Pay advances and loan policy (Louisiana): Free template

Pay advances and loan policy (Louisiana)

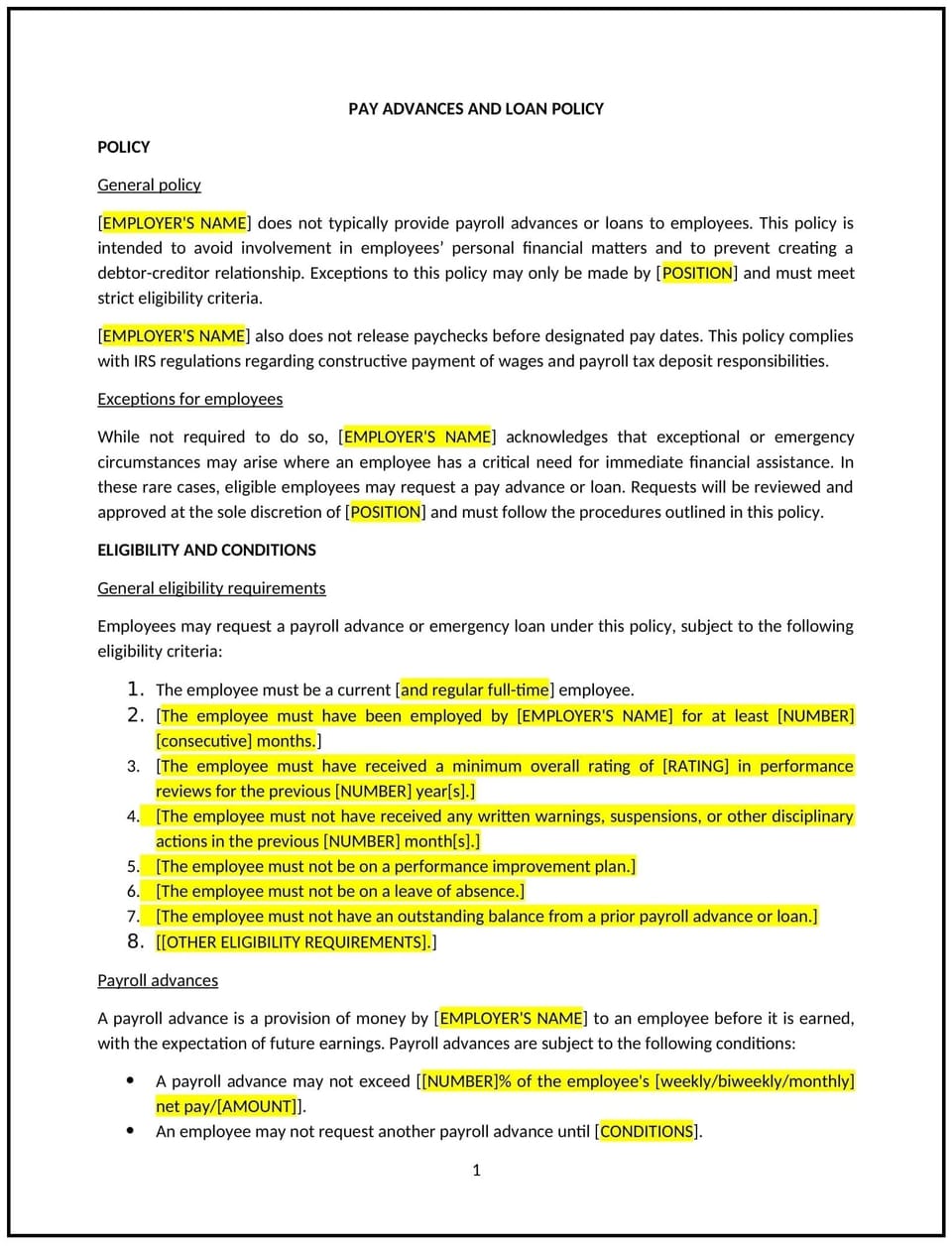

This pay advances and loan policy is designed to help Louisiana businesses provide clear guidelines for offering financial assistance to employees in the form of pay advances or loans. It outlines eligibility, application procedures, repayment terms, and responsibilities to ensure transparency and fairness.

By implementing this policy, businesses can support employees during financial challenges while maintaining operational stability.

How to use this pay advances and loan policy (Louisiana)

- Define eligibility: Specify which employees qualify for pay advances or loans based on factors like length of employment or job role.

- Outline application procedures: Provide steps for requesting financial assistance, including required documentation and approval processes.

- Include limits and conditions: Specify the maximum amount of pay advances or loans, repayment timelines, and any conditions for approval.

- Address repayment terms: Detail how repayments will be handled, such as payroll deductions or other agreed-upon methods.

- Communicate confidentiality: Emphasize that all applications and financial matters will be handled confidentially.

- Establish review processes: Include a process for reviewing requests and ensuring fairness and consistency.

Benefits of using a pay advances and loan policy (Louisiana)

Implementing this policy provides several advantages for Louisiana businesses:

- Supports employees: Provides financial assistance during emergencies or unexpected expenses.

- Promotes transparency: Establishes clear guidelines for requesting and managing pay advances or loans.

- Reduces misunderstandings: Clarifies expectations for both employees and employers regarding financial assistance.

- Encourages accountability: Ensures employees understand repayment obligations and terms.

- Reflects Louisiana-specific needs: Tailors financial assistance practices to local business operations and employee needs.

Tips for using this pay advances and loan policy (Louisiana)

- Communicate clearly: Ensure employees understand the policy and their responsibilities before applying for assistance.

- Document agreements: Use written agreements to outline terms, repayment schedules, and any conditions for approval.

- Monitor repayment: Track repayments through payroll or other systems to ensure accuracy and accountability.

- Provide flexibility: Consider reasonable accommodations for repayment terms in case of employee hardship.

- Update regularly: Revise the policy to reflect changes in workplace practices or Louisiana-specific considerations.

Q: Who is eligible to request a pay advance or loan under this policy?

A: Eligibility typically depends on factors like length of employment, job role, and the specific circumstances of the request.

Q: What is the maximum amount employees can request?

A: The maximum amount will be determined by the company’s policy and may depend on factors like the employee’s salary or length of service.

Q: How do employees apply for a pay advance or loan?

A: Employees should submit a written request to their manager or HR, including the amount requested and the reason for the request.

Q: How are repayments handled?

A: Repayments are typically deducted from payroll in installments, as outlined in a written agreement between the employee and the business.

Q: Are there any fees or interest associated with loans or advances?

A: The policy should specify whether loans or advances are interest-free or if minimal fees apply, depending on company practices.

Q: What happens if an employee leaves the company before fully repaying?

A: Outstanding balances may be deducted from the employee’s final paycheck, as permitted by the written agreement and applicable laws.

Q: How often should this policy be reviewed?

A: The policy should be reviewed annually or when workplace financial assistance practices or Louisiana-specific needs evolve.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.