Pay advances and loan policy (Hawaiʻi): Free template

Pay advances and loan policy (Hawaiʻi)

A pay advances and loan policy helps Hawaiʻi businesses establish guidelines for providing employees with financial assistance through pay advances or loans. This policy outlines procedures for requesting, approving, and repaying advances or loans, while addressing Hawaiʻi’s unique cultural and business environment. It is designed to support employees during financial emergencies while maintaining clear boundaries and protecting the business’s financial interests.

By implementing this policy, businesses in Hawaiʻi can demonstrate compassion, improve employee morale, and provide a structured approach to financial assistance.

How to use this pay advances and loan policy (Hawaiʻi)

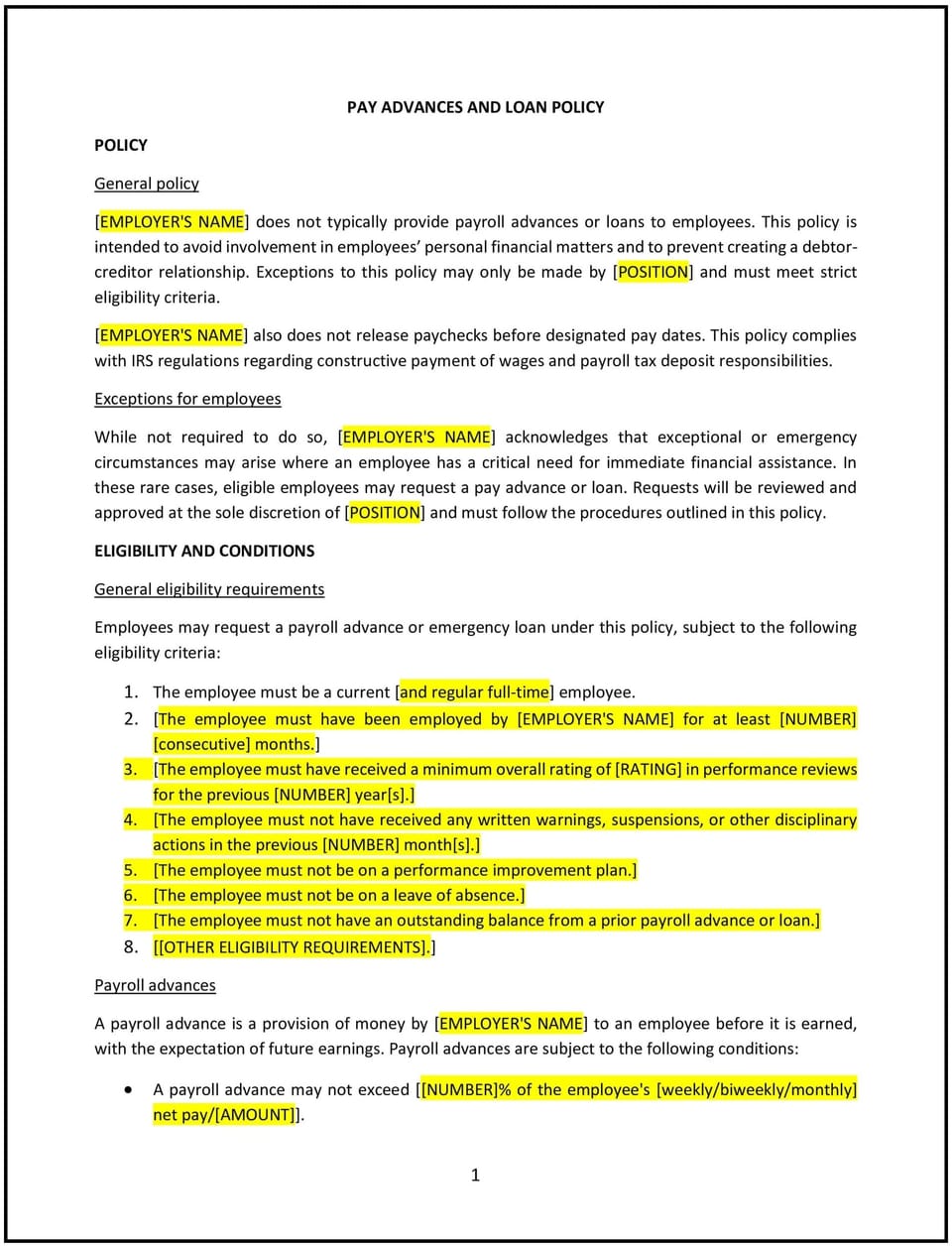

- Define pay advances and loans: Clearly outline the difference between pay advances (short-term advances on earned wages) and loans (longer-term financial assistance).

