Pay advances and loan policy (Minnesota): Free template

Pay advances and loan policy (Minnesota)

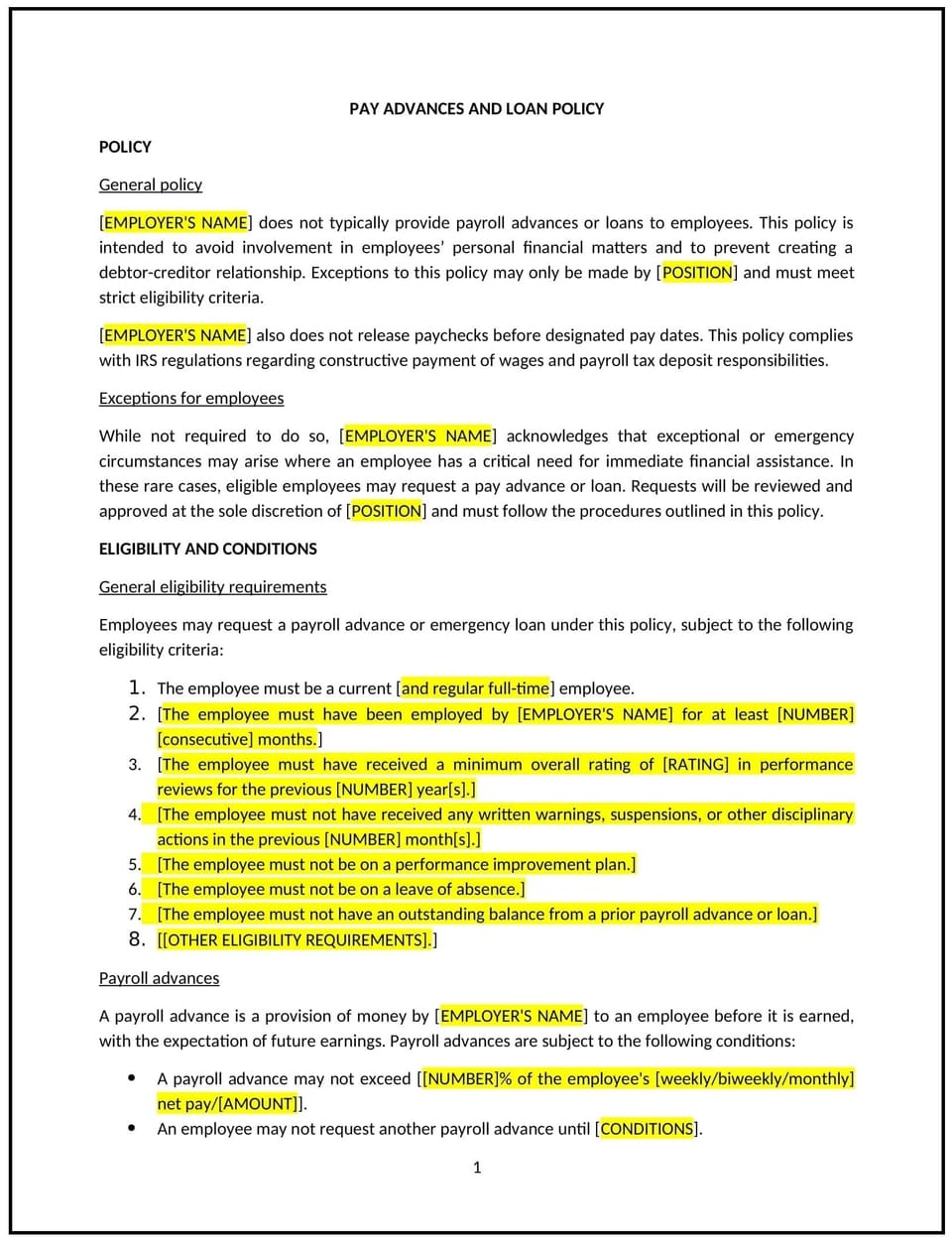

This pay advances and loan policy is designed to help Minnesota businesses manage requests from employees for financial assistance in the form of pay advances or loans. It outlines the process for granting pay advances or loans, the conditions under which they may be provided, and the responsibilities of both the employer and employee regarding repayment.

By implementing this policy, businesses can offer financial support to employees in need while maintaining clear guidelines to ensure fairness and consistency.

