Payroll and compensation policy (Florida): Free template

Payroll and compensation Policy (Florida)

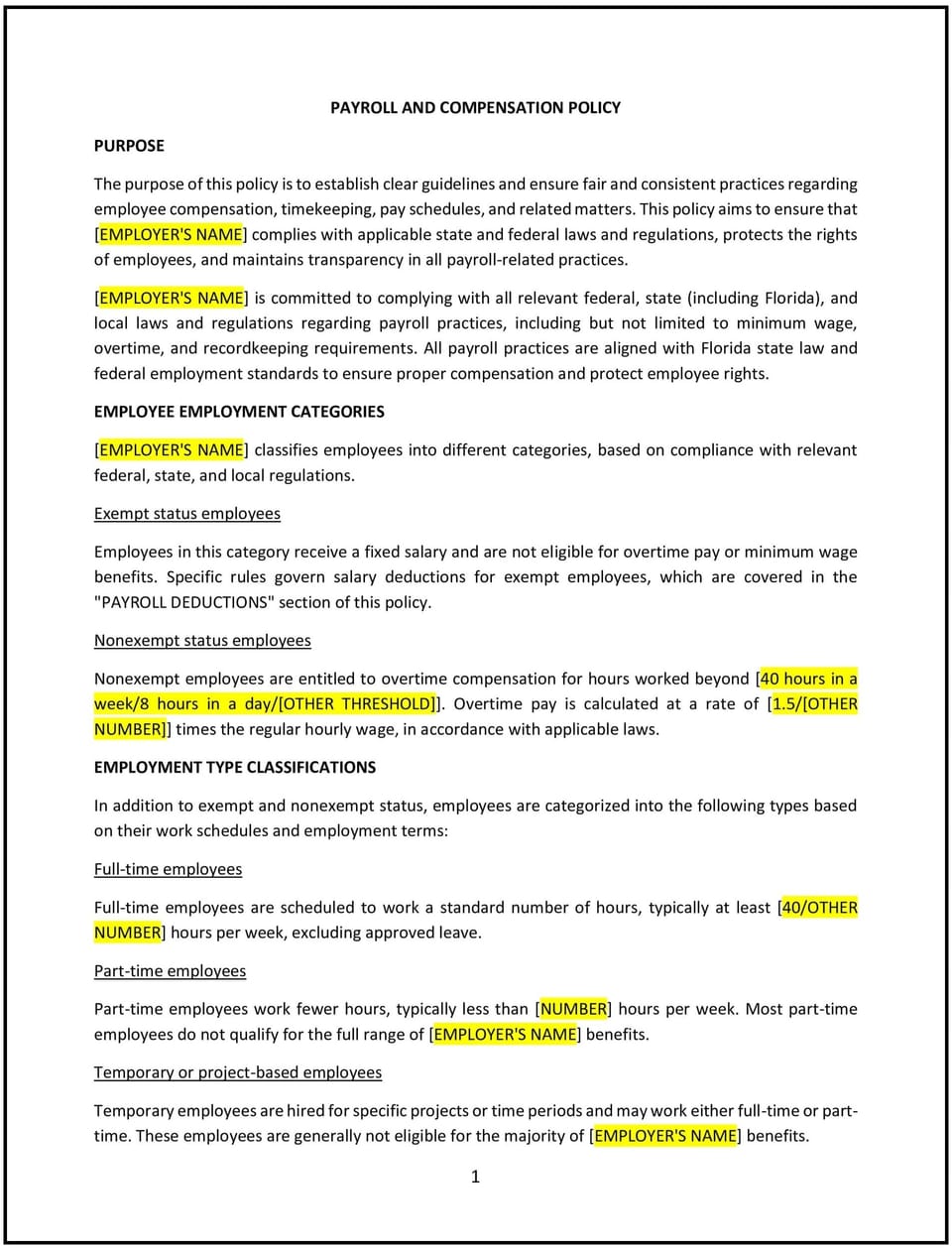

A payroll and compensation policy helps Florida businesses establish guidelines for managing employee pay, benefits, and compensation. This policy outlines procedures for calculating wages, issuing payments, and administering benefits while ensuring fairness, accuracy, and operational efficiency. It is designed to promote transparency, reduce risks, and provide clear expectations for employees and managers involved in payroll and compensation processes.

