Pay advances and loan policy (Mississippi): Free template

Pay advances and loan policy (Mississippi)

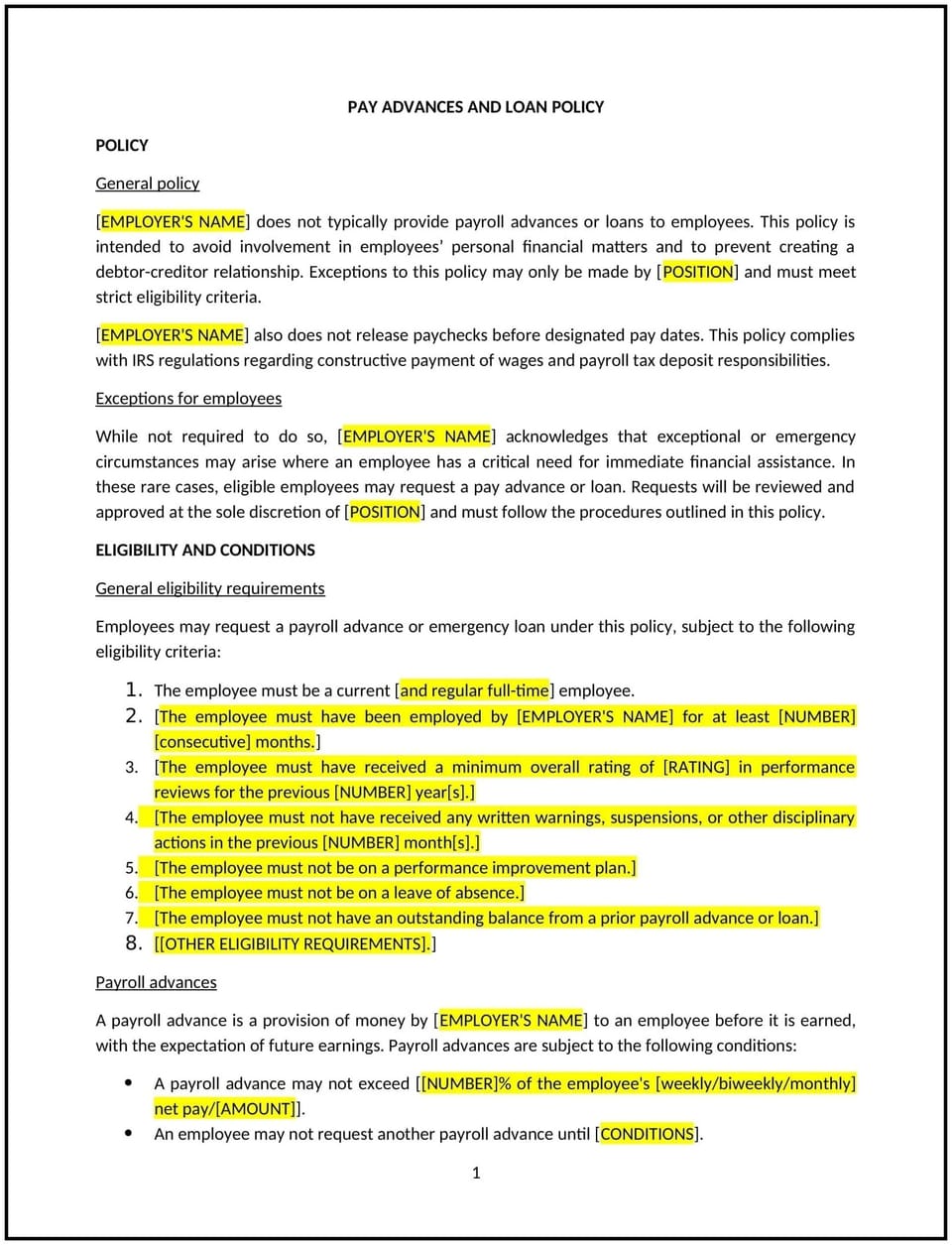

A pay advances and loan policy establishes guidelines for businesses in Mississippi regarding when and how employees may request a pay advance or loan from their employer. This policy helps businesses maintain financial stability while providing employees with temporary financial assistance in urgent situations. It also ensures transparency in the process and sets clear expectations for repayment.

By implementing this policy, businesses can provide employees with financial relief in times of need while ensuring that company resources are managed responsibly.

How to use this pay advances and loan policy (Mississippi)

- Define eligibility criteria: Outline which employees are eligible to request a pay advance or loan, such as full-time employees who have worked for a certain period.

- Establish permitted uses: Specify acceptable reasons for requesting a pay advance, such as medical emergencies, unexpected expenses, or financial hardship.

- Set limits on advances and loans: Determine the maximum amount employees may request and how often they can apply for financial assistance.

- Outline the request process: Provide a step-by-step guide on how employees can apply, including required documentation and approval procedures.

- Explain repayment terms: Define how advances or loans will be repaid, such as through payroll deductions, and specify the repayment period.

- Address interest rates or fees: If applicable, clarify whether interest or administrative fees will be charged on advances or loans.

- Prohibit excessive borrowing: Limit the frequency of requests to prevent overuse and financial strain on the business.

- Review and update the policy regularly: Ensure the policy remains relevant and aligned with business needs and best practices.

Benefits of using this pay advances and loan policy (Mississippi)

This policy offers several benefits for Mississippi businesses:

- Supports employees in financial distress: Provides a structured way for employees to receive financial assistance during emergencies.

- Promotes financial stability: Helps businesses manage pay advances and loans without disrupting payroll operations.

- Ensures consistency: Establishes a uniform process to handle requests fairly and transparently.

- Reduces financial risk: Limits the frequency and amount of pay advances or loans, protecting company resources.

- Enhances employee trust: Demonstrates that the business cares about employees’ well-being and financial security.

Tips for using this pay advances and loan policy (Mississippi)

- Communicate the policy clearly: Ensure employees understand the terms, conditions, and process for requesting pay advances or loans.

- Maintain documentation: Require employees to sign agreements detailing the repayment terms before receiving an advance or loan.

- Set fair repayment terms: Ensure repayment schedules are reasonable and do not cause financial hardship for employees.

- Monitor policy usage: Track the frequency of requests to identify trends and adjust the policy if needed.

- Review legal considerations: Consult financial or legal professionals to ensure the policy aligns with Mississippi laws and payroll regulations.

Q: Why should Mississippi businesses have a pay advances and loan policy?

A: A clear policy helps businesses manage pay advance and loan requests fairly while protecting company resources and ensuring repayment.

Q: Who is eligible for a pay advance or loan?

A: Eligibility depends on company policy but typically includes full-time employees who have been with the business for a specified period.

Q: How much can an employee request as a pay advance or loan?

A: The policy should define a maximum amount based on company resources and the employee’s salary level.

Q: How do employees repay a pay advance or loan?

A: Repayments are typically deducted from future paychecks in installments, as outlined in the agreement signed before funds are issued.

Q: Are there any fees or interest charges on pay advances or loans?

A: Businesses may choose to charge a processing fee or interest, depending on their financial policies and local regulations.

Q: Can employees request multiple advances or loans?

A: The policy should limit the number of requests within a certain period to prevent excessive borrowing.

Q: How should businesses handle unpaid advances or loans?

A: If an employee leaves before full repayment, businesses may deduct the outstanding amount from the final paycheck or pursue other legal options.

Q: How often should this policy be reviewed?

A: Businesses should review the policy annually to ensure it aligns with financial best practices and any changes in Mississippi regulations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.