Payroll and compensation policy (California): Free template

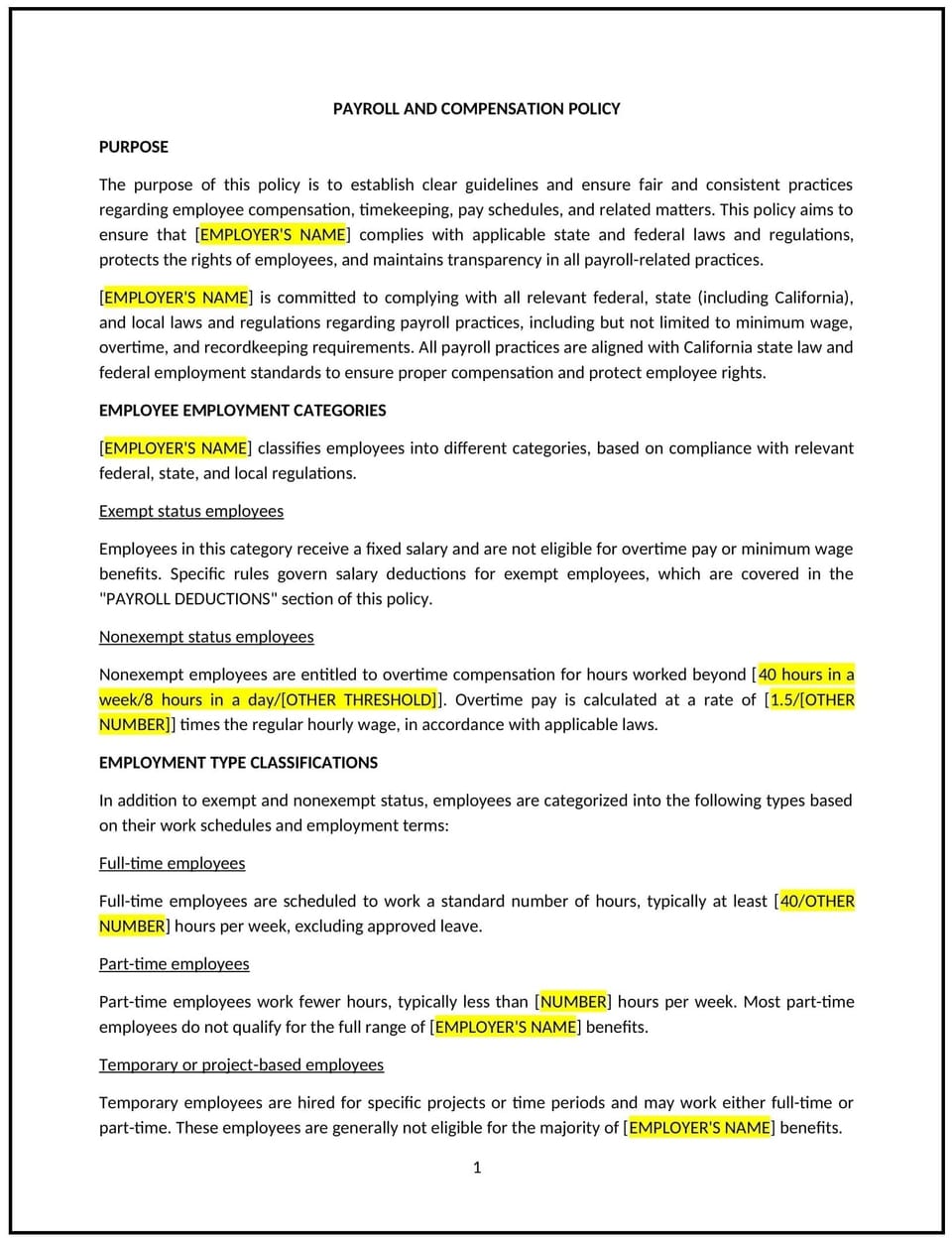

Payroll and compensation policy (California)

In California, a payroll and compensation policy provides businesses with guidelines for managing employee pay, ensuring accurate and timely wage payments, and supporting compliance with California labor laws, such as the California Labor Code and Wage Orders. This policy outlines procedures for wage calculations, payroll processing, and addressing employee concerns about compensation.

By implementing this policy, California businesses can foster transparency, maintain trust, and mitigate risks related to payroll and compensation practices.

How to use this payroll and compensation policy (California)

- Define pay structures: Clearly outline how wages, salaries, and bonuses are determined, ensuring they align with California minimum wage and overtime laws.

- Establish payroll schedules: Specify pay frequency, such as weekly, biweekly, or semimonthly, as required under California law.

- Communicate deductions: Provide transparency about lawful deductions, such as taxes, benefits, and garnishments, in compliance with state regulations.

- Address wage disputes: Outline procedures for employees to report and resolve concerns about pay discrepancies or errors.

- Ensure accurate records: Maintain detailed payroll records, including hours worked, wages paid, and deductions, as required by California law.

Benefits of using this payroll and compensation policy (California)

This policy offers several advantages for California businesses:

- Supports compliance: Reflects California labor laws governing wages, overtime, and payroll recordkeeping.

- Promotes transparency: Ensures employees understand their compensation and how payroll is managed.

- Reduces risks: Minimizes potential disputes and penalties by adhering to state wage and hour regulations.

- Enhances trust: Demonstrates the business’s commitment to fair and accurate compensation practices.

- Improves efficiency: Streamlines payroll management through clear processes and guidelines.

Tips for using this payroll and compensation policy (California)

- Reflect California-specific laws: Address state requirements, such as minimum wage increases, overtime rules, and final pay timelines for departing employees.

- Train payroll staff: Provide training on California labor laws and best practices for managing payroll and compensation.

- Use reliable systems: Implement payroll software to ensure accurate calculations and compliance with reporting requirements.

- Conduct regular audits: Periodically review payroll practices to identify and address discrepancies or non-compliance.

- Review regularly: Update the policy to reflect changes in California laws, wage orders, or business practices.

Q: How does this policy benefit the business?

A: This policy supports compliance with California labor laws, ensures accurate wage payments, and fosters employee trust through transparent payroll practices.

Q: What types of compensation are covered under this policy?

A: The policy covers wages, salaries, bonuses, overtime, and lawful deductions, as well as compliance with California minimum wage laws.

Q: How does this policy support compliance with California laws?

A: The policy aligns with state labor regulations, including minimum wage, overtime, and recordkeeping requirements, to ensure lawful payroll practices.

Q: What steps should employees take if they identify a payroll error?

A: Employees should promptly notify HR or their manager, providing details about the discrepancy, to ensure timely resolution.

Q: How can the business ensure accurate payroll management?

A: The business can use reliable payroll software, conduct regular audits, and maintain compliance with state labor laws through ongoing training and updates.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.