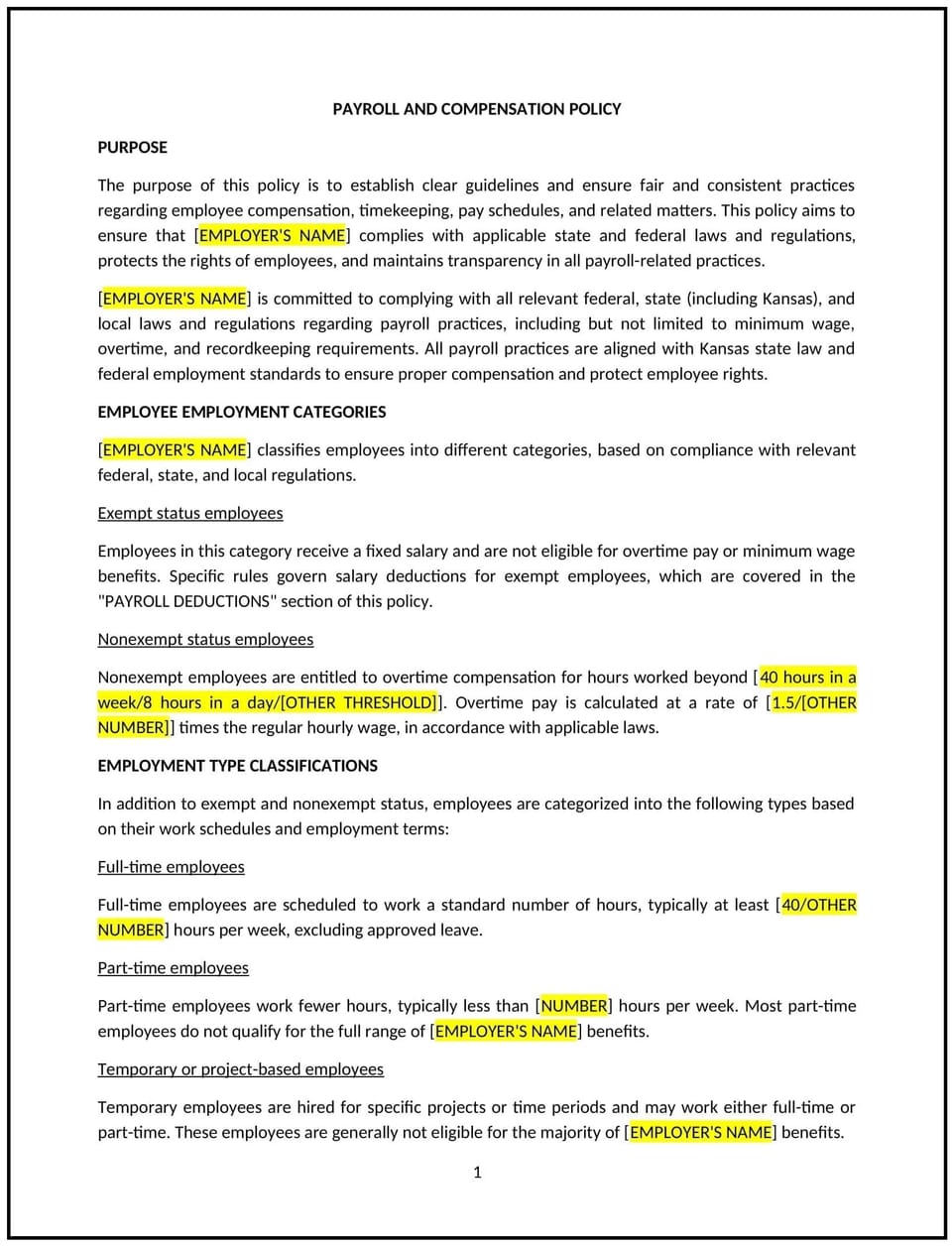

Payroll and compensation policy (Kansas): Free template

Payroll and compensation policy (Kansas)

A payroll and compensation policy helps Kansas businesses establish clear guidelines for employee compensation, including salary structure, pay schedules, overtime, bonuses, and benefits. This policy outlines how employees will be paid, the frequency of payments, and any deductions or withholdings required by law.

By implementing this policy, businesses can promote fairness, transparency, and consistency in compensation practices while ensuring legal compliance and aligning pay practices with company goals.

