Pay advances and loan policy (Kansas): Free template

Pay advances and loan policy (Kansas)

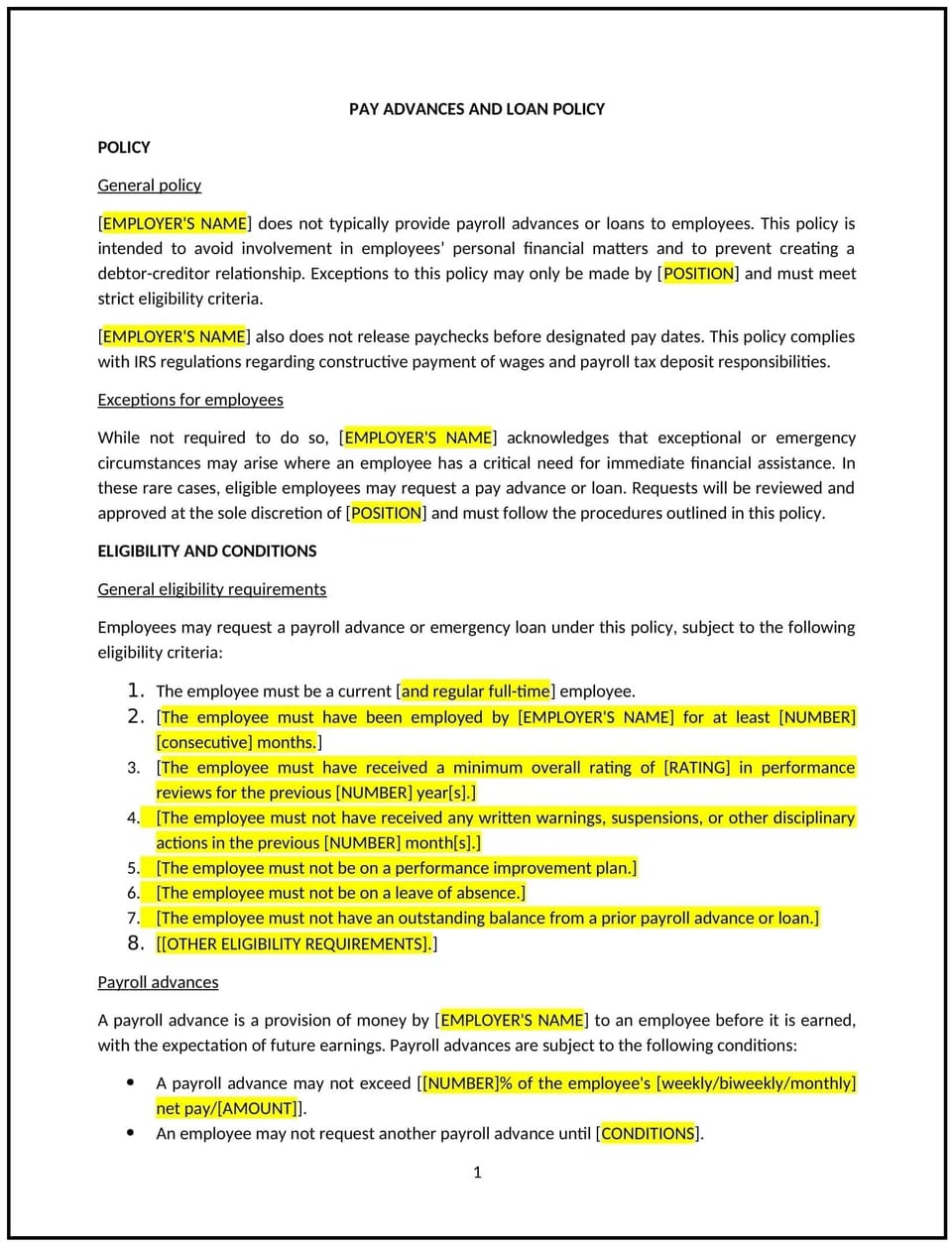

A pay advances and loan policy helps Kansas businesses manage requests from employees for early access to earned wages or loans. This policy outlines the conditions under which employees can request pay advances or loans, including eligibility requirements, the process for requesting advances or loans, repayment terms, and any associated fees or interest.

