpected expenses or emergencies.

- Enhances trust: Transparent processes foster trust and goodwill between employees and the organization.

- Protects resources: Clear repayment terms ensure financial stability for the business.

- Promotes fairness: Consistent guidelines reduce favoritism and ensure equitable access to assistance.

- Reflects Georgia-specific practices: Tailoring the policy to local workforce needs ensures its relevance and practicality.

Tips for using this pay advances and loan policy (Georgia)

- Communicate availability: Ensure employees are aware of the policy and the procedures for requesting financial assistance.

- Monitor requests: Track the frequency and amounts of pay advances or loans to identify trends and adjust the policy if needed.

- Offer financial counseling: Provide resources or referrals to help employees manage personal finances more effectively.

- Balance flexibility with limits: Allow reasonable flexibility while maintaining safeguards to protect business resources.

- Update as needed: Revise the policy periodically to address changes in financial regulations or organizational priorities.

Q: Who is eligible to request a pay advance or loan?

A: Eligibility should be based on factors such as employment status, tenure, and the business’s financial assistance criteria.

Q: How can employees request financial assistance?

A: Employees should submit a completed application form along with any required documentation to their supervisor or HR.

Q: What are the repayment terms for pay advances or loans?

A: Repayment terms may include deductions from future paychecks, a repayment schedule, and conditions for early repayment.

Q: Are there limits on the amount of a pay advance or loan?

A: Yes, businesses should define maximum amounts to ensure financial assistance is manageable for both parties.

Q: How often can employees request financial assistance?

A: Businesses should specify frequency limits, such as allowing one request per calendar year, to manage demand.

Q: Will financial assistance requests remain confidential?

A: Yes, businesses should handle requests discreetly to protect employee privacy and maintain trust.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or as needed to reflect changes in Georgia workplace practices or financial regulations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.