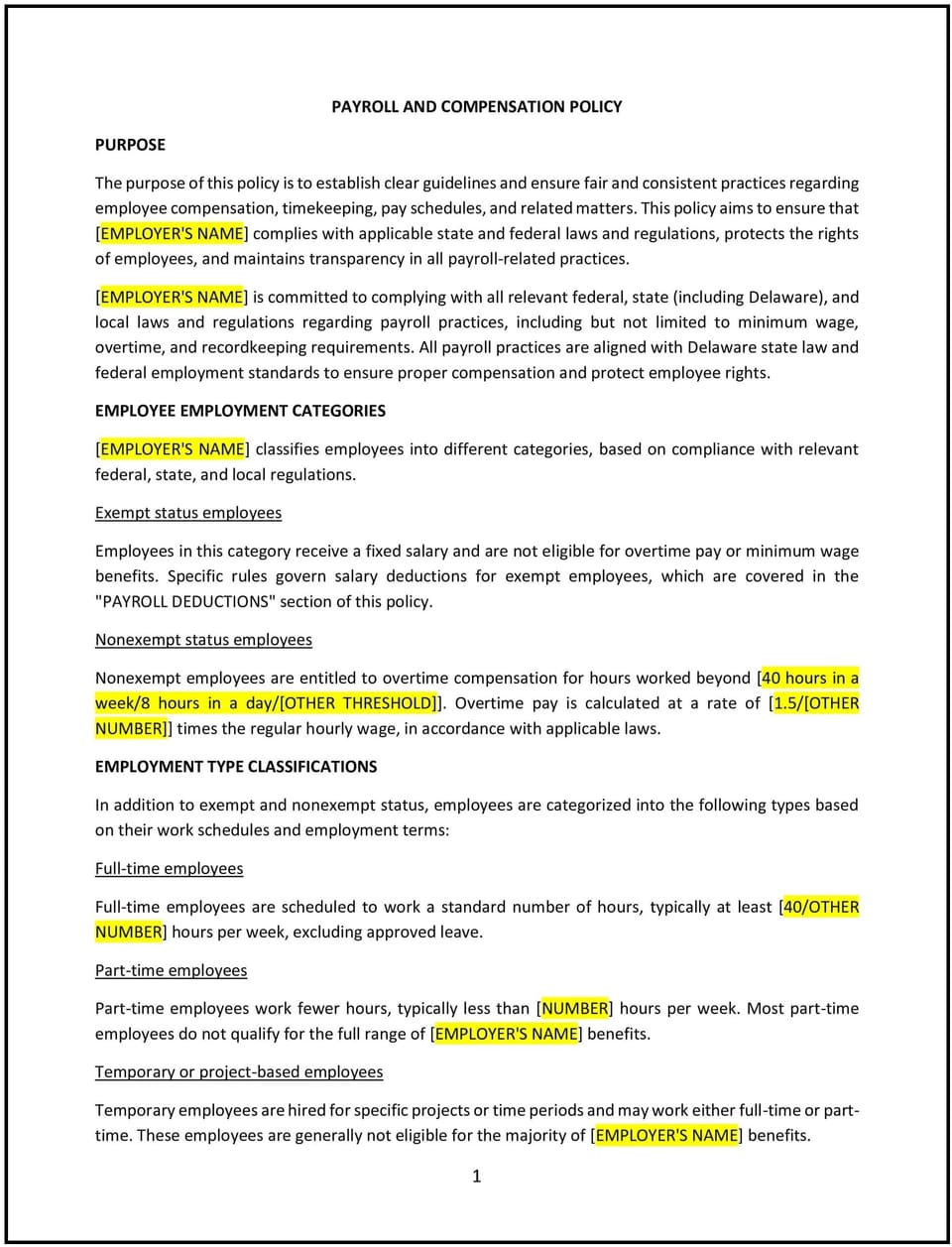

Payroll and compensation policy (Delaware): Free template

Payroll and compensation policy (Delaware)

A payroll and compensation policy helps Delaware businesses outline the processes for calculating, distributing, and managing employee wages and benefits. This policy ensures compliance with Delaware labor laws, promotes transparency, and provides guidelines for handling payroll-related matters, such as deductions, overtime, and adjustments.

By implementing this policy, businesses can maintain accurate payroll practices, support employee satisfaction, and reduce the risk of compliance issues.

How to use this payroll and compensation policy (Delaware)

- Define pay schedules: Clearly specify the frequency of pay periods, such as weekly, bi-weekly, or monthly, and the corresponding paydays.

- Outline calculation methods: Explain how wages, including overtime and bonuses, are calculated to ensure compliance with Delaware and federal wage laws.

- Address deductions: Provide details on mandatory and voluntary deductions, such as taxes, benefits, or wage garnishments, and ensure transparency.

- Establish reporting procedures: Include processes for employees to report payroll discrepancies or request adjustments to ensure timely resolutions.

- Manage confidentiality: Emphasize the secure handling of payroll data to protect employee privacy and comply with Delaware data protection laws.

- Monitor compliance: Regularly review payroll practices to ensure they align with Delaware labor laws and company policies.

Benefits of using this payroll and compensation policy (Delaware)

This policy offers several benefits for Delaware businesses:

- Ensures compliance: Reduces the risk of legal disputes by aligning payroll practices with Delaware and federal wage laws.

- Enhances accuracy: Establishes clear processes to minimize payroll errors and ensure timely payments.

- Builds employee trust: Promotes transparency and fairness in compensation practices, fostering employee satisfaction and loyalty.

- Protects data privacy: Safeguards sensitive employee information, reducing the risk of data breaches or unauthorized access.

- Reduces administrative burden: Streamlines payroll processes, making it easier to manage calculations, deductions, and compliance requirements.

Tips for using this payroll and compensation policy (Delaware)

- Communicate the policy clearly: Ensure all employees understand how payroll and compensation processes work, including pay schedules and deductions.

- Train HR and payroll staff: Provide training on Delaware labor laws, tax regulations, and best practices to ensure compliance and efficiency.

- Leverage technology: Use payroll software to automate calculations, maintain accurate records, and simplify reporting.

- Encourage employee feedback: Create a process for employees to report concerns or suggest improvements to payroll practices.

- Review regularly: Update the policy to reflect changes in Delaware wage laws, tax regulations, or company compensation strategies.

Q: Why is a payroll and compensation policy important for my business?

A: This policy ensures compliance with Delaware and federal wage laws, promotes transparency in payroll processes, and fosters employee trust by providing clear guidelines.

Q: How should businesses handle payroll discrepancies?

A: Employees should report discrepancies through the designated process outlined in the policy, and the business should address and resolve them promptly to maintain accuracy and trust.

Q: What deductions are included in this policy?

A: The policy covers mandatory deductions, such as federal and state taxes, and voluntary deductions, like benefits or retirement contributions, with clear explanations for each.

Q: How can my business ensure compliance with Delaware wage laws?

A: Regularly review payroll practices, provide training for HR and payroll staff, and use payroll software to align with Delaware and federal requirements.

Q: How often should this policy be reviewed?

A: This policy should be reviewed annually or whenever Delaware wage laws, tax regulations, or company payroll practices change to ensure continued compliance and effectiveness.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.