Payroll and compensation policy (Kentucky): Free template

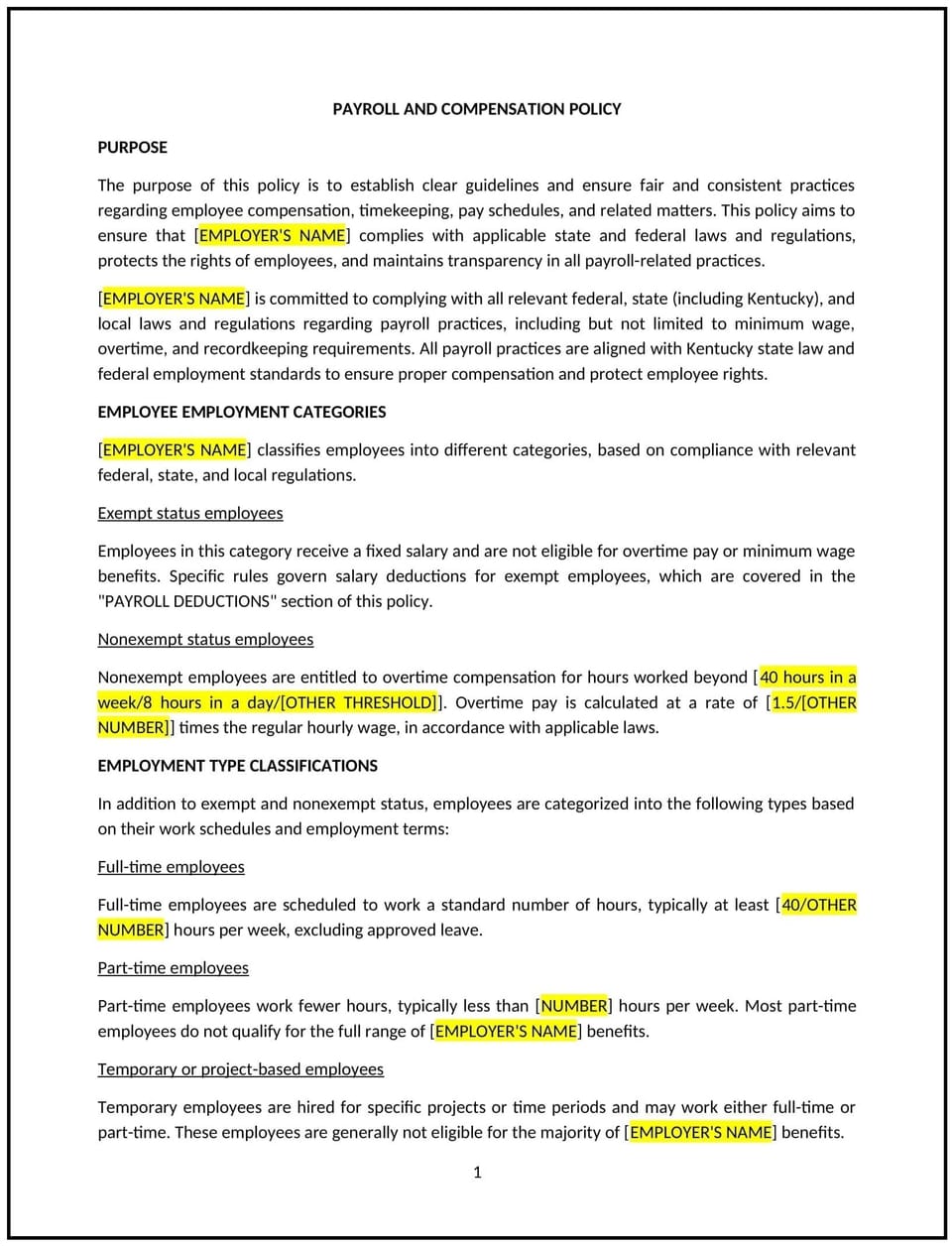

Payroll and compensation policy (Kentucky)

A payroll and compensation policy outlines the procedures Kentucky businesses use to manage employee pay, benefits, and related processes. This policy ensures employees are compensated accurately, on time, and supports compliance with applicable laws and regulations.

By adopting this policy, businesses can promote transparency, consistency, and fairness in compensation practices.

How to use this payroll and compensation policy (Kentucky)

- Define compensation structure: Outline the components of employee compensation, such as base pay, bonuses, overtime, and benefits, ensuring clarity and fairness.

- Specify pay schedules: Provide details about payroll frequency (e.g., bi-weekly or monthly) and methods of payment, such as direct deposit or checks.

- Address overtime and deductions: Clearly explain how overtime is calculated, as well as any deductions for taxes, benefits, or other authorized purposes.

- Detail compliance with laws: Ensure the policy aligns with Kentucky state wage laws, federal Fair Labor Standards Act (FLSA) requirements, and any local regulations.

- Include timekeeping procedures: Outline expectations for accurate time tracking, including tools or systems used to record hours worked.

- Explain dispute resolution: Provide a process for employees to report and resolve payroll discrepancies or compensation concerns promptly.

- Protect confidentiality: Emphasize the importance of maintaining the confidentiality of payroll records and employee compensation information.

Benefits of using this payroll and compensation policy (Kentucky)

This policy provides several key benefits for Kentucky businesses:

- Promotes fairness: Ensures consistent and equitable pay practices for all employees, building trust and satisfaction.

- Enhances compliance: Reduces the risk of legal disputes by adhering to Kentucky and federal wage and hour laws.

- Improves transparency: Clarifies payroll processes and expectations, minimizing confusion or misunderstandings.

- Supports timely payments: Establishes structured procedures to ensure employees are paid accurately and on schedule.

- Builds employee trust: Demonstrates the business’s commitment to treating employees fairly and responsibly in compensation matters.

Tips for using this payroll and compensation policy (Kentucky)

- Communicate the policy: Ensure employees are informed of payroll processes and compensation structures during onboarding and through regular updates.

- Train managers: Provide training for managers and payroll staff on the policy to ensure consistent implementation and compliance.

- Monitor compliance: Regularly review payroll practices to ensure adherence to Kentucky laws, federal regulations, and internal policies.

- Address concerns promptly: Respond to payroll discrepancies or employee concerns quickly to maintain trust and prevent disputes.

- Update regularly: Revise the policy as needed to reflect changes in wage laws, business operations, or industry standards.

Q: How often are employees paid under this policy?

A: Employees are paid according to the business’s defined pay schedule, such as bi-weekly or monthly, which complies with Kentucky wage laws.

Q: What methods of payment are available?

A: Employees may be paid via direct deposit, paper check, or another approved method outlined in the policy.

Q: How is overtime calculated?

A: Overtime is calculated in accordance with Kentucky and federal laws, typically at 1.5 times the employee’s regular hourly rate for hours worked over 40 in a workweek.

Q: What should employees do if they notice a payroll error?

A: Employees should report payroll discrepancies to their manager or HR immediately, following the dispute resolution process outlined in the policy.

Q: Are payroll deductions explained in the policy?

A: The policy details authorized deductions, including taxes, benefits contributions, and other necessary or voluntary deductions.

Q: How does the policy ensure compliance with wage laws?

A: The policy aligns with Kentucky and federal wage and hour laws to ensure that employees are compensated fairly and legally.

Q: What steps are taken to protect payroll confidentiality?

A: Payroll records and compensation information are kept secure and accessible only to authorized personnel to maintain confidentiality.

Q: How often should the payroll and compensation policy be reviewed?

A: The policy should be reviewed periodically to ensure compliance with Kentucky laws, federal regulations, and changes in business practices.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.