Pay advances and loan policy (Missouri): Free template

Pay advances and loan policy (Missouri)

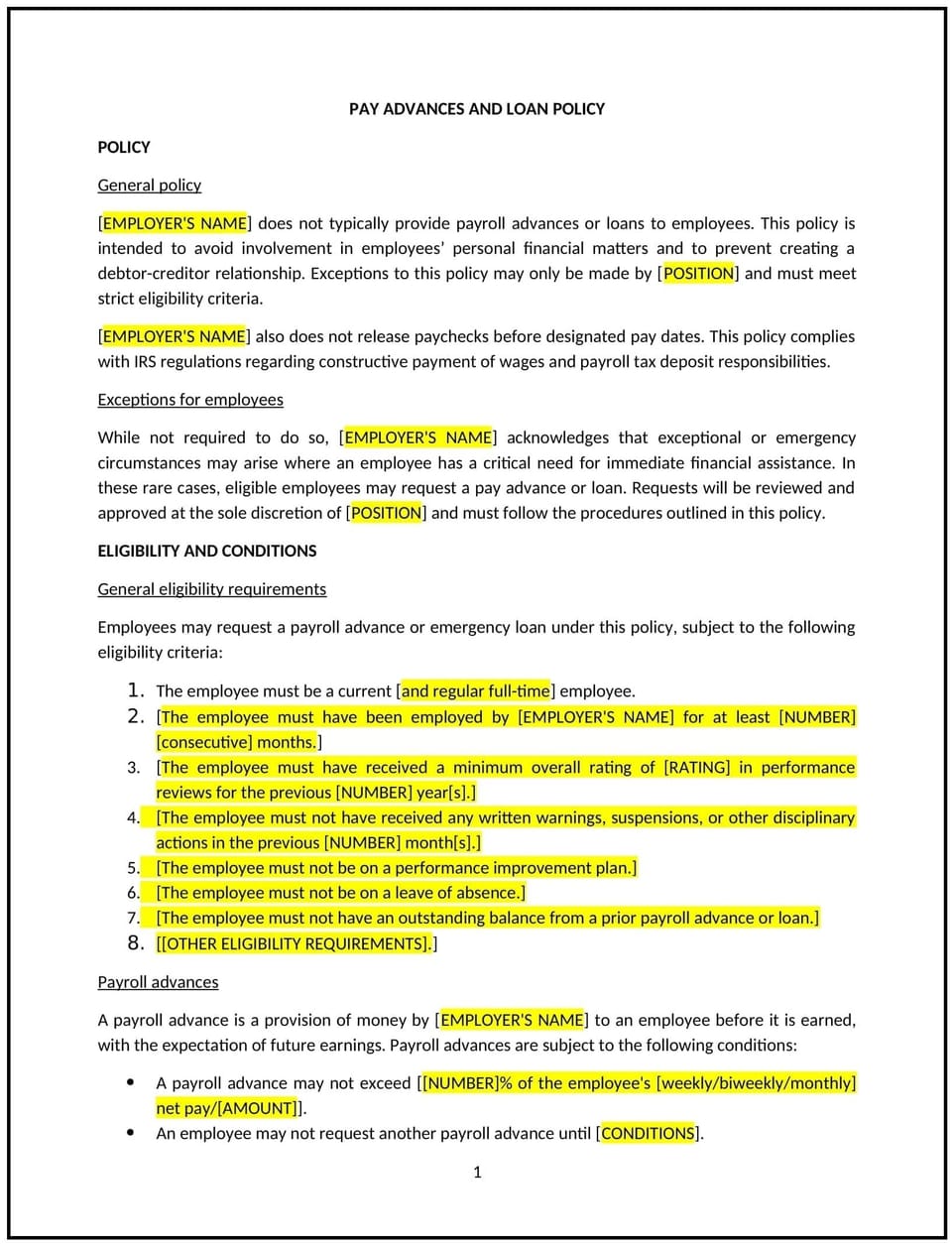

A pay advances and loan policy helps businesses in Missouri manage requests for financial assistance from employees. This policy outlines the procedures for granting pay advances or loans, including eligibility criteria, repayment terms, and the potential impact on employees' wages. It ensures that both employees and the company are protected by clear guidelines on how these financial requests will be handled.

By adopting this policy, businesses can offer financial support to employees during times of need while maintaining financial integrity and preventing abuse of the system.