By implementing this policy, businesses can provide financial support to employees in times of need while maintaining clear guidelines to manage repayment and prevent misuse.

How to use this pay advances and loan policy (Kansas)

- Define eligibility criteria: Businesses should specify which employees are eligible for pay advances or loans, considering factors such as length of employment, job performance, and financial need.

- Establish request procedures: Businesses should outline the process for requesting pay advances or loans, including how to submit requests, the documentation required, and any approval processes.

- Set repayment terms: Businesses should define clear repayment terms, including the schedule for repayment, any deductions from future paychecks, and the maximum allowable loan or advance amount.

- Specify interest and fees: If applicable, businesses should detail any interest rates or fees associated with pay advances or loans, ensuring that employees are fully aware of the costs involved.

- Limit frequency of requests: Businesses should set limits on how often employees can request pay advances or loans, to prevent frequent reliance on this option and ensure financial stability.

- Offer financial counseling: To promote financial literacy and responsible borrowing, businesses should consider offering financial counseling or resources to help employees manage their finances effectively.

- Review and update regularly: Businesses should periodically review the policy to ensure it remains relevant and reflects the company’s financial situation and employee needs.

Benefits of using a pay advances and loan policy (Kansas)

- Provides financial support: A clear policy allows businesses to provide employees with timely financial assistance during emergencies or unforeseen circumstances.

- Promotes fairness: By setting clear eligibility and repayment criteria, businesses ensure that all employees are treated fairly and consistently when requesting pay advances or loans.

- Prevents misuse: A formal policy helps prevent employees from abusing pay advances or loans, ensuring that these options are used responsibly and in line with company goals.

- Reduces financial stress: Offering pay advances or loans can help reduce employees' financial stress, improving their overall well-being and job performance.

- Encourages financial responsibility: By setting repayment terms and limits on the frequency of requests, businesses encourage employees to manage their finances responsibly and avoid relying on advances or loans too frequently.

- Enhances employee morale: Employees are likely to feel more valued and supported when they know their employer is willing to offer financial assistance when needed.

Tips for using this pay advances and loan policy (Kansas)

- Communicate the policy clearly: Businesses should ensure that all employees are aware of the pay advances and loan policy, including the eligibility criteria, request process, and repayment terms.

- Monitor repayment schedules: Businesses should track employees' repayment schedules to ensure that deductions from future paychecks are made on time and that any issues are addressed promptly.

- Be transparent about fees: Businesses should clearly communicate any fees or interest associated with pay advances or loans to ensure that employees understand the full cost of borrowing.

- Limit the amount of advances or loans: To prevent financial strain on both the business and employees, businesses should set a maximum allowable amount for pay advances or loans.

- Offer financial resources: In addition to pay advances and loans, businesses should consider offering employees resources, such as financial counseling or budgeting tools, to help them better manage their finances.

- Review the policy regularly: Businesses should review the policy periodically to ensure that it remains in line with company goals, employee needs, and legal requirements.

Q: Why should Kansas businesses implement a pay advances and loan policy?

A: Businesses should implement a pay advances and loan policy to offer employees financial support in times of need while maintaining fairness, responsibility, and clear repayment terms.

Q: Who is eligible for pay advances or loans?

A: Eligibility should be based on criteria such as length of employment, job performance, and the employee's financial need. The policy should clearly define these criteria.

Q: How do employees request a pay advance or loan?

A: Employees should follow the process outlined in the policy, which typically includes submitting a formal request, providing necessary documentation, and receiving approval from the appropriate department.

Q: Are there fees or interest charged for pay advances or loans?

A: The policy should specify any fees or interest rates associated with pay advances or loans. Businesses should be transparent about the costs involved so employees are fully informed.

Q: How often can employees request pay advances or loans?

A: Businesses should set limits on how often employees can request pay advances or loans to prevent frequent reliance on this option and ensure financial stability for both the business and the employee.

Q: What happens if an employee cannot repay their pay advance or loan?

A: The policy should specify the actions that will be taken if an employee is unable to repay their loan or advance on time, such as adjustments to the repayment schedule or deductions from future paychecks.

Q: How often should businesses review and update their pay advances and loan policy?

A: Businesses should review their policy at least annually or whenever there are significant changes in the company’s financial situation, employee needs, or legal requirements to ensure the policy remains effective and relevant.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.