Payroll and compensation policy (Illinois): Free template

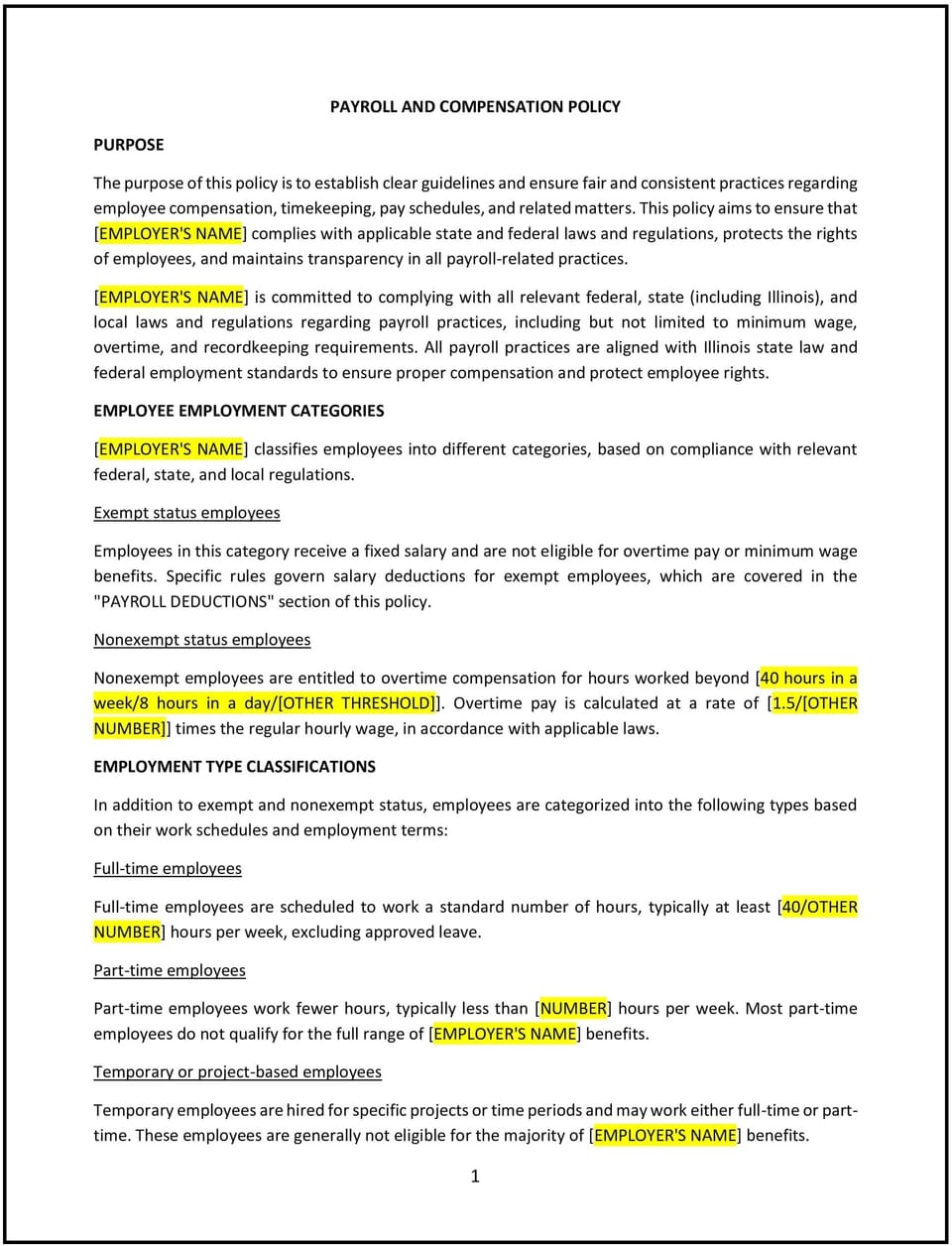

Payroll and compensation policy (Illinois)

This payroll and compensation policy is designed to help Illinois businesses manage employee wages, salaries, and related processes. It provides guidelines for payment schedules, deductions, overtime, and compliance with Illinois labor laws, including the Illinois Wage Payment and Collection Act (IWPCA).

By adopting this policy, businesses can ensure fair compensation, promote transparency, and align with legal requirements.

How to use this payroll and compensation policy (Illinois)

- Define payment schedules: Specify when employees will be paid, such as weekly, bi-weekly, or monthly, and ensure adherence to Illinois payment frequency laws.

- Outline payment methods: Include acceptable payment methods, such as direct deposit, checks, or payroll cards, and how employees can update their payment preferences.

- Address overtime pay: Detail how overtime is calculated and paid, in compliance with Illinois and federal overtime laws.

- Include deductions: Clarify permissible deductions, such as taxes, benefits, or garnishments, and how they are reflected on pay statements.

- Explain wage adjustments: Provide procedures for handling salary changes, bonuses, or pay increases, and ensure proper documentation.

- Emphasize recordkeeping: Highlight the importance of accurate timekeeping and maintaining payroll records to comply with Illinois requirements.

- Provide dispute resolution: Establish a process for employees to report payroll errors or concerns and how they will be resolved.

- Monitor compliance: Regularly review payroll practices to align with Illinois labor laws and company policies.

Benefits of using this payroll and compensation policy (Illinois)

This policy provides several benefits for Illinois businesses:

- Promotes transparency: Ensures employees understand payment schedules, methods, and deductions.

- Enhances compliance: Aligns with Illinois and federal labor laws, reducing the risk of disputes or penalties.

- Improves accuracy: Establishes clear processes for payroll management and recordkeeping.

- Builds trust: Demonstrates the company’s commitment to fair and timely compensation.

- Reduces errors: Provides employees with a clear channel to address payroll discrepancies promptly.

Tips for using this payroll and compensation policy (Illinois)

- Communicate the policy: Share the policy with employees during onboarding and make it accessible in the employee handbook.

- Train payroll staff: Ensure staff are familiar with Illinois labor laws and the company’s payroll processes to prevent errors.

- Automate payroll: Use payroll software to streamline processes, ensure accuracy, and maintain compliance with state regulations.

- Encourage reporting: Create an open environment where employees can report payroll concerns or errors without hesitation.

- Update regularly: Revise the policy to reflect changes in Illinois labor laws or company compensation practices.

Q: When are employees paid under this policy?

A: Employees are paid according to the company’s established schedule, such as weekly, bi-weekly, or monthly, in compliance with Illinois payment laws.

Q: What payment methods are available?

A: Employees can choose from direct deposit, checks, or payroll cards, as specified in this policy.

Q: How is overtime calculated?

A: Overtime is calculated based on Illinois and federal laws, typically at 1.5 times the regular hourly rate for hours worked over 40 in a week.

Q: What deductions are made from employee paychecks?

A: Deductions include mandatory taxes, benefit contributions, and any authorized garnishments or voluntary withholdings.

Q: How can employees report payroll errors?

A: Employees should report payroll discrepancies to HR or the payroll department for prompt investigation and resolution.

Q: What happens if an employee’s paycheck is delayed?

A: In the rare event of a delay, the company will work to resolve the issue immediately and ensure the employee receives their payment as soon as possible.

Q: Are pay increases or bonuses addressed in this policy?

A: Yes, salary adjustments, bonuses, and pay increases are outlined in the policy and require proper documentation and approval.

Q: How often is this policy reviewed?

A: This policy is reviewed annually or whenever significant changes occur in Illinois labor laws or workplace practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.