Pay advances and loan policy (Indiana): Free template

Pay advances and loan policy (Indiana): Free template

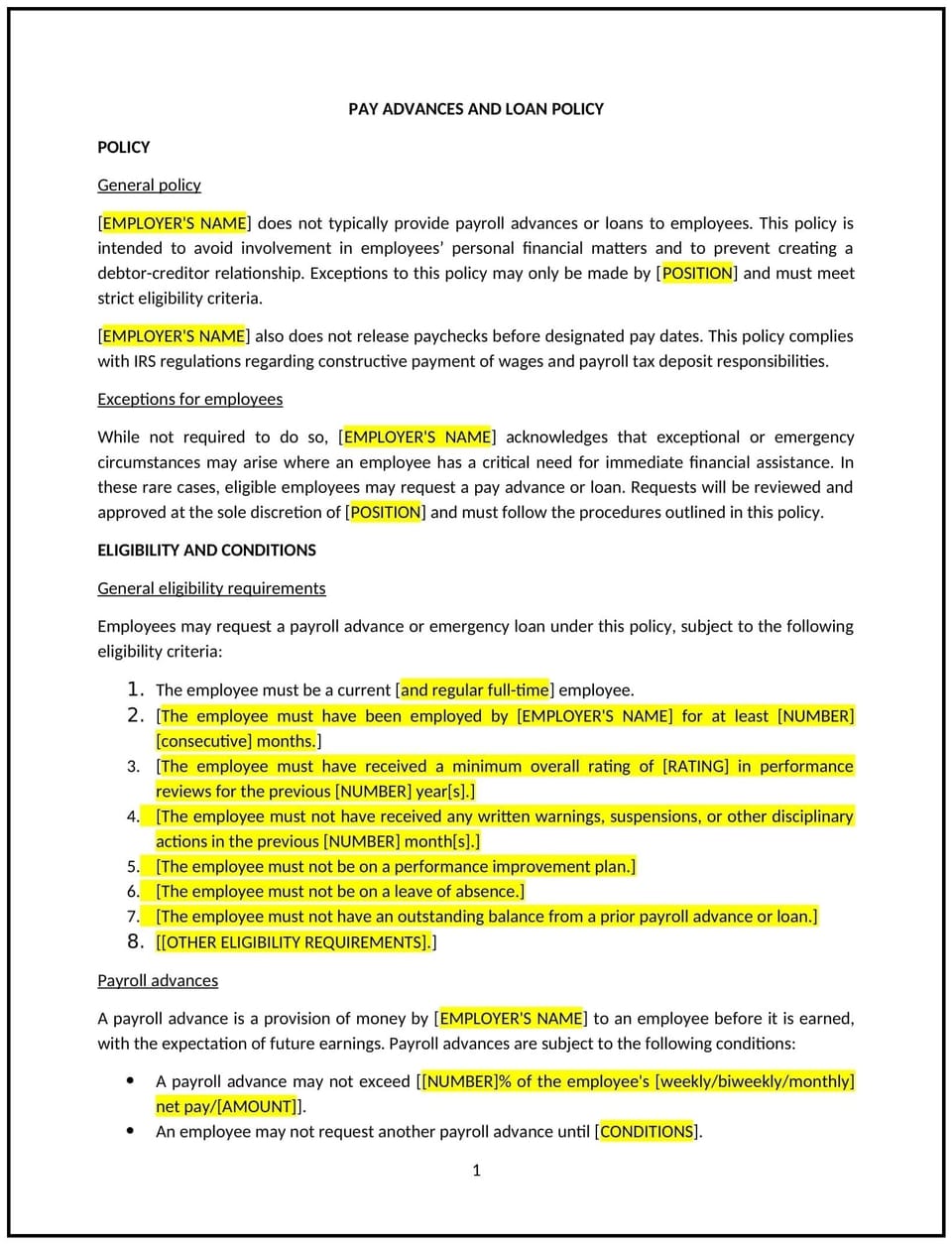

This pay advances and loan policy helps Indiana businesses establish clear guidelines for offering financial assistance to employees in the form of pay advances or loans. It outlines the conditions under which such advances or loans may be provided, the repayment terms, and the company’s expectations regarding financial assistance. This policy ensures that pay advances and loans are managed fairly, transparently, and in accordance with company practices. By using this template, businesses can provide support to employees during financial hardships while maintaining financial discipline and clear communication.

By implementing this policy, Indiana businesses can offer a structured way to assist employees with financial needs, promote responsible lending, and prevent misunderstandings regarding repayment.

How to use this pay advances and loan policy (Indiana)

- Define eligibility for pay advances and loans: Clearly outline which employees are eligible for pay advances or loans, such as full-time or part-time employees who have completed a specific period of employment. The policy should set any minimum tenure requirements or other conditions for employees to qualify for financial assistance.

- Specify the types of financial assistance: Define the types of assistance available, including whether employees can receive pay advances (early access to wages) or loans (repayment over time). The policy should clarify what situations qualify for financial assistance, such as medical emergencies, personal hardships, or family emergencies.

- Outline the maximum amount that can be advanced or loaned: Specify the maximum amount that can be provided to employees as a pay advance or loan. This could be based on a percentage of the employee’s monthly salary, a set dollar amount, or other reasonable criteria. The policy should set limits to prevent excessive financial assistance.

