Pay advances and loan policy (Illinois): Free template

Pay advances and loan policy (Illinois)

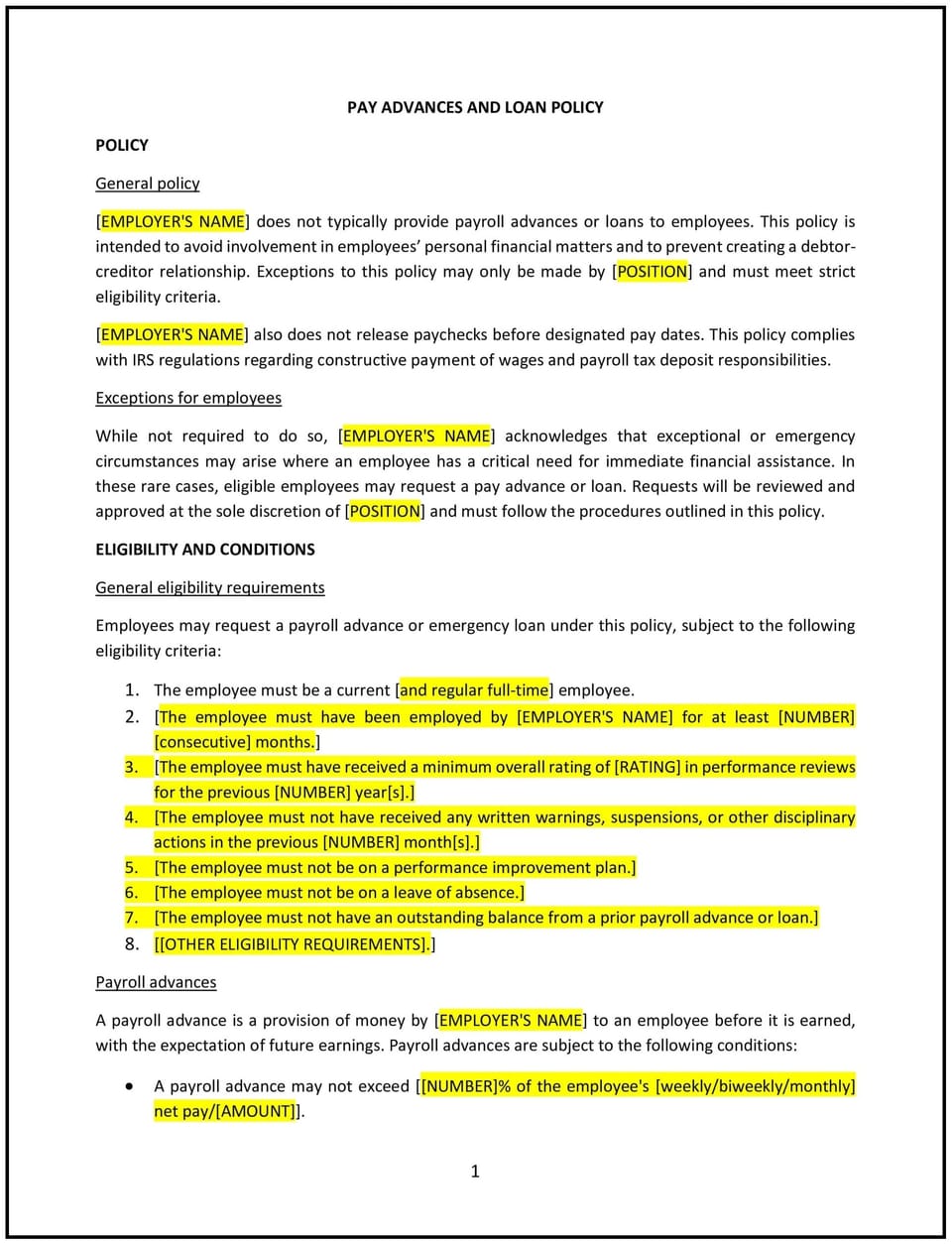

This pay advances and loan policy is designed to help Illinois businesses establish clear guidelines for providing employees with financial assistance through pay advances or loans. It outlines eligibility, application procedures, repayment terms, and measures to promote compliance with Illinois labor laws.

By adopting this policy, businesses can support employees during financial hardships while ensuring transparency and proper management of company resources.

How to use this pay advances and loan policy (Illinois)

- Define eligibility: Specify which employees are eligible for pay advances or loans, such as full-time, part-time, or those who have completed a certain tenure.

- Outline application procedures: Provide a step-by-step process for requesting a pay advance or loan, including necessary documentation and approvals.

- Set limits on advances or loans: Establish maximum amounts that employees can request, such as a percentage of their monthly wages or a fixed dollar amount.

- Include repayment terms: Specify repayment methods, such as deductions from future paychecks, and timelines for repayment.

- Address interest rates or fees: Clarify whether loans or advances include interest or administrative fees, ensuring compliance with Illinois laws.

- Emphasize confidentiality: Ensure that all requests and approvals are handled discreetly to maintain employee privacy.

- Provide approval authority: Specify who is authorized to approve advances or loans, such as HR or finance managers.

- Monitor compliance: Regularly review policies and practices to align with Illinois labor laws and company financial protocols.

Benefits of using this pay advances and loan policy (Illinois)

This policy provides several benefits for Illinois businesses:

- Supports employees: Offers financial assistance during emergencies or unexpected expenses.

- Promotes transparency: Establishes clear guidelines for requesting and managing advances or loans.

- Enhances compliance: Aligns with Illinois labor laws to avoid disputes or penalties.

- Maintains accountability: Ensures proper management of company resources and repayment processes.

- Reduces workplace stress: Helps employees address financial challenges, improving overall morale and productivity.

Tips for using this pay advances and loan policy (Illinois)

- Communicate the policy: Share the policy with employees during onboarding and make it accessible in the employee handbook.

- Train managers: Educate HR and finance managers on handling requests and ensuring compliance with company policies and Illinois laws.

- Document agreements: Require employees to sign written agreements detailing the terms of advances or loans, including repayment schedules.

- Limit frequency: Establish restrictions on how often employees can request advances or loans to manage company resources effectively.

- Update regularly: Revise the policy to reflect changes in Illinois laws or company financial practices.

Q: Who is eligible for pay advances or loans under this policy?

A: Eligibility depends on the employee’s tenure, employment status, and financial need, as outlined in this policy.

Q: How can employees request a pay advance or loan?

A: Employees must submit a written request to HR or finance, including the amount needed and the reason for the request.

Q: What is the maximum amount an employee can request?

A: The maximum amount is typically a percentage of the employee’s monthly wages or a fixed dollar limit, as specified in the policy.

Q: How are repayments handled?

A: Repayments are usually deducted from future paychecks in installments, based on a mutually agreed schedule.

Q: Are there any interest charges or fees?

A: Interest or fees may apply, depending on the company’s policy, but all terms will comply with Illinois labor laws.

Q: How is confidentiality maintained?

A: All requests and approvals are handled discreetly, ensuring the employee’s privacy is respected.

Q: What happens if an employee leaves before repaying the advance or loan?

A: Outstanding amounts may be deducted from the employee’s final paycheck, subject to Illinois wage laws, or repayment arrangements may be made.

Q: How often is this policy reviewed?

A: This policy is reviewed annually or whenever significant changes occur in Illinois labor laws or company practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.