Pay advances and loan policy (Iowa): Free template

Pay advances and loan policy (Iowa)

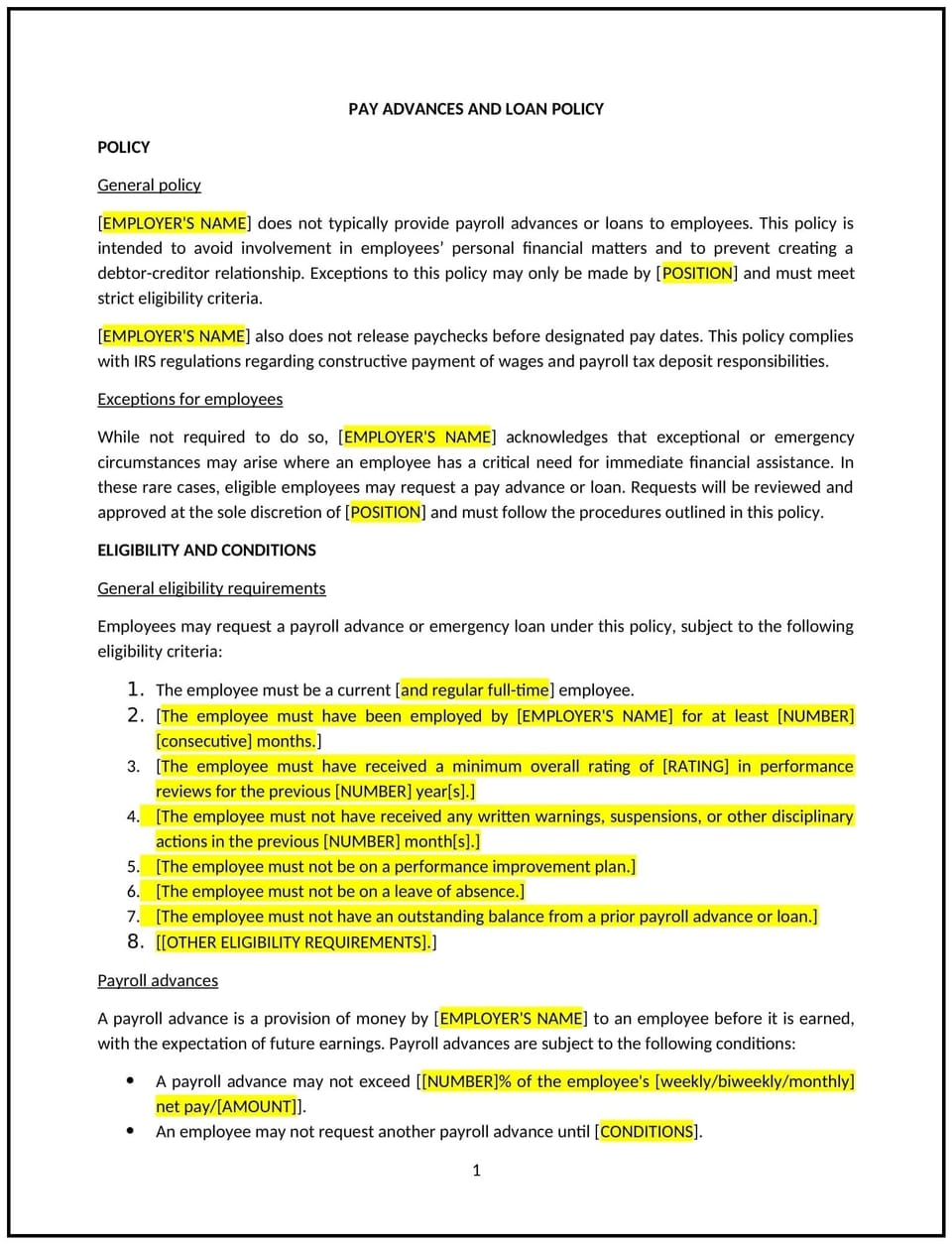

A pay advances and loan policy helps Iowa businesses manage requests from employees for early access to wages or loans. This policy defines when and how employees can request pay advances or loans, the conditions under which they are granted, and the repayment process. By implementing this policy, businesses can maintain financial stability while supporting employees who may face unexpected financial hardships.

By adopting this policy, businesses can establish clear, transparent guidelines for pay advances and loans, ensuring that both the company and its employees understand the terms and responsibilities involved.

How to use this pay advances and loan policy (Iowa)

- Define eligibility criteria: Specify which employees are eligible for pay advances or loans, such as full-time or part-time status, length of employment, and the type of financial hardship that would warrant an advance.

- Set limits on advances or loans: Establish clear limits on how much can be borrowed or advanced, and under what circumstances. This should include whether the employee can receive the full amount of their earnings in advance or if it is a partial amount.