How to use this pay advances and loan policy (Minnesota)

- Define eligibility: Specify which employees are eligible to request pay advances or loans, including factors such as length of employment, job performance, or financial need.

- Set clear terms for advances and loans: Outline the conditions under which pay advances or loans can be granted, including maximum amounts, repayment schedules, and any interest rates or fees that may apply.

- Establish a formal request process: Provide a clear process for employees to request pay advances or loans, including documentation requirements and a formal approval process involving HR or management.

- Define repayment terms: Specify how repayments will be made, such as through payroll deductions or lump-sum payments. Clarify the consequences of non-payment or late payments and outline any actions the business may take in such cases.

- Address loan forgiveness: If applicable, clarify whether any portion of the loan may be forgiven under certain circumstances, such as continued employment with the company for a specified period.

- Ensure transparency: Provide employees with a written agreement that clearly outlines the terms of the loan or advance, including the amount, repayment schedule, and any penalties for non-compliance.

- Promote financial education: Encourage employees to seek financial advice or resources to better manage their finances, and make sure they understand the potential impact of taking a pay advance or loan on their future paychecks.

Benefits of using a pay advances and loan policy (Minnesota)

Implementing this policy provides several advantages for Minnesota businesses:

- Supports employee financial well-being: Offering pay advances or loans provides financial relief to employees during times of financial hardship, which can increase employee satisfaction and loyalty.

- Reduces financial stress: By giving employees access to funds when needed, businesses can help alleviate financial stress, allowing employees to focus better on their work.

- Encourages retention: Offering financial assistance as part of a broader benefits package may increase employee retention, particularly during challenging personal financial times.

- Establishes clear expectations: A formal policy ensures that employees are aware of the company’s guidelines for requesting pay advances or loans, preventing misunderstandings or disputes.

- Reflects Minnesota-specific considerations: Tailors the policy to Minnesota’s laws and economic environment, ensuring it is in line with local labor standards and expectations regarding employee financial support.

Tips for using this pay advances and loan policy (Minnesota)

- Communicate clearly: Ensure that employees understand how the pay advances and loan process works, including eligibility, repayment terms, and potential consequences for non-payment.

- Offer financial education: Provide employees with resources or workshops on budgeting and financial management to help them make informed decisions about taking advances or loans.

- Be fair and consistent: Apply the policy consistently across all employees to prevent favoritism and ensure fairness in decision-making.

- Review the policy regularly: Periodically review the policy to ensure it remains aligned with the company’s financial capabilities and employees’ needs. It may need to be updated based on changes in company performance or Minnesota state regulations.

- Establish repayment monitoring: Implement a system to track loan repayments, ensuring that all loans and advances are repaid as agreed. Follow up with employees who fall behind on repayments to address the issue early.

Q: Who is eligible to request a pay advance or loan?

A: Businesses should specify eligibility requirements, such as a minimum length of employment or a certain level of job performance. Generally, employees should have demonstrated reliability and financial need.

Q: How much can an employee request in a pay advance or loan?

A: The policy should outline the maximum amount employees can request, based on factors such as their salary or hours worked. The amount should be reasonable and tied to the employee’s pay schedule.

Q: What are the repayment terms for a pay advance or loan?

A: Repayment terms should be clearly outlined, including the amount to be repaid, the payment schedule, and any deductions from the employee’s paycheck. Repayments should be structured to ensure that they are manageable for the employee.

Q: Can employees take more than one pay advance or loan?

A: Businesses should specify whether employees are allowed to request multiple advances or loans and set limits on the total amount an employee can borrow during a specified period.

Q: What happens if an employee is unable to repay a pay advance or loan?

A: The policy should outline the steps businesses will take if an employee fails to repay a pay advance or loan, such as adjusting payroll deductions, offering extended repayment terms, or pursuing other legal actions if necessary.

Q: Is there any interest on the pay advance or loan?

A: The policy should specify whether interest or fees apply to the loan. Some businesses may choose to offer interest-free advances, while others may charge a nominal fee to cover administrative costs.

Q: Can employees request a loan for non-emergency reasons?

A: Businesses should clarify whether loans are only available for emergency purposes or if they can be used for general financial needs. This helps ensure that the loans are used appropriately.

Q: How often should this policy be reviewed?

A: The policy should be reviewed at least annually or when there are changes in Minnesota’s labor laws, the company’s financial situation, or employee feedback to ensure it remains relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.