How to use this payroll and compensation policy (Kansas)

- Define compensation structure: Businesses should outline how salaries or hourly wages are determined, including any factors such as experience, job responsibilities, performance, and market rates.

- Set pay schedules: The policy should specify the frequency of payments, such as weekly, biweekly, or monthly, and any applicable deadlines for payroll processing.

- Address overtime pay: Businesses should establish guidelines for overtime pay, including how it is calculated (typically at time-and-a-half for hours worked over 40 hours per week) and any applicable legal exemptions.

- Specify deductions: The policy should detail any mandatory deductions, such as federal and state taxes, Social Security, Medicare, and any other deductions like retirement plan contributions or health insurance premiums.

- Define bonuses and incentives: If applicable, businesses should clarify the criteria for earning performance-based bonuses, commissions, or other incentive programs and how these are calculated.

- Address paid time off (PTO) and benefits: Businesses should specify how PTO, sick leave, holiday pay, and other employee benefits are handled, including accrual rates and usage guidelines.

- Review and update regularly: Businesses should periodically review the policy to ensure it aligns with current laws, industry standards, and business practices.

Benefits of using a payroll and compensation policy (Kansas)

- Promotes fairness and consistency: A clear policy ensures that all employees are paid equitably based on their roles, performance, and market value, reducing potential discrimination or bias.

- Increases transparency: By outlining compensation details, businesses foster transparency and trust between management and employees regarding pay expectations.

- Reduces legal risks: A formal policy helps businesses stay compliant with federal and state labor laws, preventing legal issues related to employee pay.

- Enhances employee satisfaction: Employees are more likely to feel valued and engaged when they understand their compensation structure and benefits, improving morale and retention.

- Supports financial planning: With clear pay schedules and benefits information, employees can better manage their finances and make informed decisions.

- Strengthens company reputation: Businesses known for fair and transparent compensation practices attract top talent and maintain a strong reputation in the industry.

Tips for using this payroll and compensation policy (Kansas)

- Communicate the policy clearly: Businesses should ensure that all employees are aware of the payroll and compensation policy and understand how their pay and benefits are determined.

- Keep detailed records: Businesses should maintain accurate payroll records, including hours worked, overtime calculations, and deductions, to avoid discrepancies or legal issues.

- Monitor pay equity: Businesses should regularly review their compensation structure to ensure they are paying competitive wages and meeting industry standards to retain talent.

- Be transparent with employees: Employees should have access to clear information about their pay structure, overtime eligibility, and benefits, ensuring transparency and reducing misunderstandings.

- Stay updated on legal requirements: Businesses should stay informed about any changes to labor laws, minimum wage rates, and tax regulations to ensure compliance.

- Offer competitive benefits: In addition to salary, businesses should offer attractive benefits packages that include health insurance, retirement plans, and paid time off to attract and retain top talent.

Q: Why should Kansas businesses implement a payroll and compensation policy?

A: Businesses should implement a payroll and compensation policy to provide transparency, ensure fairness in pay, comply with labor laws, and enhance employee satisfaction and retention.

Q: How should businesses determine employee compensation?

A: Compensation should be based on factors such as the employee's role, experience, qualifications, performance, and market rates. The policy should outline how these factors are considered when setting wages or salaries.

Q: How often should businesses pay employees?

A: The policy should specify the frequency of pay, such as weekly, biweekly, or monthly, and outline the payroll processing schedule and deadlines.

Q: How is overtime pay calculated?

A: Overtime pay should be calculated according to applicable labor laws, typically at a rate of time-and-a-half for any hours worked over 40 hours in a workweek, unless the employee is exempt from overtime.

Q: What deductions should be made from employees' pay?

A: The policy should specify mandatory deductions, such as federal and state taxes, Social Security, Medicare, and any voluntary deductions like retirement contributions or health insurance premiums.

Q: How are bonuses or performance incentives handled?

A: Businesses should outline the criteria for earning bonuses or incentives, including performance targets, sales goals, or other measurable achievements, and describe how these are calculated and paid.

Q: How often should businesses review their payroll and compensation policy?

A: Businesses should review their payroll and compensation policy annually or whenever there are significant changes in labor laws, business practices, or market conditions to ensure it remains effective and competitive.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.