By implementing this policy, businesses in Florida can demonstrate their commitment to ethical practices, enhance operational efficiency, and align with the state’s focus on fostering a fair and transparent workplace.

How to use this payroll and compensation policy (Florida)

- Define pay practices: Clearly specify how employees are compensated, including salary, hourly wages, bonuses, and other forms of remuneration.

- Establish calculation procedures: Outline how businesses should calculate wages, overtime, and other pay elements accurately and consistently.

- Address payment methods: Explain how and when employees will be paid, including direct deposit, paper checks, or other methods.

- Specify benefit administration: Provide guidelines on how businesses will administer benefits, such as health insurance, retirement plans, and paid time off.

- Communicate the policy: Share the policy with employees during onboarding and through regular communications to ensure awareness and understanding.

- Monitor adherence: Regularly review payroll and compensation practices and address any concerns or discrepancies promptly.

- Update the policy: Periodically assess the policy to reflect changes in workplace dynamics, legal standards, or business needs.

Benefits of using this payroll and compensation policy (Florida)

This policy offers several advantages for Florida businesses:

- Promotes transparency: Clear guidelines help ensure that all payroll and compensation practices are reported and reviewed.

- Reduces risks: Defined procedures minimize the likelihood of errors, disputes, or reputational damage.

- Builds trust: Demonstrates the business’s commitment to ethical practices and employee well-being.

- Aligns with community values: Reflects Florida’s emphasis on fairness, transparency, and mutual respect in the workplace.

- Enhances reputation: A robust policy showcases the business’s dedication to ethical practices and operational integrity.

- Improves decision-making: Helps businesses anticipate potential risks and incorporate safeguards into payroll and compensation practices.

- Supports growth: A strong framework for managing payroll and compensation fosters a culture of accountability and continuous improvement.

Tips for using this payroll and compensation policy (Florida)

- Communicate clearly: Ensure employees understand the policy by providing written materials and discussing it during meetings or training sessions.

- Train employees: Educate staff on recognizing payroll and compensation issues, understanding the policy, and following procedures.

- Use technology: Leverage tools like payroll management software to automate calculations, track payments, and monitor compliance.

- Stay informed: Keep up with changes in employment laws, regulations, or best practices that may affect payroll and compensation practices.

- Encourage feedback: Solicit input from employees to identify areas for improvement and ensure the policy meets their needs.

- Review periodically: Assess the policy’s effectiveness and make updates as needed to reflect changes in workplace dynamics or business goals.

Q: Why should Florida businesses adopt a payroll and compensation policy?

A: Businesses should adopt this policy to promote transparency, reduce risks, and demonstrate their commitment to ethical practices regarding payroll and compensation.

Q: What types of pay practices should businesses consider?

A: Businesses should consider practices such as salary, hourly wages, bonuses, commissions, and other forms of remuneration, ensuring they align with business needs and legal requirements.

Q: How should businesses handle payroll calculations?

A: Businesses should calculate wages, overtime, and other pay elements accurately and consistently, using reliable methods and tools to ensure precision.

Q: Should businesses offer direct deposit for payroll?

A: Businesses should consider offering direct deposit as a convenient and secure method for paying employees, ensuring clear communication and compliance with legal requirements.

Q: How can businesses ensure fairness in administering benefits?

A: Businesses should apply the policy consistently across all employees, ensuring that decisions are based on objective criteria and documented evidence.

Q: What should businesses do if an employee disputes a payroll issue?

A: Businesses should address disputes promptly by investigating the issue, communicating with the employee, and taking corrective actions as necessary.

Q: How often should businesses review the policy?

A: Businesses should review the policy annually or whenever there are significant changes in workplace dynamics, legal standards, or business operations.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.