Pay advances and loan policy (Idaho): Free template

Pay advances and loan policy (Idaho)

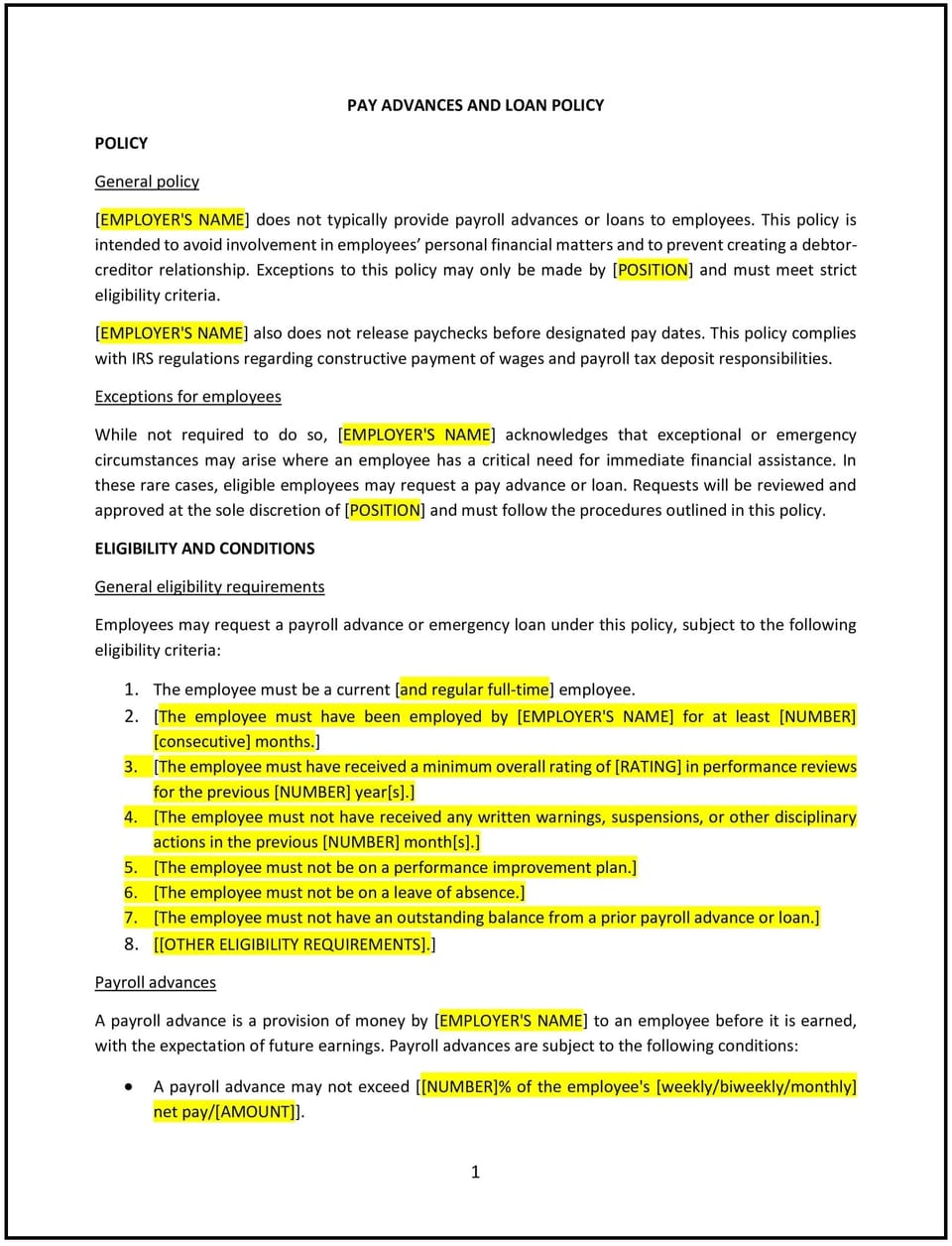

A pay advances and loan policy helps Idaho businesses establish clear guidelines for providing financial assistance to employees in the form of pay advances or loans. This policy outlines eligibility criteria, repayment terms, and the process for requesting and approving advances or loans. It also emphasizes the importance of maintaining fairness, transparency, and financial responsibility.