- Outline repayment terms: Specify the repayment process, including how the advance or loan will be repaid (e.g., through payroll deductions) and the timeline for repayment.

- Provide for emergency situations: Identify types of emergencies or situations in which pay advances or loans may be granted, such as medical expenses, personal emergencies, or temporary financial hardship.

- Address interest and fees: Clearly state whether interest or fees will apply to pay advances or loans, and how these will be calculated and disclosed to the employee.

- Communicate the process: Establish a clear, documented process for employees to request pay advances or loans, including the forms, approvals, and documentation required.

- Review and update regularly: Periodically review and update the policy to reflect changes in legal requirements, company finances, and employee needs.

Benefits of using this pay advances and loan policy (Iowa)

This policy offers several key benefits for Iowa businesses:

- Supports employee well-being: Pay advances or loans can provide much-needed financial relief to employees facing unexpected expenses, improving job satisfaction and loyalty.

- Maintains financial stability: By setting clear limits and repayment terms, businesses can manage the financial impact of pay advances or loans and prevent excessive debt accumulation.

- Reduces financial strain on employees: Offering pay advances or loans can help employees avoid predatory lending or high-interest borrowing, supporting their financial health.

- Enhances employee trust: Providing employees with access to financial support during difficult times demonstrates that the company cares about their well-being and fosters a positive work environment.

- Encourages transparency: Clear guidelines and expectations regarding pay advances and loans reduce confusion and ensure fairness in the process, preventing misunderstandings or disputes.

- Minimizes legal risks: By setting specific guidelines for pay advances and loans, businesses can avoid potential legal issues related to improper deductions or unauthorized loans.

Tips for using this pay advances and loan policy (Iowa)

- Communicate the policy to employees: Ensure all employees are aware of the policy and the process for requesting pay advances or loans, and provide them with easy access to the necessary forms and documentation.

- Set clear limits: Establish firm limits on the amount that can be borrowed, to prevent employees from becoming financially dependent on pay advances and to avoid financial strain on the business.

- Keep records of all requests: Document all requests for pay advances or loans, including the amount requested, reason for the request, and repayment terms, to ensure transparency and accountability.

- Ensure fairness in decision-making: Treat all employees equally when granting pay advances or loans, and avoid any favoritism or bias in the approval process.

- Monitor repayment schedules: Track the repayment of advances or loans to ensure that employees are adhering to the agreed-upon terms and address any issues promptly if payments fall behind.

- Reassess the policy as needed: Regularly review the policy to ensure it remains effective, taking into account changes in employee needs, business operations, or legal requirements.

Q: Why should Iowa businesses implement a pay advances and loan policy?

A: Businesses should implement a pay advances and loan policy to provide financial support to employees facing unexpected hardships while maintaining control over the repayment process and minimizing risks to the business.

Q: Who is eligible for pay advances or loans?

A: Eligibility criteria may include factors such as length of service, full-time or part-time status, and the specific financial hardship faced by the employee. Businesses should clearly define these criteria in the policy.

Q: How much can employees borrow or receive in advance?

A: The amount that can be borrowed or advanced should be clearly defined in the policy. Businesses should set a limit based on the employee’s earnings or the nature of the hardship, ensuring that advances do not exceed a reasonable amount.

Q: How will pay advances or loans be repaid?

A: Repayment terms should be outlined in the policy, including whether repayments will be made through payroll deductions, the timeline for repayment, and the frequency of deductions. Businesses should ensure that repayments are manageable for employees.

Q: Will employees have to pay interest or fees on pay advances or loans?

A: Businesses should specify whether any interest or fees will apply to pay advances or loans, and how these will be calculated. Transparency is key to avoiding confusion or disputes.

Q: Can employees request pay advances or loans for any reason?

A: Pay advances or loans should only be granted for legitimate financial hardships, such as medical emergencies, unexpected personal expenses, or other urgent financial needs. The policy should specify what qualifies as a valid reason.

Q: What happens if an employee is unable to repay their pay advance or loan?

A: The policy should outline the steps to take if an employee cannot repay their loan or advance on time, such as renegotiating repayment terms or other solutions. It is important to be flexible but clear about expectations.

Q: Can employees request multiple pay advances or loans?

A: Businesses should define whether employees can request multiple pay advances or loans and set reasonable limits to avoid employees becoming dependent on this form of financial assistance.

Q: How often should businesses review their pay advances and loan policy?

A: Businesses should review their policy regularly, at least annually, to ensure that it continues to meet employee needs, reflects any changes in legal requirements, and is aligned with the organization’s financial capabilities.

Q: How can businesses ensure the policy is fair?

A: Businesses should apply the policy consistently across all employees, ensure transparency in the approval and repayment processes, and regularly review the policy to ensure it remains equitable for all employees.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.