- Define repayment terms: Establish clear terms for repayment of pay advances and loans, including the repayment schedule, the frequency of deductions from wages (e.g., bi-weekly or monthly), and the maximum repayment period. The policy should also specify the interest rate, if applicable, and any additional fees or penalties for late payments.

- Address the process for requesting financial assistance: Provide a clear procedure for employees to request a pay advance or loan, including who they should contact, what documentation is required (e.g., proof of need or hardship), and the timeline for submitting requests. The policy should outline the steps for approval and approval criteria.

- Clarify the consequences of non-repayment: The policy should specify the consequences for non-repayment of pay advances or loans, including whether the outstanding balance will be deducted from the employee’s final paycheck if they leave the company. The policy should also address what happens if an employee is unable to meet the repayment terms due to extenuating circumstances.

- Protect the company’s financial interests: Ensure that the policy protects the company’s financial interests by establishing guidelines that prevent employees from taking excessive advances or loans and provide clear repayment terms. The policy should also state that loans or advances are discretionary, and the company reserves the right to approve or deny requests based on business needs.

- Set guidelines for loan or advance approval: Outline the decision-making process for approving pay advances or loans. This should include who has the authority to approve requests (e.g., HR, finance, or department managers) and any criteria used to assess whether an employee’s request will be approved (e.g., the employee’s current pay, work performance, and financial history).

- Offer financial education resources: Consider providing employees with access to financial education resources to help them manage their finances more effectively. The policy should encourage employees to seek financial counseling if needed and provide support to help them avoid financial distress.

Benefits of using this pay advances and loan policy (Indiana)

Implementing this policy provides several key benefits for Indiana businesses:

- Promotes financial transparency: The policy provides clear guidelines on how pay advances and loans will be handled, ensuring that employees understand the terms and conditions before requesting assistance.

- Protects the company’s financial stability: By setting limits and repayment terms, the policy helps prevent the company from over-extending financial assistance, protecting the company’s financial interests and ensuring that loans are repaid on time.

- Increases employee trust and satisfaction: Offering pay advances and loans as a form of financial support demonstrates that the company cares about its employees’ well-being and is willing to assist them during times of need, increasing overall employee satisfaction and loyalty.

- Reduces financial strain on employees: The policy helps employees manage financial hardships by providing a structured and supportive way to access funds, reducing stress and increasing employee focus and productivity.

- Prevents misunderstandings and disputes: By providing a clear process and repayment guidelines, the policy helps prevent confusion and disputes related to pay advances and loans, ensuring that both the company and employees understand their obligations.

- Encourages responsible financial behavior: The policy encourages employees to request financial assistance only when necessary and to manage repayment responsibly, promoting financial discipline within the workforce.

Tips for using this pay advances and loan policy (Indiana)

- Communicate the policy clearly: Ensure that all employees are aware of the pay advances and loan policy by including it in the employee handbook, onboarding materials, and through internal communications. Employees should understand how to request financial assistance, the limits on loans, and the repayment terms.

- Review loan or advance requests promptly: Establish a clear and efficient process for reviewing and approving requests for pay advances or loans. The policy should specify a timeline for approval and ensure that employees receive timely responses to their requests.

- Monitor repayment progress: HR or payroll teams should monitor the progress of repayment to ensure that employees are making payments as agreed. The policy should outline how repayment schedules will be tracked and how late payments will be addressed.

- Offer financial counseling resources: Encourage employees to seek financial counseling if they are facing financial difficulties. The policy could include a list of trusted financial advisors or resources that employees can turn to for advice on managing their finances.

- Be flexible in difficult circumstances: In cases where employees may be struggling to meet repayment terms due to unforeseen financial hardship, consider offering flexible repayment options or restructuring the loan. The policy should allow for flexibility in these situations while protecting the company’s interests.

Q: Who is eligible to request a pay advance or loan?

A: The policy should specify the eligibility criteria for requesting a pay advance or loan, such as a minimum period of employment or a demonstrated need for financial assistance. It may apply to full-time, part-time, and temporary employees, depending on the company’s guidelines.

Q: How much can employees request as a pay advance or loan?

A: The policy should specify the maximum amount that can be requested, which could be based on the employee’s salary, the company’s financial policies, or a set limit. The policy should ensure that amounts are reasonable and appropriate for the employee’s financial situation.

Q: How do employees request a pay advance or loan?

A: Employees should submit a formal request to HR or the finance department, providing the necessary documentation to support their request. The policy should outline the process for submitting requests, including any forms, required information, and the timeline for review.

Q: Will employees be charged interest on loans?

A: The policy should clarify whether interest will be charged on loans and, if so, specify the rate and how it will be calculated. If no interest is charged, this should also be stated in the policy.

Q: What happens if an employee cannot repay the loan on time?

A: The policy should outline the steps that will be taken if an employee cannot meet their repayment obligations, such as renegotiating the repayment schedule or deducting the outstanding amount from the employee’s final paycheck if they leave the company.

Q: Can employees request multiple pay advances or loans?

A: The policy should specify whether employees can request multiple advances or loans and under what conditions. It may place limits on the frequency of requests to ensure that employees do not rely too heavily on financial assistance.

Q: How often should the pay advances and loan policy be reviewed?

A: The policy should be reviewed periodically to ensure it remains aligned with the company’s financial goals, legal requirements, and best practices. The policy should be updated as necessary to address any changes in business operations, regulations, or employee needs.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.