How to use this pay advances and loan policy (Missouri)

- Define eligibility: Specify which employees are eligible for pay advances or loans, including criteria such as length of service, job performance, or any other qualifying factors.

- Outline repayment terms: Clearly define the repayment process, including how deductions will be made from the employee's paychecks, the repayment schedule, and any interest rates or fees that may apply.

- Set maximum limits: Establish limits on the amount of a pay advance or loan that can be granted, ensuring that employees do not request amounts that exceed reasonable limits based on their salary and repayment capacity.

- Address frequency of requests: Define how often an employee can request a pay advance or loan, ensuring that the business is not financially strained by frequent requests and that employees are using this benefit responsibly.

- Document the request process: Specify the process employees must follow to request a pay advance or loan, including required documentation, how the request will be reviewed, and who will approve it.

- Consider the impact on wages: Outline how the pay advance or loan will impact the employee's future wages and whether any additional conditions apply to their continued employment.

- Review regularly: Periodically review and update the policy to ensure it remains aligned with company financial health, employee needs, and any changes in Missouri state law.

Benefits of using this pay advances and loan policy (Missouri)

This policy provides several benefits for businesses in Missouri:

- Supports employee well-being: By offering pay advances or loans, businesses can help employees manage unexpected expenses or financial hardships, improving overall employee satisfaction and loyalty.

- Maintains financial stability: A clear policy helps businesses manage the financial impact of pay advances and loans by setting clear limits, repayment terms, and eligibility criteria.

- Reduces financial risk: By outlining clear terms and conditions for pay advances or loans, businesses can minimize the risk of employees defaulting on payments or requesting excessive amounts.

- Enhances transparency: A formalized process ensures that all employees are treated fairly and equally, with consistent guidelines for when and how they can request financial assistance.

- Promotes responsible financial behavior: By setting limits and repayment schedules, businesses can encourage employees to use pay advances or loans responsibly and avoid dependency on this financial support.

- Complies with legal requirements: A well-structured policy ensures that businesses comply with Missouri state laws related to wage deductions and employee financial assistance.

Tips for using this pay advances and loan policy (Missouri)

- Communicate the policy clearly: Ensure that all employees are aware of the policy and understand how to request a pay advance or loan, the eligibility criteria, and the repayment process.

- Set clear repayment terms: Outline clear repayment schedules and ensure that employees understand how pay advances or loans will be deducted from their future wages.

- Establish a formal request process: Ensure that employees follow a formal process when requesting a pay advance or loan, which helps the company maintain control over financial requests and ensures consistency.

- Monitor financial health: Keep track of any outstanding pay advances or loans and review employees' ability to repay them. Be mindful of employees who may struggle to meet repayment terms.

- Offer financial education: Consider providing employees with access to financial planning resources or education to help them manage their finances responsibly, reducing the need for pay advances or loans.

- Review regularly: Periodically review and update the policy to reflect any changes in business operations, employee feedback, or Missouri state laws related to pay advances and loans.

Q: Why should businesses in Missouri adopt a pay advances and loan policy?

A: Businesses should adopt this policy to support employees during financial hardships, maintain financial stability, ensure transparency, and prevent abuse of pay advances or loans while protecting the company’s financial health.

Q: Who is eligible to request a pay advance or loan?

A: Businesses should specify eligibility criteria, such as length of service, employment status, or job performance, to determine which employees are eligible for pay advances or loans.

Q: What are the repayment terms for pay advances or loans?

A: The policy should outline clear repayment terms, including the amount to be deducted from the employee’s paycheck, the repayment schedule, and any applicable fees or interest rates.

Q: How often can employees request a pay advance or loan?

A: Businesses should define how often employees can request pay advances or loans, ensuring that employees do not rely too heavily on financial assistance and that the company’s resources remain stable.

Q: What is the maximum amount an employee can borrow?

A: The policy should set a reasonable limit on the amount of a pay advance or loan that an employee can request, typically based on their salary or other financial criteria, to prevent excessive borrowing.

Q: What happens if an employee is unable to repay the loan?

A: The policy should include procedures for addressing non-repayment, such as additional deductions, payment plans, or other arrangements, while considering the employee’s ability to repay.

Q: How often should businesses review their pay advances and loan policy?

A: Businesses should review the policy regularly, at least annually, to ensure it remains relevant to the company’s financial health, employee needs, and any changes in Missouri state law regarding wage deductions or financial assistance.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.