- Establish eligibility criteria: Specify which employees are eligible for advances or loans, such as full-time staff or those with a minimum tenure.

- Set limits: Define the maximum amount employees can request as an advance or loan, typically as a percentage of their salary or a fixed amount.

- Create request procedures: Provide clear instructions for employees to request advances or loans, including required documentation and approval processes.

- Address repayment terms: Outline how advances or loans will be repaid, such as through payroll deductions or installment plans, and specify any interest or fees.

- Communicate the policy: Share the policy with employees during onboarding and through internal communications to ensure awareness and understanding.

- Train managers: Educate supervisors on how to handle requests, evaluate eligibility, and ensure compliance with the policy.

- Monitor compliance: Regularly review advance and loan requests to ensure adherence to the policy and address any issues promptly.

- Review and update the policy: Regularly assess the policy’s effectiveness and make adjustments as needed to reflect changes in business needs or employee circumstances.

Benefits of using this pay advances and loan policy (Hawaiʻi)

This policy offers several advantages for Hawaiʻi businesses:

- Supports employees in need: Providing financial assistance during emergencies demonstrates the business’s commitment to employee well-being.

- Improves employee morale: Offering pay advances or loans can increase job satisfaction and loyalty among employees.

- Reduces financial stress: Employees facing financial difficulties can focus better on their work when their immediate needs are addressed.

- Enhances workplace culture: A compassionate approach to financial assistance fosters a positive and supportive work environment.

- Encourages accountability: Clear repayment terms ensure employees understand their obligations and repay advances or loans responsibly.

- Protects business interests: Structured procedures minimize the risk of financial losses or disputes related to pay advances or loans.

- Builds trust: Employees are more likely to trust leadership when they see a commitment to supporting their financial needs.

Tips for using this pay advances and loan policy (Hawaiʻi)

- Communicate the policy effectively: Share the policy with employees during onboarding and through regular reminders, such as emails or posters in common areas.

- Provide training: Educate managers on how to handle requests, evaluate eligibility, and ensure compliance with the policy.

- Be transparent: Clearly explain the policy’s purpose, benefits, and expectations to employees to build trust and cooperation.

- Monitor compliance: Regularly review advance and loan requests to ensure adherence to the policy and address any issues promptly.

- Be consistent: Apply the policy uniformly to all employees to avoid perceptions of bias or favoritism.

- Review the policy periodically: Update the policy as needed to reflect changes in business needs or employee circumstances.

Q: Why should Hawaiʻi businesses adopt a pay advances and loan policy?

A: Businesses should adopt this policy to support employees during financial emergencies, improve morale, and provide a structured approach to financial assistance.

Q: What is the difference between a pay advance and a loan?

A: A pay advance is a short-term advance on earned wages, while a loan is a longer-term financial assistance arrangement with defined repayment terms.

Q: Who is eligible for pay advances or loans?

A: Eligibility should be clearly defined in the policy, typically including full-time employees or those with a minimum tenure.

Q: How much can employees request as an advance or loan?

A: The policy should specify limits, such as a percentage of the employee’s salary or a fixed amount, to ensure fairness and financial sustainability.

Q: How should employees repay advances or loans?

A: Repayment terms should be outlined in the policy, such as payroll deductions or installment plans, and may include interest or fees.

Q: What training should businesses provide to managers?

A: Businesses should educate managers on how to handle requests, evaluate eligibility, and ensure compliance with the policy.

Q: How often should the policy be reviewed?

A: The policy should be reviewed annually or as needed to reflect changes in business needs or employee circumstances.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.