By implementing this policy, businesses can support employees during financial hardships while protecting their own financial interests and maintaining a professional workplace environment.

How to use this pay advances and loan policy (Idaho)

- Define eligibility: Specify which employees are eligible for pay advances or loans, such as full-time or long-term employees, and outline any requirements, such as a minimum tenure or performance standards.

- Establish request procedures: Provide clear instructions for employees to request pay advances or loans, including required documentation, approval processes, and timelines.

- Set repayment terms: Outline the terms for repaying advances or loans, such as installment amounts, due dates, and any interest or fees that may apply.

- Address limits and caps: Define the maximum amount employees can request as an advance or loan, ensuring it aligns with the business’s financial capacity and risk tolerance.

- Communicate consequences for non-repayment: Explain the actions the business will take if an employee fails to repay an advance or loan, such as payroll deductions or disciplinary measures.

- Train managers: Provide training for managers on how to handle pay advance or loan requests, maintain confidentiality, and enforce the policy consistently.

- Review and update the policy: Periodically assess the policy’s effectiveness and make adjustments based on changes in business needs, employee feedback, or Idaho laws.

Benefits of using this pay advances and loan policy (Idaho)

This policy provides several advantages for Idaho businesses:

- Supports employee well-being: Offering pay advances or loans can help employees manage financial emergencies, reducing stress and improving morale.

- Enhances retention: A supportive policy fosters loyalty and reduces turnover by demonstrating the business’s commitment to employees’ financial well-being.

- Promotes fairness: Clear guidelines ensure all employees are treated equally when requesting financial assistance, fostering a sense of fairness and transparency.

- Protects business interests: The policy helps businesses manage financial risks by setting clear repayment terms and consequences for non-repayment.

- Reduces legal risks: A well-defined policy minimizes the risk of disputes or claims related to pay advances or loans.

- Encourages financial responsibility: The policy promotes accountability by requiring employees to adhere to repayment terms and manage their finances responsibly.

Tips for using this pay advances and loan policy (Idaho)

- Communicate the policy clearly: Share the policy with employees during onboarding and through internal communication channels to ensure awareness and understanding.

- Train managers: Provide training for managers on how to handle pay advance or loan requests, maintain confidentiality, and enforce the policy consistently.

- Monitor requests: Keep track of pay advance or loan requests to ensure consistency and fairness in applying the policy.

- Review financial impact: Regularly assess the financial impact of providing pay advances or loans and adjust the policy as needed to align with the business’s capacity.

- Encourage transparency: Foster open communication with employees about the policy and the support available to them during financial hardships.

- Document everything: Maintain records of requests, approvals, repayment schedules, and any actions taken to enforce the policy, ensuring accountability and transparency.

Q: Why should Idaho businesses have a pay advances and loan policy?

A: A pay advances and loan policy provides clear guidelines for offering financial assistance to employees, supporting their well-being while protecting the business’s financial interests.

Q: What should businesses consider when offering pay advances or loans?

A: Businesses should establish eligibility criteria, set clear repayment terms, and define limits on the amount employees can request to manage financial risks.

Q: How should employees request a pay advance or loan?

A: Employees should follow the procedures outlined in the policy, including submitting a written request, providing necessary documentation, and obtaining approval from their manager or HR.

Q: What repayment terms should businesses set for pay advances or loans?

A: Businesses should outline installment amounts, due dates, and any interest or fees that may apply, ensuring the terms are reasonable and manageable for employees.

Q: How can businesses handle non-repayment of advances or loans?

A: Businesses should outline consequences for non-repayment, such as payroll deductions or disciplinary measures, and communicate these clearly to employees.

Q: What steps should businesses take to maintain fairness?

A: Businesses should apply the policy consistently, provide clear communication, and document all requests and approvals to ensure fairness and transparency.

Q: How often should businesses review their pay advances and loan policy?

A: Businesses should review the policy annually or as needed to ensure it aligns with current business needs, financial capacity, and Idaho laws.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.